Pay by bank transactions offer direct transfers from customer accounts, enhancing security and reducing transaction fees compared to debit card payments, which rely on card networks and intermediaries. Debit cards provide convenience and widespread acceptance but may involve higher processing costs and increased fraud risks. Discover how choosing between pay by bank and debit card payments can impact your financial efficiency and security.

Why it is important

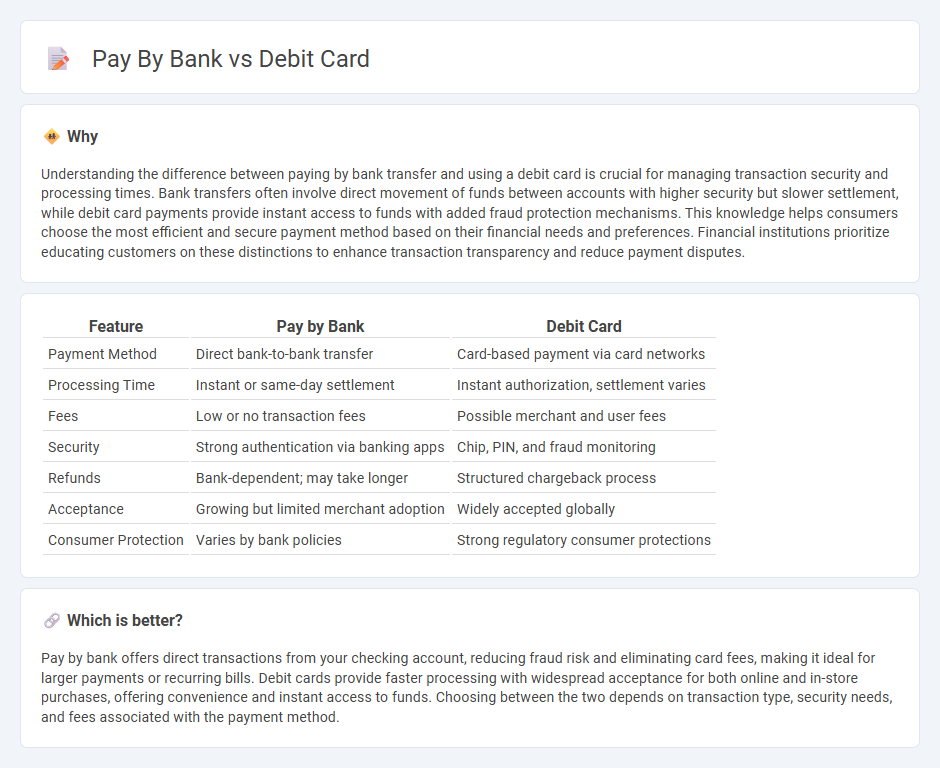

Understanding the difference between paying by bank transfer and using a debit card is crucial for managing transaction security and processing times. Bank transfers often involve direct movement of funds between accounts with higher security but slower settlement, while debit card payments provide instant access to funds with added fraud protection mechanisms. This knowledge helps consumers choose the most efficient and secure payment method based on their financial needs and preferences. Financial institutions prioritize educating customers on these distinctions to enhance transaction transparency and reduce payment disputes.

Comparison Table

| Feature | Pay by Bank | Debit Card |

|---|---|---|

| Payment Method | Direct bank-to-bank transfer | Card-based payment via card networks |

| Processing Time | Instant or same-day settlement | Instant authorization, settlement varies |

| Fees | Low or no transaction fees | Possible merchant and user fees |

| Security | Strong authentication via banking apps | Chip, PIN, and fraud monitoring |

| Refunds | Bank-dependent; may take longer | Structured chargeback process |

| Acceptance | Growing but limited merchant adoption | Widely accepted globally |

| Consumer Protection | Varies by bank policies | Strong regulatory consumer protections |

Which is better?

Pay by bank offers direct transactions from your checking account, reducing fraud risk and eliminating card fees, making it ideal for larger payments or recurring bills. Debit cards provide faster processing with widespread acceptance for both online and in-store purchases, offering convenience and instant access to funds. Choosing between the two depends on transaction type, security needs, and fees associated with the payment method.

Connection

Pay by bank and debit card transactions both rely on secure electronic payment networks that directly link consumers' bank accounts to merchants, allowing real-time fund transfers. Debit card payments withdraw money immediately from the cardholder's checking account, while pay by bank methods use open banking APIs to authorize direct payments without card intermediaries. Integration of these systems enhances transaction speed, security, and user convenience by leveraging customers' existing bank credentials for seamless payment experiences.

Key Terms

**Transaction Method**

Debit card transactions rely on card networks like Visa or MasterCard to authorize payments through magnetic stripe, chip, or contactless methods. Pay by Bank uses direct bank-to-merchant communication to initiate payments via secure open banking protocols without intermediaries. Discover the key differences in transaction speed, security, and processing fees by exploring how each method operates.

**Account Linking**

Debit card payments involve directly using bank account details stored on the card, allowing transactions to access funds instantly through the card network. Pay by Bank enables secure account linking through open banking APIs, facilitating direct payments from the consumer's bank account without sharing card details, enhancing security and reducing fraud risk. Discover how seamless account linking transforms payment experiences with Pay by Bank.

**Settlement Speed**

Settlement speed for debit card transactions typically ranges from one to three business days, depending on the issuing bank and payment network processing times. Pay by Bank payments leverage real-time or near-instant bank transfers, enabling funds to settle within minutes, significantly reducing waiting periods. Discover the advantages of faster settlements with Pay by Bank solutions.

Source and External Links

Using Debit Cards - A debit card lets you pay with money directly from your checking account, unlike a credit card which borrows money; debit cards do not charge interest or build credit history and can be used for purchases, ATM withdrawals, and cash back at stores.

Debit cards - better than cash | Apply online - Debit cards allow you to access money in your checking account immediately for everyday purchases, bill payments, and ATM cash withdrawals, and include security features like CVV and PIN protection.

Debit card - Debit cards can be processed through different systems like EFTPOS and signature debit, and are issued under major networks such as Visa and Mastercard, used globally with variations by country or region.

dowidth.com

dowidth.com