Neo banking leverages digital platforms to offer streamlined, user-friendly financial services without traditional branch networks, focusing on convenience and lower fees. Investment banks specialize in complex financial transactions like underwriting, mergers, and asset management for corporations and high-net-worth clients. Discover how these banking models redefine financial services and which suits your needs best.

Why it is important

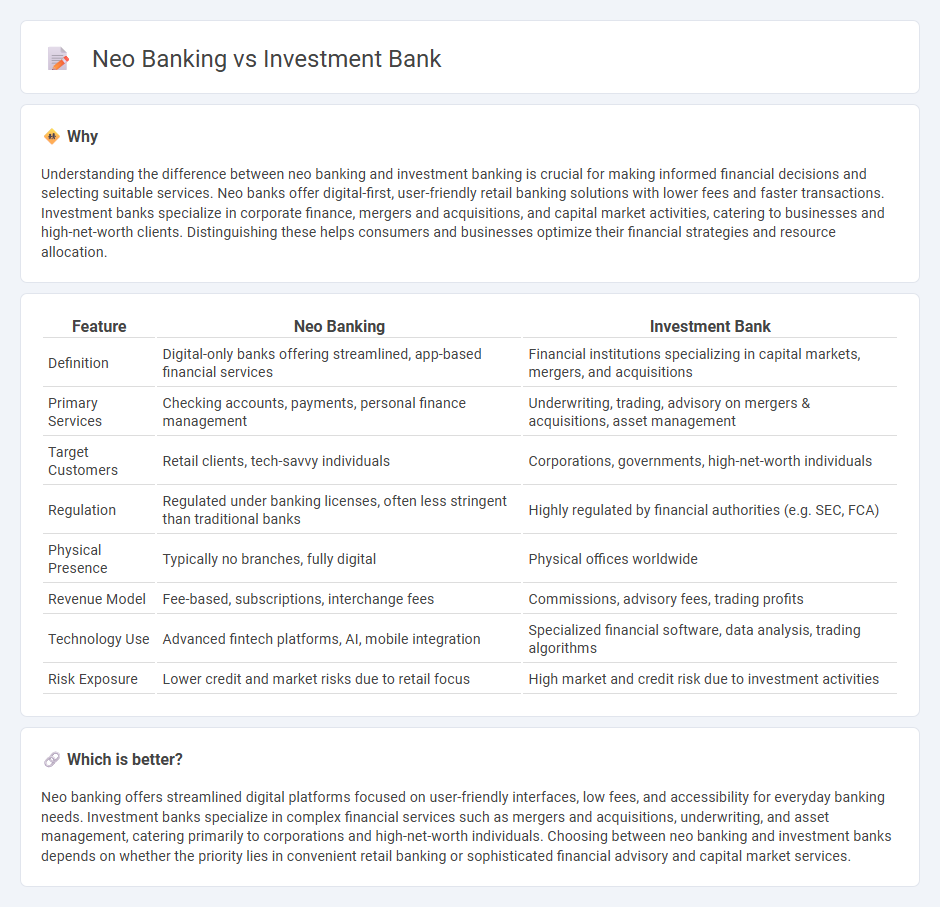

Understanding the difference between neo banking and investment banking is crucial for making informed financial decisions and selecting suitable services. Neo banks offer digital-first, user-friendly retail banking solutions with lower fees and faster transactions. Investment banks specialize in corporate finance, mergers and acquisitions, and capital market activities, catering to businesses and high-net-worth clients. Distinguishing these helps consumers and businesses optimize their financial strategies and resource allocation.

Comparison Table

| Feature | Neo Banking | Investment Bank |

|---|---|---|

| Definition | Digital-only banks offering streamlined, app-based financial services | Financial institutions specializing in capital markets, mergers, and acquisitions |

| Primary Services | Checking accounts, payments, personal finance management | Underwriting, trading, advisory on mergers & acquisitions, asset management |

| Target Customers | Retail clients, tech-savvy individuals | Corporations, governments, high-net-worth individuals |

| Regulation | Regulated under banking licenses, often less stringent than traditional banks | Highly regulated by financial authorities (e.g. SEC, FCA) |

| Physical Presence | Typically no branches, fully digital | Physical offices worldwide |

| Revenue Model | Fee-based, subscriptions, interchange fees | Commissions, advisory fees, trading profits |

| Technology Use | Advanced fintech platforms, AI, mobile integration | Specialized financial software, data analysis, trading algorithms |

| Risk Exposure | Lower credit and market risks due to retail focus | High market and credit risk due to investment activities |

Which is better?

Neo banking offers streamlined digital platforms focused on user-friendly interfaces, low fees, and accessibility for everyday banking needs. Investment banks specialize in complex financial services such as mergers and acquisitions, underwriting, and asset management, catering primarily to corporations and high-net-worth individuals. Choosing between neo banking and investment banks depends on whether the priority lies in convenient retail banking or sophisticated financial advisory and capital market services.

Connection

Neo banking leverages digital platforms to offer banking services without traditional physical branches, focusing on user-friendly interfaces and real-time financial management. Investment banks provide specialized financial services such as underwriting, asset management, and mergers and acquisitions advisory, driving capital market activities. Both neo banks and investment banks intersect through digital innovations that enhance customer access to investment products, streamline transaction processing, and enable efficient capital flow in the modern financial ecosystem.

Key Terms

Underwriting

Investment banks specialize in underwriting by assuming the risk of issuing new securities and ensuring capital raising for corporations through initial public offerings (IPOs) and bond issuances. Neo banks, operating primarily as digital financial platforms, do not perform underwriting but focus on providing streamlined banking services such as payments, deposits, and budgeting tools. Explore how underwriting differentiates traditional investment banks from neo banking models and their impact on capital markets.

Digital-only platform

Investment banks primarily offer comprehensive financial services including underwriting, mergers and acquisitions advisory, and capital raising, often serving large corporations and institutional clients. Neo banks operate exclusively as digital-only platforms, focusing on user-friendly interfaces and streamlined banking services tailored to retail customers and small businesses without physical branches. Discover how the digital-only nature of neo banks is transforming traditional investment banking models by exploring their unique service offerings and technology integrations.

Securities trading

Investment banks specialize in securities trading by underwriting and facilitating stock and bond issuances, as well as providing market-making and advisory services for mergers and acquisitions. Neo banks, however, offer digital-first banking services with limited or no direct securities trading capabilities, often partnering with traditional financial firms to provide investment products. Explore the evolving dynamics between these financial institutions to understand their distinct roles in securities trading.

Source and External Links

Investment banking - Wikipedia - Investment banking is an advisory-based financial service that provides corporations, institutions, and governments with services such as issuing securities, mergers and acquisitions, treasury management, and risk controls, split into front, middle, and back office activities.

Investment Bank | Mergers & Acquisitions | InvestmentBank.com - This site offers investment banking and capital advisory services primarily to middle-market companies for acquiring, selling, or raising growth capital.

Investment Bank | UBS Global - UBS Investment Bank provides expert advice, innovative solutions, and access to global capital markets, highlighting recognized awards for derivatives and equity services.

dowidth.com

dowidth.com