Super apps integrate diverse financial services, from banking to payments, creating an all-in-one platform for users. Digital wallets focus primarily on facilitating seamless electronic transactions and storing payment information securely. Explore how these innovations are transforming the future of banking and payments.

Why it is important

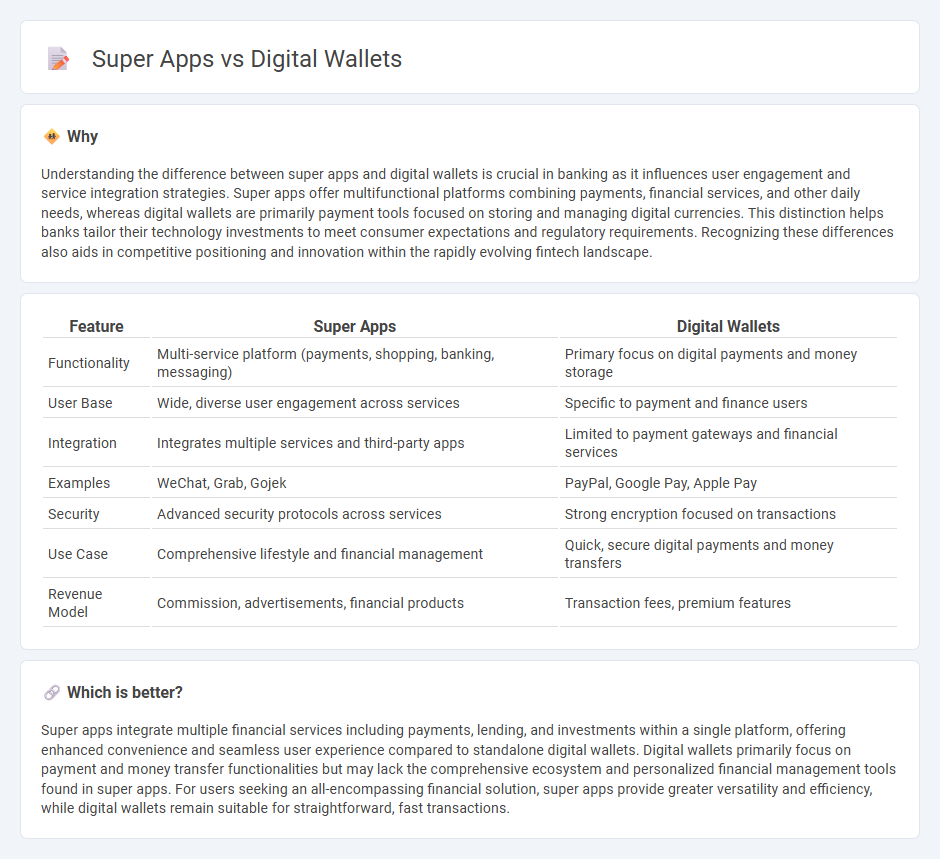

Understanding the difference between super apps and digital wallets is crucial in banking as it influences user engagement and service integration strategies. Super apps offer multifunctional platforms combining payments, financial services, and other daily needs, whereas digital wallets are primarily payment tools focused on storing and managing digital currencies. This distinction helps banks tailor their technology investments to meet consumer expectations and regulatory requirements. Recognizing these differences also aids in competitive positioning and innovation within the rapidly evolving fintech landscape.

Comparison Table

| Feature | Super Apps | Digital Wallets |

|---|---|---|

| Functionality | Multi-service platform (payments, shopping, banking, messaging) | Primary focus on digital payments and money storage |

| User Base | Wide, diverse user engagement across services | Specific to payment and finance users |

| Integration | Integrates multiple services and third-party apps | Limited to payment gateways and financial services |

| Examples | WeChat, Grab, Gojek | PayPal, Google Pay, Apple Pay |

| Security | Advanced security protocols across services | Strong encryption focused on transactions |

| Use Case | Comprehensive lifestyle and financial management | Quick, secure digital payments and money transfers |

| Revenue Model | Commission, advertisements, financial products | Transaction fees, premium features |

Which is better?

Super apps integrate multiple financial services including payments, lending, and investments within a single platform, offering enhanced convenience and seamless user experience compared to standalone digital wallets. Digital wallets primarily focus on payment and money transfer functionalities but may lack the comprehensive ecosystem and personalized financial management tools found in super apps. For users seeking an all-encompassing financial solution, super apps provide greater versatility and efficiency, while digital wallets remain suitable for straightforward, fast transactions.

Connection

Super apps integrate multiple financial services including digital wallets, enabling seamless in-app transactions, bill payments, and money transfers. Digital wallets within these platforms store payment information securely, facilitating instant peer-to-peer payments and merchant purchases. This interconnected ecosystem enhances user convenience and drives digital banking adoption globally.

Key Terms

Mobile Payments

Digital wallets enable seamless mobile payments by securely storing users' payment information and allowing quick transactions across various platforms. Super apps integrate digital wallets within a broader ecosystem, offering mobile payments alongside services like messaging, ride-hailing, and e-commerce, enhancing convenience and user engagement. Explore how these technologies are transforming mobile payment experiences and shaping the future of digital finance.

Ecosystem Integration

Digital wallets primarily facilitate seamless payments and financial transactions, focusing on convenience and security for users managing digital currencies and banking functions. Super apps go beyond by integrating a wide range of services such as messaging, e-commerce, ride-hailing, and financial services within a single ecosystem, creating a more holistic user experience. Explore how ecosystem integration transforms user engagement and drives innovation in fintech by discovering the latest trends in digital wallets and super apps.

Financial Services Expansion

Digital wallets primarily facilitate secure and instant payments along with basic financial transactions such as money transfers and bill payments. Super apps integrate digital wallets within a broader ecosystem, offering a wide range of financial services including lending, insurance, investments, and personalized financial management tools. Explore the evolving landscape of financial services expansion within these platforms to understand how consumer needs and market dynamics are reshaping digital finance.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - Digital wallets are software systems that securely store payment information, enabling online purchases, money transfers, and contactless payments, with types ranging from centralized (e.g., PayPal, Apple Pay) to decentralized (e.g., MetaMask, Trust Wallet) platforms.

What is a Digital Wallet and How to Use It? - A digital wallet is a secure app on your mobile device that stores payment methods and important documents, allowing for electronic payments, loyalty card storage, and instant access to financial data without carrying physical cards.

Digital Wallets: Everything You Need to Know - Digital wallets let you make payments in stores, online, or via apps using your smartphone, with enhanced security features like encryption and biometric authentication, and can also store tickets, coupons, and even cryptocurrencies.

dowidth.com

dowidth.com