Personal financial management tools empower users to track expenses, create budgets, and set savings goals with comprehensive insights into their financial health. Digital wallets offer seamless, contactless payment solutions by storing multiple credit, debit, and loyalty cards in one secure app for quick transactions. Explore how these innovative banking technologies can transform your financial experience.

Why it is important

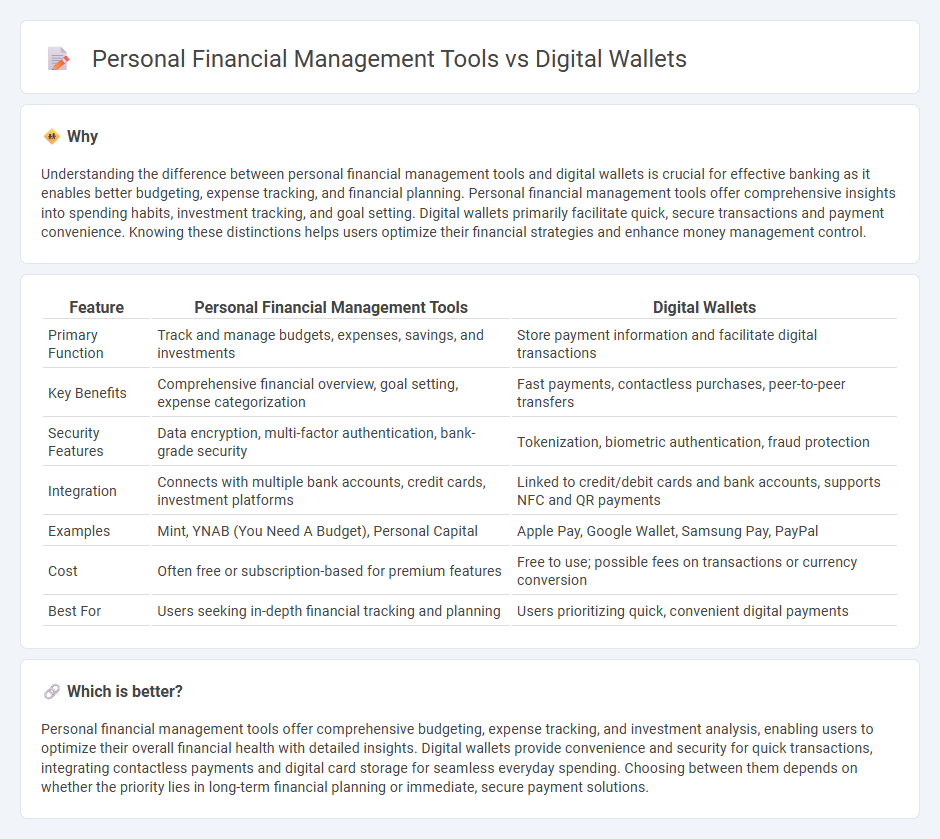

Understanding the difference between personal financial management tools and digital wallets is crucial for effective banking as it enables better budgeting, expense tracking, and financial planning. Personal financial management tools offer comprehensive insights into spending habits, investment tracking, and goal setting. Digital wallets primarily facilitate quick, secure transactions and payment convenience. Knowing these distinctions helps users optimize their financial strategies and enhance money management control.

Comparison Table

| Feature | Personal Financial Management Tools | Digital Wallets |

|---|---|---|

| Primary Function | Track and manage budgets, expenses, savings, and investments | Store payment information and facilitate digital transactions |

| Key Benefits | Comprehensive financial overview, goal setting, expense categorization | Fast payments, contactless purchases, peer-to-peer transfers |

| Security Features | Data encryption, multi-factor authentication, bank-grade security | Tokenization, biometric authentication, fraud protection |

| Integration | Connects with multiple bank accounts, credit cards, investment platforms | Linked to credit/debit cards and bank accounts, supports NFC and QR payments |

| Examples | Mint, YNAB (You Need A Budget), Personal Capital | Apple Pay, Google Wallet, Samsung Pay, PayPal |

| Cost | Often free or subscription-based for premium features | Free to use; possible fees on transactions or currency conversion |

| Best For | Users seeking in-depth financial tracking and planning | Users prioritizing quick, convenient digital payments |

Which is better?

Personal financial management tools offer comprehensive budgeting, expense tracking, and investment analysis, enabling users to optimize their overall financial health with detailed insights. Digital wallets provide convenience and security for quick transactions, integrating contactless payments and digital card storage for seamless everyday spending. Choosing between them depends on whether the priority lies in long-term financial planning or immediate, secure payment solutions.

Connection

Personal financial management tools integrate seamlessly with digital wallets by syncing transaction data and account balances in real-time, enhancing budgeting accuracy and spending insights. These tools use aggregated digital wallet information to categorize expenses automatically, helping users track financial goals more effectively. The connection between both technologies fosters improved money management by providing consolidated views of income, expenses, and savings within a single platform.

Key Terms

Mobile Payments

Mobile payments via digital wallets like Apple Pay, Google Wallet, and Samsung Pay enable seamless, contactless transactions using smartphones and wearable devices, enhancing convenience and security. Personal financial management tools such as Mint and YNAB integrate with bank accounts and credit cards to track spending, create budgets, and offer real-time insights, promoting better financial discipline. Discover how combining mobile payment technology with financial management apps can optimize your financial experience.

Budget Tracking

Digital wallets streamline budget tracking by instantly categorizing transactions and providing real-time spending insights through AI-driven analytics. Personal financial management tools enhance budget tracking by aggregating data from multiple accounts, offering customizable budget plans and predictive expense forecasting. Explore detailed comparisons to discover which solution fits your financial management style best.

Account Aggregation

Digital wallets primarily facilitate secure transaction processing and payment storage, while personal financial management (PFM) tools emphasize comprehensive account aggregation to provide a holistic view of an individual's financial health. Account aggregation in PFM tools integrates data from multiple bank accounts, credit cards, loans, and investment portfolios, enabling advanced budgeting, forecasting, and personalized financial insights. Explore the detailed benefits and functionality of account aggregation in PFM tools to optimize your financial management strategy.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - A digital wallet is a software-based system that securely stores payment information, enabling online purchases, money transfers, and contactless payments, with types like centralized wallets (e.g., PayPal, Apple Pay) and decentralized wallets (e.g., MetaMask) catering to different needs and security preferences.

What is a Digital Wallet and How to Use It? - Digital wallets are secure electronic payment solutions on mobile devices that store payment info and other digital documents, allowing easy, secure transactions without physical cards, often using biometric technology for enhanced security.

Digital Wallets: Everything You Need to Know - Digital wallets save payment details in encrypted, secure locations on devices and use features like unique virtual card numbers, fingerprint protection, and two-factor authentication to keep users' money safe while facilitating contactless and online payments.

dowidth.com

dowidth.com