Neobanks leverage advanced digital technology to offer seamless, app-based banking experiences with lower fees and high accessibility. Community banks emphasize personalized customer service, local decision-making, and reinvestment in regional economies, fostering strong community ties. Explore the key differences between neobanks and community banks to find the best fit for your financial needs.

Why it is important

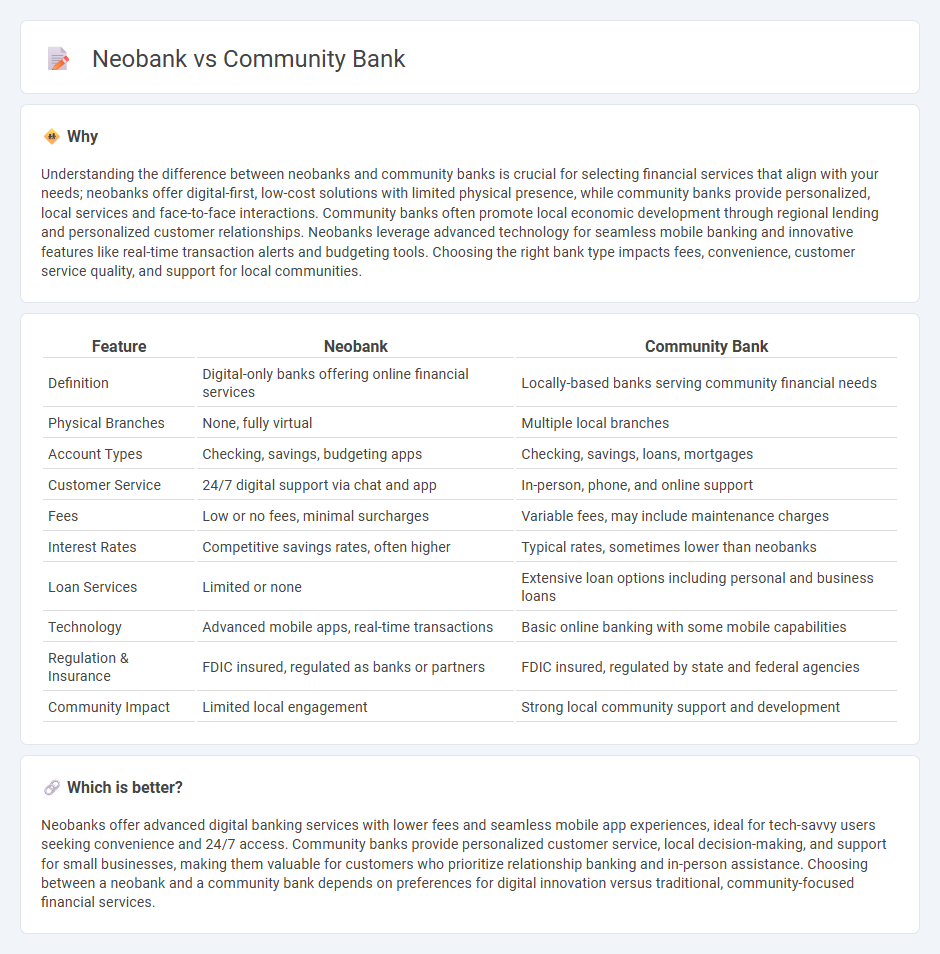

Understanding the difference between neobanks and community banks is crucial for selecting financial services that align with your needs; neobanks offer digital-first, low-cost solutions with limited physical presence, while community banks provide personalized, local services and face-to-face interactions. Community banks often promote local economic development through regional lending and personalized customer relationships. Neobanks leverage advanced technology for seamless mobile banking and innovative features like real-time transaction alerts and budgeting tools. Choosing the right bank type impacts fees, convenience, customer service quality, and support for local communities.

Comparison Table

| Feature | Neobank | Community Bank |

|---|---|---|

| Definition | Digital-only banks offering online financial services | Locally-based banks serving community financial needs |

| Physical Branches | None, fully virtual | Multiple local branches |

| Account Types | Checking, savings, budgeting apps | Checking, savings, loans, mortgages |

| Customer Service | 24/7 digital support via chat and app | In-person, phone, and online support |

| Fees | Low or no fees, minimal surcharges | Variable fees, may include maintenance charges |

| Interest Rates | Competitive savings rates, often higher | Typical rates, sometimes lower than neobanks |

| Loan Services | Limited or none | Extensive loan options including personal and business loans |

| Technology | Advanced mobile apps, real-time transactions | Basic online banking with some mobile capabilities |

| Regulation & Insurance | FDIC insured, regulated as banks or partners | FDIC insured, regulated by state and federal agencies |

| Community Impact | Limited local engagement | Strong local community support and development |

Which is better?

Neobanks offer advanced digital banking services with lower fees and seamless mobile app experiences, ideal for tech-savvy users seeking convenience and 24/7 access. Community banks provide personalized customer service, local decision-making, and support for small businesses, making them valuable for customers who prioritize relationship banking and in-person assistance. Choosing between a neobank and a community bank depends on preferences for digital innovation versus traditional, community-focused financial services.

Connection

Neobanks and community banks are connected through their shared focus on enhancing customer experience and local engagement, with neobanks providing digital-first banking solutions and community banks emphasizing personalized service within local markets. Both institutions collaborate by integrating advanced fintech technologies to improve accessibility, streamline financial services, and support underserved communities. This synergy allows neobanks to leverage the trust and regional expertise of community banks while community banks benefit from the innovative, cost-efficient platforms pioneered by neobanks.

Key Terms

Brick-and-Mortar Presence

Community banks maintain a strong brick-and-mortar presence, offering personalized in-branch services that cater to local customers' unique financial needs. Neobanks operate fully online, leveraging digital platforms to provide seamless banking experiences without physical locations or traditional infrastructure. Discover how the tangible advantages of community banks compare with the innovative accessibility of neobanks.

Digital-Only Platform

Community banks offer personalized services through physical branches, fostering strong local relationships and trust, while neobanks operate solely on digital-only platforms, providing seamless, user-friendly mobile and online banking experiences with real-time transaction capabilities. Neobanks excel in lower fees, instant account setup, and innovative tech-driven features, attracting tech-savvy customers seeking convenience and speed. Explore the distinct benefits of each banking model to determine which suits your financial lifestyle best.

Regulatory Framework

Community banks operate under stringent federal and state regulations, including the Dodd-Frank Act and FDIC oversight, ensuring robust consumer protection and financial stability. Neobanks, while generally not holding banking licenses themselves, partner with traditional banks to provide services, thus operating within the regulatory frameworks governing their banking partners. Explore the detailed regulatory distinctions and compliance requirements shaping these financial institutions.

Source and External Links

BCB Bank - BCB Bank is a community bank known for its customer service and local banking conveniences.

Community Bank, N.A. - Community Bank, N.A. is a commercial bank serving customers in Upstate New York, Northeastern Pennsylvania, Vermont, and Massachusetts.

Penn Community Bank - Penn Community Bank offers personal and business banking solutions in Bucks, Montgomery, and surrounding counties.

dowidth.com

dowidth.com