Core banking modernization enhances operational efficiency and customer experience by upgrading legacy systems with cloud-based platforms and real-time processing capabilities. Blockchain adoption introduces decentralized, secure, and transparent transaction frameworks that reduce fraud and streamline cross-border payments. Explore the transformative impact of these technologies on the future of banking.

Why it is important

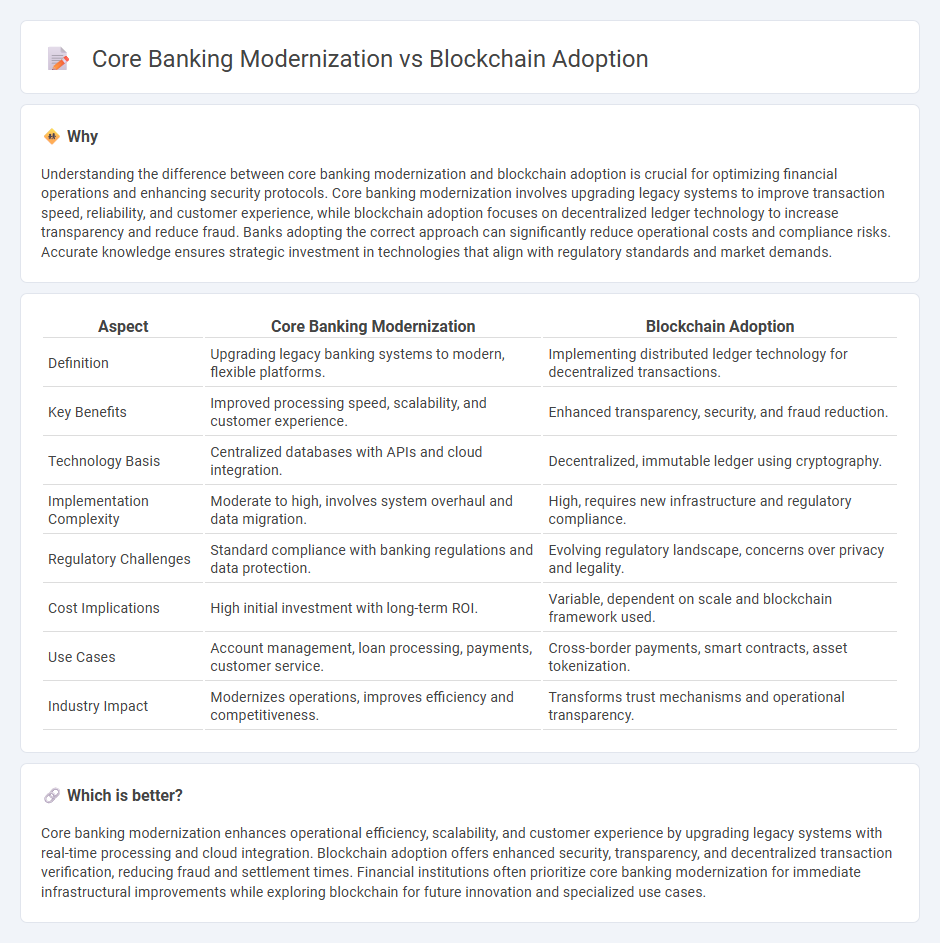

Understanding the difference between core banking modernization and blockchain adoption is crucial for optimizing financial operations and enhancing security protocols. Core banking modernization involves upgrading legacy systems to improve transaction speed, reliability, and customer experience, while blockchain adoption focuses on decentralized ledger technology to increase transparency and reduce fraud. Banks adopting the correct approach can significantly reduce operational costs and compliance risks. Accurate knowledge ensures strategic investment in technologies that align with regulatory standards and market demands.

Comparison Table

| Aspect | Core Banking Modernization | Blockchain Adoption |

|---|---|---|

| Definition | Upgrading legacy banking systems to modern, flexible platforms. | Implementing distributed ledger technology for decentralized transactions. |

| Key Benefits | Improved processing speed, scalability, and customer experience. | Enhanced transparency, security, and fraud reduction. |

| Technology Basis | Centralized databases with APIs and cloud integration. | Decentralized, immutable ledger using cryptography. |

| Implementation Complexity | Moderate to high, involves system overhaul and data migration. | High, requires new infrastructure and regulatory compliance. |

| Regulatory Challenges | Standard compliance with banking regulations and data protection. | Evolving regulatory landscape, concerns over privacy and legality. |

| Cost Implications | High initial investment with long-term ROI. | Variable, dependent on scale and blockchain framework used. |

| Use Cases | Account management, loan processing, payments, customer service. | Cross-border payments, smart contracts, asset tokenization. |

| Industry Impact | Modernizes operations, improves efficiency and competitiveness. | Transforms trust mechanisms and operational transparency. |

Which is better?

Core banking modernization enhances operational efficiency, scalability, and customer experience by upgrading legacy systems with real-time processing and cloud integration. Blockchain adoption offers enhanced security, transparency, and decentralized transaction verification, reducing fraud and settlement times. Financial institutions often prioritize core banking modernization for immediate infrastructural improvements while exploring blockchain for future innovation and specialized use cases.

Connection

Core banking modernization involves upgrading legacy systems to enhance efficiency, scalability, and security, which creates a robust foundation for integrating blockchain technology. Blockchain adoption in banking streamlines transaction processing, improves transparency, and strengthens data integrity by leveraging decentralized ledger systems. The synergy between these advancements drives innovation in digital banking services, enabling faster settlements, fraud reduction, and enhanced customer trust.

Key Terms

Distributed Ledger Technology (DLT)

Distributed Ledger Technology (DLT) offers enhanced transparency, security, and efficiency over traditional core banking systems, driving increasing blockchain adoption in the financial sector. Core banking modernization leverages DLT to streamline transactions, reduce settlement times, and improve data integrity across decentralized networks. Explore how integrating blockchain with modern banking infrastructure reshapes financial services and operational frameworks.

Legacy Systems

Legacy systems in core banking hinder blockchain adoption due to their inflexible architectures and data silos, limiting seamless integration with decentralized technologies. Modernizing these traditional platforms with APIs, microservices, and cloud-native solutions enhances scalability and interoperability essential for blockchain implementation. Explore how upgrading legacy infrastructure accelerates blockchain benefits in banking for improved security and transactional transparency.

Smart Contracts

Smart Contracts streamline automated transactions by embedding business logic directly into blockchain protocols, reducing processing time and minimizing errors compared to traditional core banking systems. While core banking modernization enhances existing infrastructure with improved scalability and integration capabilities, blockchain adoption introduces decentralized trust and transparency, essential for real-time contract execution and settlement. Explore how Smart Contracts transform financial services by enabling secure, efficient, and programmable banking operations.

Source and External Links

Blockchain is one step away from mainstream adoption - Blockworks - Blockchain's path to mass adoption mirrors past tech innovation cycles, with recent SEC approval of spot bitcoin ETFs marking a key milestone signaling validation and acceleration toward mainstream use.

The State of Blockchain Adoption in the Enterprise (2025) - Enterprise adoption is real but selective, led by financial services with growing use in supply chain, healthcare, and auditing; financial firms embrace blockchain for payments, asset tokenization, and infrastructure upgrades, while France emerges as a crypto adoption leader.

Blockchain adoption is gathering steam - OMFIF - Blockchain's adoption in institutional finance continues to grow steadily, evidenced by rising issuance of blockchain-based bonds and expanding interest beyond bonds to other asset classes in traditional finance markets.

dowidth.com

dowidth.com