Income streaming in banking involves generating consistent revenue through ongoing fees, interest, and service charges tied to customer accounts and financial products. Underwriting fees are one-time charges banks earn by evaluating and assuming risk in lending or securities issuance, playing a critical role in capital markets and loan syndication. Explore the differences between income streaming and underwriting fees to enhance your understanding of banking revenue models.

Why it is important

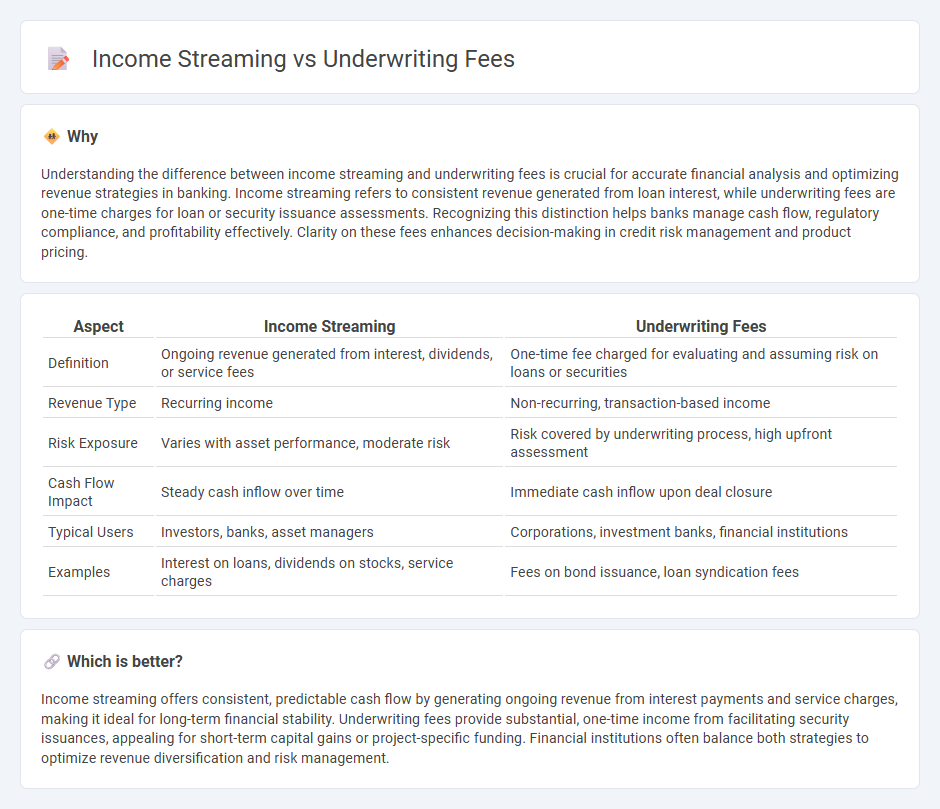

Understanding the difference between income streaming and underwriting fees is crucial for accurate financial analysis and optimizing revenue strategies in banking. Income streaming refers to consistent revenue generated from loan interest, while underwriting fees are one-time charges for loan or security issuance assessments. Recognizing this distinction helps banks manage cash flow, regulatory compliance, and profitability effectively. Clarity on these fees enhances decision-making in credit risk management and product pricing.

Comparison Table

| Aspect | Income Streaming | Underwriting Fees |

|---|---|---|

| Definition | Ongoing revenue generated from interest, dividends, or service fees | One-time fee charged for evaluating and assuming risk on loans or securities |

| Revenue Type | Recurring income | Non-recurring, transaction-based income |

| Risk Exposure | Varies with asset performance, moderate risk | Risk covered by underwriting process, high upfront assessment |

| Cash Flow Impact | Steady cash inflow over time | Immediate cash inflow upon deal closure |

| Typical Users | Investors, banks, asset managers | Corporations, investment banks, financial institutions |

| Examples | Interest on loans, dividends on stocks, service charges | Fees on bond issuance, loan syndication fees |

Which is better?

Income streaming offers consistent, predictable cash flow by generating ongoing revenue from interest payments and service charges, making it ideal for long-term financial stability. Underwriting fees provide substantial, one-time income from facilitating security issuances, appealing for short-term capital gains or project-specific funding. Financial institutions often balance both strategies to optimize revenue diversification and risk management.

Connection

Income streaming in banking generates consistent cash flows, which directly impacts the evaluation of underwriting fees by providing reliable revenue projections. Underwriting fees reflect the risk assessment and anticipated profitability of loan or security issuance, both influenced by stable income streams. Efficient income streaming enhances the accuracy of underwriting models, leading to optimized fee structures aligned with borrower credit quality and market conditions.

Key Terms

Risk Assessment

Underwriting fees are fixed costs charged during the risk evaluation process, directly covering expenses related to credit analysis and policy issuance, while income streaming involves continuous revenue derived from interest or premiums linked to the ongoing risk exposure over time. Effective risk assessment requires balancing upfront underwriting fees with the potential income stream to ensure profitability and sustainable risk management. Explore detailed insights on optimizing risk assessment strategies by understanding the interplay between underwriting fees and income streaming.

Origination Fees

Origination fees are a critical component of underwriting fees, representing the charges lenders impose for processing new loan applications and initiating credit agreements, directly impacting the revenue of financial institutions. These fees contribute to income streaming by providing a steady, upfront cash flow that enhances profitability and risk management during loan origination. Explore more to understand how origination fees strategically influence underwriting income streams and overall financial performance.

Recurring Revenue

Underwriting fees typically generate one-time income during the initial issuance of securities, while income streaming focuses on creating recurring revenue through continuous financial arrangements such as royalties or subscription services. Emphasizing recurring revenue strategies enhances long-term cash flow stability and investor confidence. Explore detailed analysis to understand how shifting from underwriting fees to income streaming can transform your financial model.

Source and External Links

What are Underwriting Fees? - SuperfastCPA CPA Review - Underwriting fees are charges collected by underwriters for assessing and assuming risk, varying by transaction type, such as a 1% fee on mortgage loans or a 5% fee on securities IPO proceeds, compensating the underwriter for their evaluation and risk-bearing services.

Underwriting fees definition - AccountingTools - Underwriting fees are amounts charged by underwriters, often investment banks, for services rendered in securities offerings, covering coordination, risk-taking, and allocation, and may include hidden costs like discounted share pricing to favor investors.

5.4.2 Underwriting Fees and Expenses - Underwriting fees in bond sales, known as the gross spread, include takedown commissions, expenses for advertising and legal fees, compensation for risk, and sometimes management fees, all paid by the issuer indirectly to the underwriter.

dowidth.com

dowidth.com