Finfluencers leverage social media platforms to provide accessible and relatable financial advice, targeting a broad online audience with bite-sized investment tips and market insights. Investment advisors offer personalized, regulated financial planning and portfolio management, catering to clients seeking tailored strategies and professional oversight. Explore the distinct advantages of finfluencers and investment advisors to determine which best suits your financial goals.

Why it is important

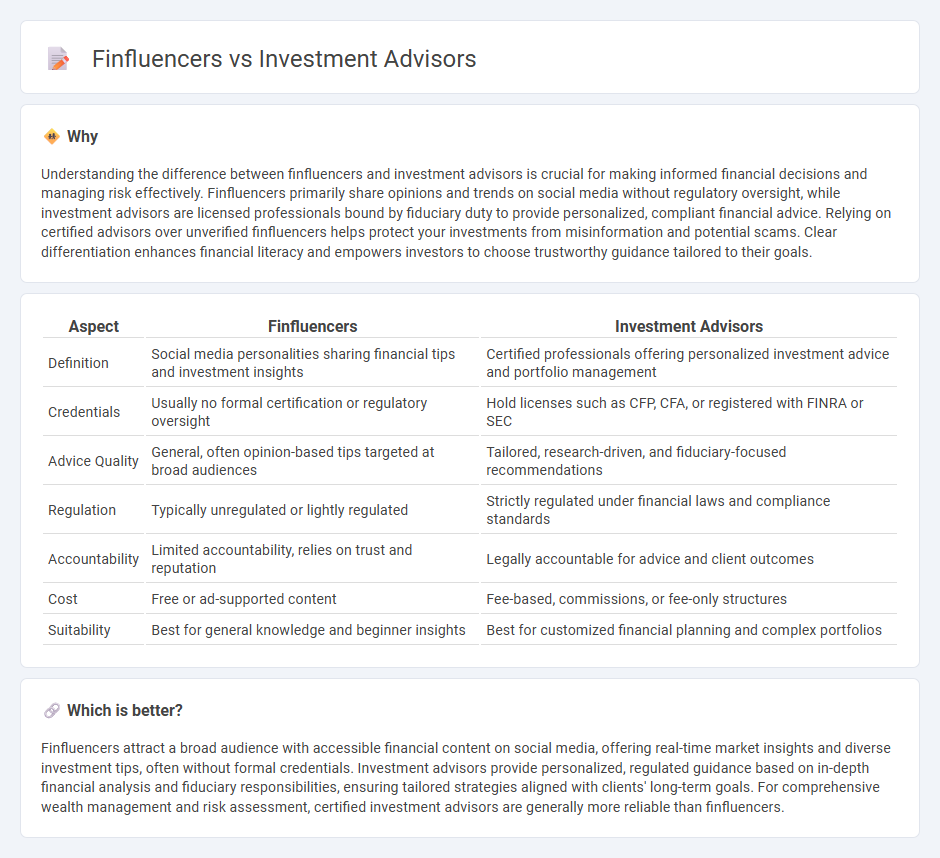

Understanding the difference between finfluencers and investment advisors is crucial for making informed financial decisions and managing risk effectively. Finfluencers primarily share opinions and trends on social media without regulatory oversight, while investment advisors are licensed professionals bound by fiduciary duty to provide personalized, compliant financial advice. Relying on certified advisors over unverified finfluencers helps protect your investments from misinformation and potential scams. Clear differentiation enhances financial literacy and empowers investors to choose trustworthy guidance tailored to their goals.

Comparison Table

| Aspect | Finfluencers | Investment Advisors |

|---|---|---|

| Definition | Social media personalities sharing financial tips and investment insights | Certified professionals offering personalized investment advice and portfolio management |

| Credentials | Usually no formal certification or regulatory oversight | Hold licenses such as CFP, CFA, or registered with FINRA or SEC |

| Advice Quality | General, often opinion-based tips targeted at broad audiences | Tailored, research-driven, and fiduciary-focused recommendations |

| Regulation | Typically unregulated or lightly regulated | Strictly regulated under financial laws and compliance standards |

| Accountability | Limited accountability, relies on trust and reputation | Legally accountable for advice and client outcomes |

| Cost | Free or ad-supported content | Fee-based, commissions, or fee-only structures |

| Suitability | Best for general knowledge and beginner insights | Best for customized financial planning and complex portfolios |

Which is better?

Finfluencers attract a broad audience with accessible financial content on social media, offering real-time market insights and diverse investment tips, often without formal credentials. Investment advisors provide personalized, regulated guidance based on in-depth financial analysis and fiduciary responsibilities, ensuring tailored strategies aligned with clients' long-term goals. For comprehensive wealth management and risk assessment, certified investment advisors are generally more reliable than finfluencers.

Connection

Finfluencers leverage social media platforms to provide accessible investment insights and banking advice, influencing retail investors' financial decisions. Investment advisors offer personalized strategies based on comprehensive market analysis, complementing the broad educational reach of finfluencers. The collaboration between finfluencers and investment advisors enhances informed decision-making within banking and investment sectors.

Key Terms

Fiduciary Duty

Investment advisors are legally bound by fiduciary duty to act in their clients' best interests, ensuring transparent, personalized financial advice based on thorough analysis. Finfluencers, while influential on social media platforms, often lack fiduciary responsibility and may promote investments primarily for personal gain or brand partnerships without comprehensive client consideration. Explore the key distinctions between fiduciary duty and social media influence to understand how it impacts your financial decisions.

Regulation/Compliance

Investment advisors operate under strict regulations enforced by bodies like the SEC and FINRA, ensuring fiduciary duty and client protection through comprehensive compliance frameworks. Finfluencers, often unregulated, provide financial advice without mandatory adherence to these stringent standards, raising concerns about misinformation and investor risk. Explore how regulatory differences impact investment guidance quality and safety by learning more about compliance requirements.

Disclosure

Investment advisors adhere to strict disclosure regulations imposed by entities like the SEC, ensuring transparency about fees, conflicts of interest, and investment risks. Finfluencers, often operating outside formal regulatory frameworks, may lack comprehensive disclosure requirements, leading to potential conflicts and misinformation. Explore more about the critical role of disclosure in financial guidance to make informed decisions.

Source and External Links

Investment Advisers | Investor.gov - An investment adviser is a firm or person who, for compensation, provides ongoing advice on buying, selling, and holding securities, typically registering with the SEC or state authorities and charging fees based on assets under management.

Investment Advisers | FINRA.org - Registered investment advisers (RIAs) offer personalized investment advice, may hold client assets with broker-dealers for safekeeping, and provide clients with relationship summaries outlining services and costs.

Investment Advisers - NASAA - State regulators oversee investment advisers with assets under $100 million and investment adviser representatives who work directly with retail investors, enforcing licensing, compliance, and protections especially for seniors and vulnerable adults.

dowidth.com

dowidth.com