Robo advisors use algorithms and automation to create and manage investment portfolios with low fees and minimal human intervention. Discretionary portfolio managers provide personalized investment strategies through active management and expert decision-making tailored to individual client goals. Explore more to understand which approach aligns best with your financial objectives and risk tolerance.

Why it is important

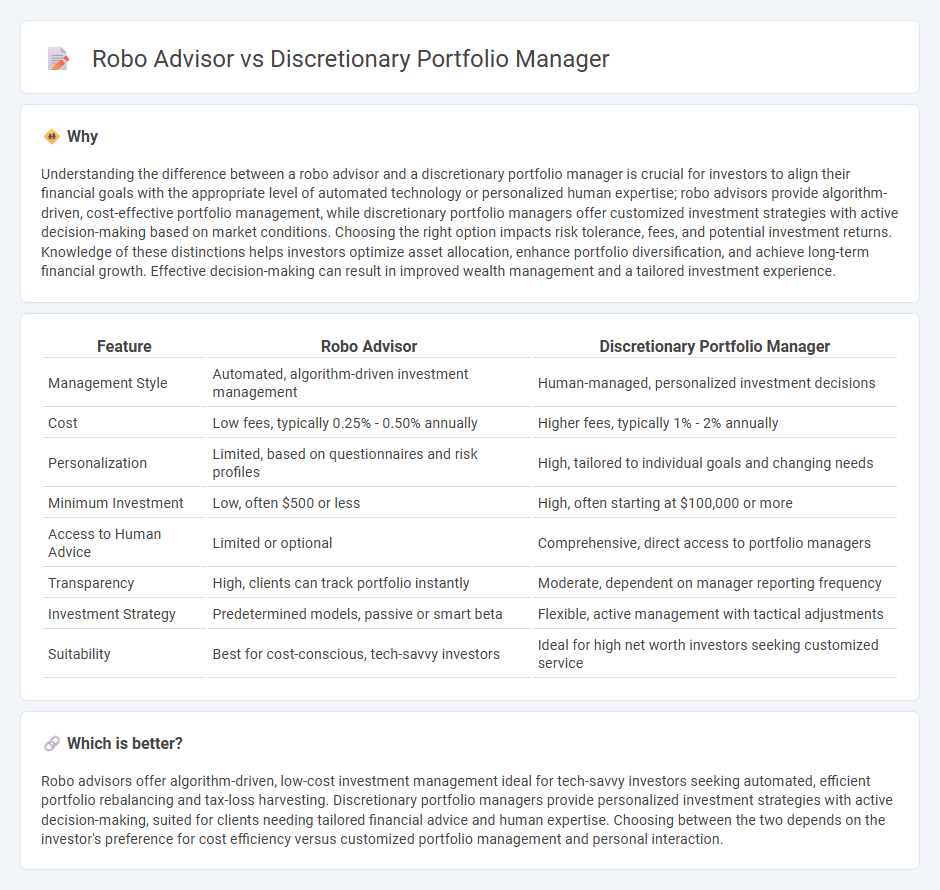

Understanding the difference between a robo advisor and a discretionary portfolio manager is crucial for investors to align their financial goals with the appropriate level of automated technology or personalized human expertise; robo advisors provide algorithm-driven, cost-effective portfolio management, while discretionary portfolio managers offer customized investment strategies with active decision-making based on market conditions. Choosing the right option impacts risk tolerance, fees, and potential investment returns. Knowledge of these distinctions helps investors optimize asset allocation, enhance portfolio diversification, and achieve long-term financial growth. Effective decision-making can result in improved wealth management and a tailored investment experience.

Comparison Table

| Feature | Robo Advisor | Discretionary Portfolio Manager |

|---|---|---|

| Management Style | Automated, algorithm-driven investment management | Human-managed, personalized investment decisions |

| Cost | Low fees, typically 0.25% - 0.50% annually | Higher fees, typically 1% - 2% annually |

| Personalization | Limited, based on questionnaires and risk profiles | High, tailored to individual goals and changing needs |

| Minimum Investment | Low, often $500 or less | High, often starting at $100,000 or more |

| Access to Human Advice | Limited or optional | Comprehensive, direct access to portfolio managers |

| Transparency | High, clients can track portfolio instantly | Moderate, dependent on manager reporting frequency |

| Investment Strategy | Predetermined models, passive or smart beta | Flexible, active management with tactical adjustments |

| Suitability | Best for cost-conscious, tech-savvy investors | Ideal for high net worth investors seeking customized service |

Which is better?

Robo advisors offer algorithm-driven, low-cost investment management ideal for tech-savvy investors seeking automated, efficient portfolio rebalancing and tax-loss harvesting. Discretionary portfolio managers provide personalized investment strategies with active decision-making, suited for clients needing tailored financial advice and human expertise. Choosing between the two depends on the investor's preference for cost efficiency versus customized portfolio management and personal interaction.

Connection

Robo advisors utilize algorithm-driven models to automate investment decisions, providing cost-effective portfolio management tailored to client risk profiles. Discretionary portfolio managers offer personalized investment strategies by actively managing assets on behalf of clients, often integrating advanced technology for data analysis. Both approaches aim to optimize investment performance through efficient asset allocation and risk management, blending automation with professional oversight.

Key Terms

Investment Strategy

Discretionary portfolio managers tailor investment strategies based on active market analysis and client-specific objectives, employing human expertise to adjust portfolios dynamically. Robo advisors utilize algorithm-driven models, offering automated, low-cost asset allocation based on risk tolerance and predefined financial goals. Explore detailed comparisons to determine which investment strategy aligns best with your financial needs.

Human Oversight

Discretionary portfolio managers provide personalized investment strategies with active human oversight, allowing for tailored adjustments based on market conditions and client goals. Robo advisors rely on algorithm-driven models with limited human intervention, offering automated portfolio management at lower costs. Explore the benefits and limitations of each approach to determine the best fit for your investment needs.

Automation

Discretionary portfolio managers provide personalized investment decisions based on human expertise, while robo advisors utilize advanced algorithms and automation to manage portfolios with minimal human intervention. Automation in robo advisors ensures efficient, cost-effective portfolio management through continuous monitoring and automatic rebalancing aligned with preset client goals. Discover how automation-driven investment strategies can optimize your portfolio management experience.

Source and External Links

What Is Discretionary Fund Management? - Discretionary fund managers continuously monitor markets and adjust portfolios based on client objectives and risk tolerance.

Discretionary Investment Management - This form of investment management involves making decisions on behalf of clients without their direct involvement, often aiming to outperform benchmarks.

The Six Foundations of Discretionary Portfolio Management - Discretionary portfolio management optimizes client returns by combining asset allocation with professional stewardship based on client aspirations.

dowidth.com

dowidth.com