Pay by bank leverages direct bank-to-merchant transactions, providing enhanced security and faster settlement times compared to mobile wallets that store payment information digitally for consumer convenience. Banks offer real-time authentication and fraud detection, while mobile wallets rely on device security and tokenization to protect user data. Explore the key differences and benefits of each payment method to determine the best fit for your financial needs.

Why it is important

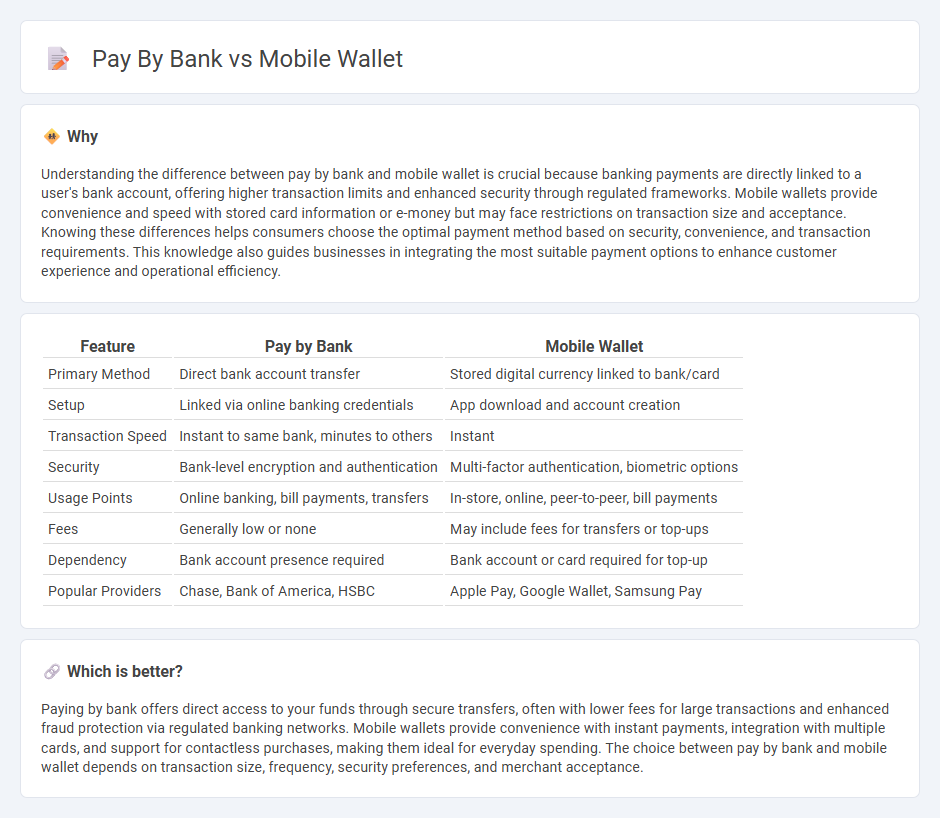

Understanding the difference between pay by bank and mobile wallet is crucial because banking payments are directly linked to a user's bank account, offering higher transaction limits and enhanced security through regulated frameworks. Mobile wallets provide convenience and speed with stored card information or e-money but may face restrictions on transaction size and acceptance. Knowing these differences helps consumers choose the optimal payment method based on security, convenience, and transaction requirements. This knowledge also guides businesses in integrating the most suitable payment options to enhance customer experience and operational efficiency.

Comparison Table

| Feature | Pay by Bank | Mobile Wallet |

|---|---|---|

| Primary Method | Direct bank account transfer | Stored digital currency linked to bank/card |

| Setup | Linked via online banking credentials | App download and account creation |

| Transaction Speed | Instant to same bank, minutes to others | Instant |

| Security | Bank-level encryption and authentication | Multi-factor authentication, biometric options |

| Usage Points | Online banking, bill payments, transfers | In-store, online, peer-to-peer, bill payments |

| Fees | Generally low or none | May include fees for transfers or top-ups |

| Dependency | Bank account presence required | Bank account or card required for top-up |

| Popular Providers | Chase, Bank of America, HSBC | Apple Pay, Google Wallet, Samsung Pay |

Which is better?

Paying by bank offers direct access to your funds through secure transfers, often with lower fees for large transactions and enhanced fraud protection via regulated banking networks. Mobile wallets provide convenience with instant payments, integration with multiple cards, and support for contactless purchases, making them ideal for everyday spending. The choice between pay by bank and mobile wallet depends on transaction size, frequency, security preferences, and merchant acceptance.

Connection

Pay by bank and mobile wallet systems are interconnected through real-time payment networks that enable seamless fund transfers directly from a user's bank account to their mobile wallet. This connection allows instant authentication, transaction authorization, and secure processing, reducing reliance on cash and physical cards. The integration enhances financial inclusion by providing users with convenient, cashless payment options linked to their existing banking infrastructure.

Key Terms

Digital Wallet

Mobile wallet technology offers users the convenience of storing multiple payment methods, loyalty cards, and transaction histories in one secure app, enabling quick tap-and-pay experiences at retail points. Pay by bank services facilitate direct bank-to-merchant transactions without intermediaries, enhancing security and reducing fraud risk while maintaining real-time payment confirmations. Discover how digital wallet innovations are reshaping consumer payment habits and banking interactions.

Direct Bank Transfer

Direct Bank Transfer offers a secure, instant payment method by transferring funds directly from the payer's bank account to the recipient's, bypassing intermediaries commonly seen in mobile wallets. Unlike mobile wallets, which store funds digitally and require periodic reloading through bank or card links, Direct Bank Transfer leverages real-time payment infrastructure for faster settlement and reduced transaction fees. Explore the benefits and use cases of Direct Bank Transfer to determine which payment system best suits your financial needs.

Payment Authentication

Mobile wallet payment authentication typically relies on biometric methods such as fingerprint or facial recognition combined with device-level encryption, ensuring secure and convenient transactions. Pay by Bank uses Strong Customer Authentication (SCA) protocols mandated by PSD2, involving multi-factor authentication tied directly to the user's bank account for enhanced security. Explore how these authentication technologies impact transaction safety and user experience.

Source and External Links

Cards - Mobile Wallet - This app allows users to manage their cards efficiently, enabling mobile payments and offering features like barcode presentation and card notifications.

Digital Wallet vs. Mobile Wallet - Explains the differences between digital wallets and mobile wallets, highlighting their respective uses and benefits.

The Mobile Wallet - Offers a convenient way to store digital passes and cards on smart devices, featuring a user-friendly interface and security features.

dowidth.com

dowidth.com