Personal finance automation tools enhance money management by offering personalized budgeting, spending analysis, and savings recommendations through advanced algorithms. Retail banking chatbots provide real-time customer service, transaction processing, and account inquiries, improving user experience and operational efficiency. Explore how these technologies transform financial management by learning more about their capabilities and benefits.

Why it is important

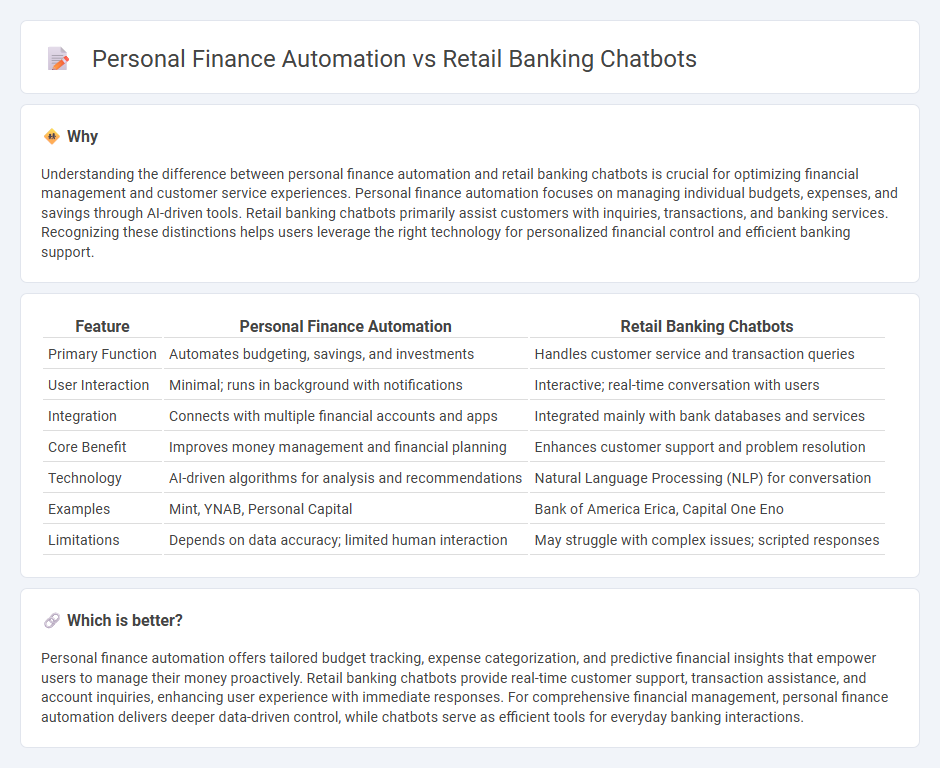

Understanding the difference between personal finance automation and retail banking chatbots is crucial for optimizing financial management and customer service experiences. Personal finance automation focuses on managing individual budgets, expenses, and savings through AI-driven tools. Retail banking chatbots primarily assist customers with inquiries, transactions, and banking services. Recognizing these distinctions helps users leverage the right technology for personalized financial control and efficient banking support.

Comparison Table

| Feature | Personal Finance Automation | Retail Banking Chatbots |

|---|---|---|

| Primary Function | Automates budgeting, savings, and investments | Handles customer service and transaction queries |

| User Interaction | Minimal; runs in background with notifications | Interactive; real-time conversation with users |

| Integration | Connects with multiple financial accounts and apps | Integrated mainly with bank databases and services |

| Core Benefit | Improves money management and financial planning | Enhances customer support and problem resolution |

| Technology | AI-driven algorithms for analysis and recommendations | Natural Language Processing (NLP) for conversation |

| Examples | Mint, YNAB, Personal Capital | Bank of America Erica, Capital One Eno |

| Limitations | Depends on data accuracy; limited human interaction | May struggle with complex issues; scripted responses |

Which is better?

Personal finance automation offers tailored budget tracking, expense categorization, and predictive financial insights that empower users to manage their money proactively. Retail banking chatbots provide real-time customer support, transaction assistance, and account inquiries, enhancing user experience with immediate responses. For comprehensive financial management, personal finance automation delivers deeper data-driven control, while chatbots serve as efficient tools for everyday banking interactions.

Connection

Personal finance automation leverages AI-powered retail banking chatbots to enhance user experience by providing real-time financial advice and transaction management. Chatbots use machine learning algorithms to analyze spending patterns, automate budgeting, and offer personalized savings tips, promoting efficient money management. Integration of these technologies streamlines banking operations while increasing customer engagement and satisfaction.

Key Terms

**Retail Banking Chatbots:**

Retail banking chatbots enhance customer service by providing instant responses to queries, enabling seamless account management, and offering personalized financial advice through AI-driven interactions. These chatbots leverage natural language processing to understand and address common banking needs like balance inquiries, transaction history, and fraud alerts, improving operational efficiency and customer satisfaction. Discover how retail banking chatbots transform user experiences and streamline financial services.

Conversational AI

Conversational AI in retail banking chatbots enhances real-time customer engagement by providing personalized support and resolving queries efficiently, whereas personal finance automation focuses on streamlining financial management through automated budgeting, expense tracking, and investment advice. Retail banking chatbots leverage natural language processing to interpret complex customer intents, improving satisfaction and operational scalability. Explore how Conversational AI transforms financial services by merging interactive communication with intelligent automation.

Customer Support

Retail banking chatbots enhance customer support by providing real-time assistance, handling routine inquiries, and offering 24/7 availability, significantly reducing wait times and operational costs. Personal finance automation prioritizes financial management through automated budgeting, expense tracking, and personalized financial advice, focusing less on direct customer interaction. Explore more about how these technologies reshape customer support and financial management in banking.

Source and External Links

Best Chatbots in Banking To Transform Banking Services - Banking chatbots act as personal assistants, handling tasks like answering FAQs, managing transactions, closing accounts, blocking cards, and providing personalized product recommendations, while also supporting bank employees by automating routine tasks and gathering customer insights.

Chatbots in Banking: Trends & Innovations in 2025 - Modern banking chatbots enable customers to make payments, track transfers, open or close accounts, check balances, receive spending alerts, and get location-based services, while also assisting staff with repetitive tasks and real-time notifications.

What's the Current State of Chatbots in Mobile Banking? - Leading retail banking chatbots like Bank of America's Erica and TD Bank's Clari offer advanced features such as account transfers, card management, spending analysis, and complex query resolution directly within the chat interface, significantly enhancing mobile banking convenience.

dowidth.com

dowidth.com