Instant settlement enables real-time transfer of funds between different banks, drastically reducing transaction times and enhancing liquidity management. On-us settlement involves transactions within the same bank, allowing immediate fund availability without interbank processing delays. Explore the differences to understand which settlement method best suits your banking needs.

Why it is important

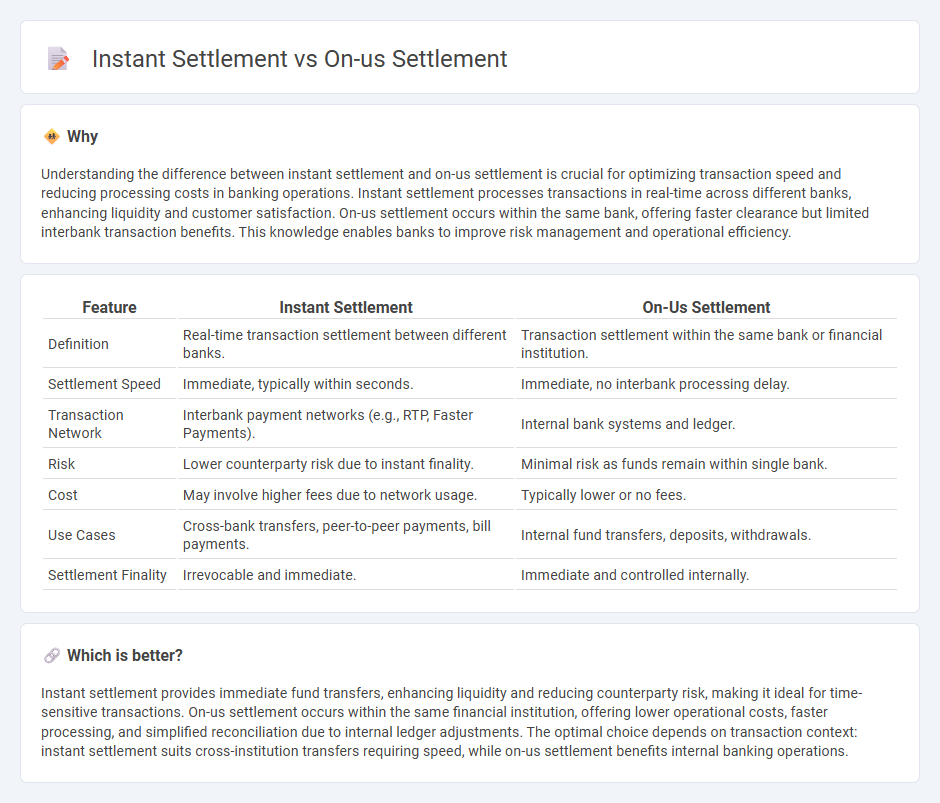

Understanding the difference between instant settlement and on-us settlement is crucial for optimizing transaction speed and reducing processing costs in banking operations. Instant settlement processes transactions in real-time across different banks, enhancing liquidity and customer satisfaction. On-us settlement occurs within the same bank, offering faster clearance but limited interbank transaction benefits. This knowledge enables banks to improve risk management and operational efficiency.

Comparison Table

| Feature | Instant Settlement | On-Us Settlement |

|---|---|---|

| Definition | Real-time transaction settlement between different banks. | Transaction settlement within the same bank or financial institution. |

| Settlement Speed | Immediate, typically within seconds. | Immediate, no interbank processing delay. |

| Transaction Network | Interbank payment networks (e.g., RTP, Faster Payments). | Internal bank systems and ledger. |

| Risk | Lower counterparty risk due to instant finality. | Minimal risk as funds remain within single bank. |

| Cost | May involve higher fees due to network usage. | Typically lower or no fees. |

| Use Cases | Cross-bank transfers, peer-to-peer payments, bill payments. | Internal fund transfers, deposits, withdrawals. |

| Settlement Finality | Irrevocable and immediate. | Immediate and controlled internally. |

Which is better?

Instant settlement provides immediate fund transfers, enhancing liquidity and reducing counterparty risk, making it ideal for time-sensitive transactions. On-us settlement occurs within the same financial institution, offering lower operational costs, faster processing, and simplified reconciliation due to internal ledger adjustments. The optimal choice depends on transaction context: instant settlement suits cross-institution transfers requiring speed, while on-us settlement benefits internal banking operations.

Connection

Instant settlement in banking refers to the immediate transfer of funds between accounts, enhancing transaction speed and liquidity management. On-us settlement occurs when a transaction happens within the same bank, allowing for quicker processing since the funds do not need to move across different financial institutions. The connection lies in on-us settlements enabling true instant settlements by eliminating the delays associated with interbank transfers, thereby improving overall efficiency in payment systems.

Key Terms

Clearing

On-us settlement occurs when both the payer and payee accounts reside within the same financial institution, enabling immediate clearing without interbank reconciliation. Instant settlement, on the other hand, involves real-time clearing across different banks through centralized clearinghouses or payment networks, reducing settlement risk and enhancing liquidity. Explore deeper into clearing mechanisms and their impact on payment efficiency.

Fund Transfer

On-us settlement occurs when both the sender's and receiver's accounts are held within the same financial institution, allowing for rapid fund transfers without interbank processing delays. Instant settlement, on the other hand, enables real-time fund transfers across different banks, ensuring immediate availability of funds regardless of the institutions involved. Explore the benefits of each settlement type to optimize your fund transfer processes efficiently.

Real-Time Payment

On-us settlement processes transactions within the same financial institution, enabling faster clearing and reduced risk, while instant settlement in real-time payment systems ensures funds transfer occurs immediately between different institutions, enhancing liquidity and customer satisfaction. Real-Time Payment platforms utilize advanced infrastructure like ISO 20022 messaging standards and 24/7 availability to provide seamless instant settlement across banks globally. Explore how these settlement methods transform payment ecosystems by improving efficiency and reducing transaction times.

Source and External Links

Clearing and Settlement Demystified - On-us settlement refers to transactions that are settled internally within a single institution's own books, such as certain government securities transactions, thereby reducing the need to settle through external systems like the Federal Reserve's book-entry system.

Facilitating increased adoption of PvP - final report - On-us settlement means both legs of a trade are settled across the books of one institution, which can reduce settlement risk if payments occur simultaneously or within agreed credit lines, but does not completely eliminate risk like payment-versus-payment mechanisms do.

The Onus of 'On Us' Checks - In banking, an "on-us" check is one drawn on an account held at the same bank where it is presented, allowing the bank to both receive and pay the item internally without external clearing.

dowidth.com

dowidth.com