Hyperpersonalization in banking leverages advanced AI algorithms and real-time data to tailor financial products and services uniquely to each customer's preferences and life stage. Behavioral analytics examines transactional patterns and customer interactions to predict needs and optimize service delivery. Explore how integrating hyperpersonalization and behavioral analytics transforms customer engagement and boosts banking performance.

Why it is important

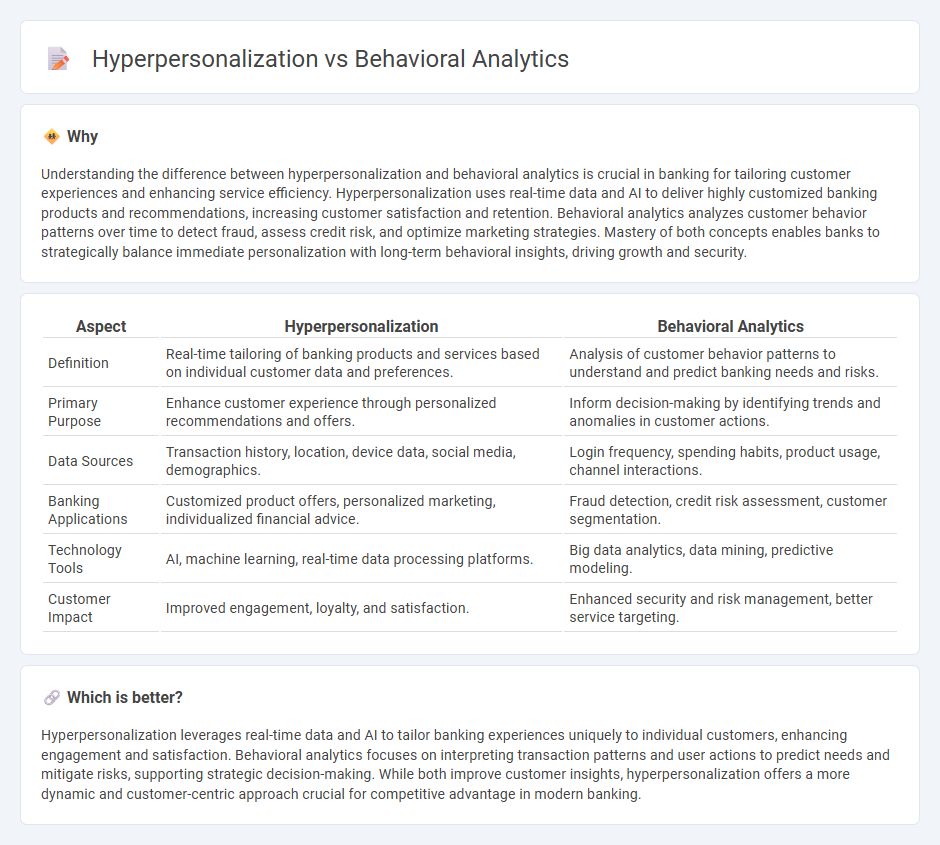

Understanding the difference between hyperpersonalization and behavioral analytics is crucial in banking for tailoring customer experiences and enhancing service efficiency. Hyperpersonalization uses real-time data and AI to deliver highly customized banking products and recommendations, increasing customer satisfaction and retention. Behavioral analytics analyzes customer behavior patterns over time to detect fraud, assess credit risk, and optimize marketing strategies. Mastery of both concepts enables banks to strategically balance immediate personalization with long-term behavioral insights, driving growth and security.

Comparison Table

| Aspect | Hyperpersonalization | Behavioral Analytics |

|---|---|---|

| Definition | Real-time tailoring of banking products and services based on individual customer data and preferences. | Analysis of customer behavior patterns to understand and predict banking needs and risks. |

| Primary Purpose | Enhance customer experience through personalized recommendations and offers. | Inform decision-making by identifying trends and anomalies in customer actions. |

| Data Sources | Transaction history, location, device data, social media, demographics. | Login frequency, spending habits, product usage, channel interactions. |

| Banking Applications | Customized product offers, personalized marketing, individualized financial advice. | Fraud detection, credit risk assessment, customer segmentation. |

| Technology Tools | AI, machine learning, real-time data processing platforms. | Big data analytics, data mining, predictive modeling. |

| Customer Impact | Improved engagement, loyalty, and satisfaction. | Enhanced security and risk management, better service targeting. |

Which is better?

Hyperpersonalization leverages real-time data and AI to tailor banking experiences uniquely to individual customers, enhancing engagement and satisfaction. Behavioral analytics focuses on interpreting transaction patterns and user actions to predict needs and mitigate risks, supporting strategic decision-making. While both improve customer insights, hyperpersonalization offers a more dynamic and customer-centric approach crucial for competitive advantage in modern banking.

Connection

Hyperpersonalization in banking utilizes behavioral analytics to create individualized customer experiences by analyzing transaction patterns, spending habits, and financial goals. This data-driven approach allows banks to tailor product recommendations, marketing messages, and risk assessments, enhancing customer engagement and satisfaction. Leveraging advanced algorithms and machine learning ensures predictive insights that drive hyperpersonalized services, improving retention and revenue growth.

Key Terms

**Behavioral Analytics:**

Behavioral analytics involves collecting and analyzing user data such as click patterns, session duration, and purchase history to understand customer behavior and preferences. This data-driven approach enables businesses to identify trends and predict future actions, enhancing decision-making processes and marketing strategies. Explore more to discover how behavioral analytics transforms customer insights into actionable growth opportunities.

Customer Segmentation

Behavioral analytics utilizes data on customer actions and preferences to create precise customer segments, enabling businesses to target audiences based on real-time behavior patterns. Hyperpersonalization leverages these insights further by tailoring content, offers, and experiences to individual customer needs within each segment using AI and machine learning. Explore how combining behavioral analytics with hyperpersonalization can transform customer segmentation strategies for maximum engagement.

Transaction Patterns

Behavioral analytics examines transaction patterns to identify customer preferences, habits, and purchasing triggers by analyzing data such as frequency, value, and timing of transactions. Hyperpersonalization leverages these insights to tailor real-time experiences, offers, and recommendations aligned with individual behaviors, driving higher engagement and conversion rates. Discover how combining transactional data analysis with hyperpersonalization strategies can transform customer interactions and boost business performance.

Source and External Links

What is Behavioral Analytics? - RudderStack - Behavioral analytics is the study of customer behaviors online, analyzing how users interact with products and services to improve engagement, retention, and predict future actions by tracking events such as clicks, mouse movements, and time spent on pages.

The Role of Behavioral Analytics in Cybersecurity | Splunk - Behavioral analytics applies AI and machine learning to detect unusual user and entity activity patterns that indicate security threats, helping organizations identify insider threats, data exfiltration, and DDoS attacks by analyzing deviations from normal behavior.

What is Behavioral Analysis and How to Use Behavioral Data? - OpenText - Behavioral analytics collects and examines large user and entity data sets to detect patterns and anomalies using AI, allowing better decision-making across fields like cybersecurity, eCommerce, and healthcare by understanding normal behaviors and identifying deviations that may indicate threats or changing preferences.

dowidth.com

dowidth.com