Personal finance automation streamlines budgeting, savings, and investment tracking by leveraging AI-driven tools to enhance individual financial management. Regulatory compliance software ensures banks adhere to legal standards, mitigating risks and preventing fraud through real-time monitoring and reporting features. Discover how integrating these technologies can optimize financial operations and security.

Why it is important

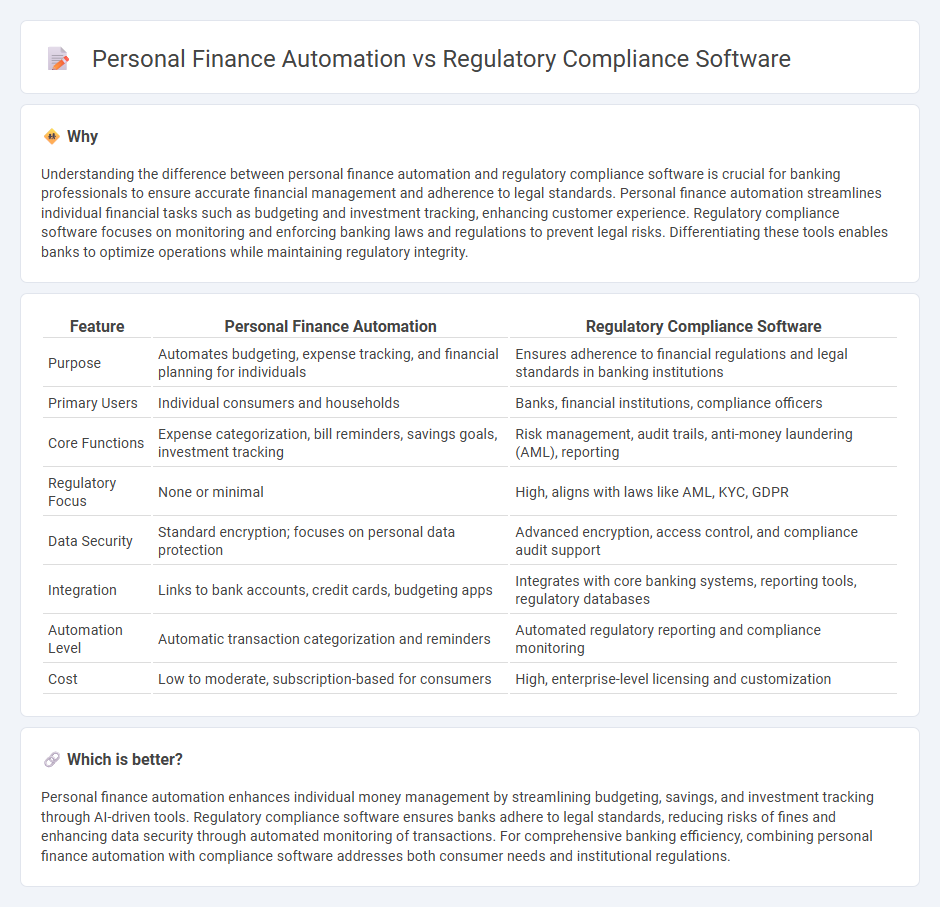

Understanding the difference between personal finance automation and regulatory compliance software is crucial for banking professionals to ensure accurate financial management and adherence to legal standards. Personal finance automation streamlines individual financial tasks such as budgeting and investment tracking, enhancing customer experience. Regulatory compliance software focuses on monitoring and enforcing banking laws and regulations to prevent legal risks. Differentiating these tools enables banks to optimize operations while maintaining regulatory integrity.

Comparison Table

| Feature | Personal Finance Automation | Regulatory Compliance Software |

|---|---|---|

| Purpose | Automates budgeting, expense tracking, and financial planning for individuals | Ensures adherence to financial regulations and legal standards in banking institutions |

| Primary Users | Individual consumers and households | Banks, financial institutions, compliance officers |

| Core Functions | Expense categorization, bill reminders, savings goals, investment tracking | Risk management, audit trails, anti-money laundering (AML), reporting |

| Regulatory Focus | None or minimal | High, aligns with laws like AML, KYC, GDPR |

| Data Security | Standard encryption; focuses on personal data protection | Advanced encryption, access control, and compliance audit support |

| Integration | Links to bank accounts, credit cards, budgeting apps | Integrates with core banking systems, reporting tools, regulatory databases |

| Automation Level | Automatic transaction categorization and reminders | Automated regulatory reporting and compliance monitoring |

| Cost | Low to moderate, subscription-based for consumers | High, enterprise-level licensing and customization |

Which is better?

Personal finance automation enhances individual money management by streamlining budgeting, savings, and investment tracking through AI-driven tools. Regulatory compliance software ensures banks adhere to legal standards, reducing risks of fines and enhancing data security through automated monitoring of transactions. For comprehensive banking efficiency, combining personal finance automation with compliance software addresses both consumer needs and institutional regulations.

Connection

Personal finance automation and regulatory compliance software are interconnected through their shared goal of enhancing financial accuracy and security within banking institutions. Automation tools streamline transaction tracking, budgeting, and reporting, while compliance software ensures adherence to regulations such as AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements. Integrating these technologies helps banks reduce operational risks, improve customer trust, and maintain regulatory transparency efficiently.

Key Terms

**Regulatory Compliance Software:**

Regulatory compliance software automates the monitoring, reporting, and management of legal requirements across industries such as finance, healthcare, and manufacturing, ensuring organizations adhere to laws like GDPR, HIPAA, and SOX. This software integrates real-time risk assessment, audit trails, and document management to reduce non-compliance penalties and streamline regulatory workflows. Discover how regulatory compliance software can safeguard your business and enhance operational efficiency.

AML (Anti-Money Laundering)

Regulatory compliance software specializes in AML by automating transaction monitoring, suspicious activity detection, and reporting to meet legal standards and avoid penalties. Personal finance automation primarily helps individuals manage budgets, track expenses, and optimize savings but lacks the advanced AML capabilities required for financial institutions. Explore how integrating robust AML compliance tools can enhance your risk management strategy.

KYC (Know Your Customer)

Regulatory compliance software specializes in automating KYC (Know Your Customer) processes by verifying customer identities, monitoring transactions, and ensuring adherence to legal standards such as AML (Anti-Money Laundering) regulations. Personal finance automation tools, conversely, focus on managing individual financial tasks like budgeting and expense tracking, often lacking the sophisticated identity verification and compliance monitoring features critical in KYC. Explore how different solutions address KYC challenges and streamline compliance efforts to safeguard your financial operations.

Source and External Links

Regulatory Compliance Software | Objective Corporation - Objective RegWorks is a specialized regulatory compliance management platform for government agencies, offering automated workflows, real-time collaboration, risk-based intelligence, and configurable reporting to ensure adherence to legislation and enable informed enforcement actions.

Regulatory compliance software | Save time, stay compliant - Diligent - Diligent provides centralized, AI-powered compliance management with automated regulatory updates, risk oversight, and built-in reporting, helping organizations reduce manual effort, avoid fines, and maintain a single source of truth for compliance status.

How to Choose a Compliance Management Tool - ZenGRC - ZenGRC offers all-purpose compliance and risk management tools suitable for various industries, alongside specialized solutions for sectors like healthcare and finance, with features to streamline governance, risk, and compliance (GRC) processes.

dowidth.com

dowidth.com