Wealthtech focuses on digital solutions for managing personal investments and wealth planning, leveraging AI and big data to optimize portfolio performance and client engagement. Core banking technology underpins fundamental banking operations such as account management, transaction processing, and compliance, ensuring the secure and efficient delivery of banking services. Explore the evolving landscape of wealthtech and core banking technology to understand their impact on the future of financial services.

Why it is important

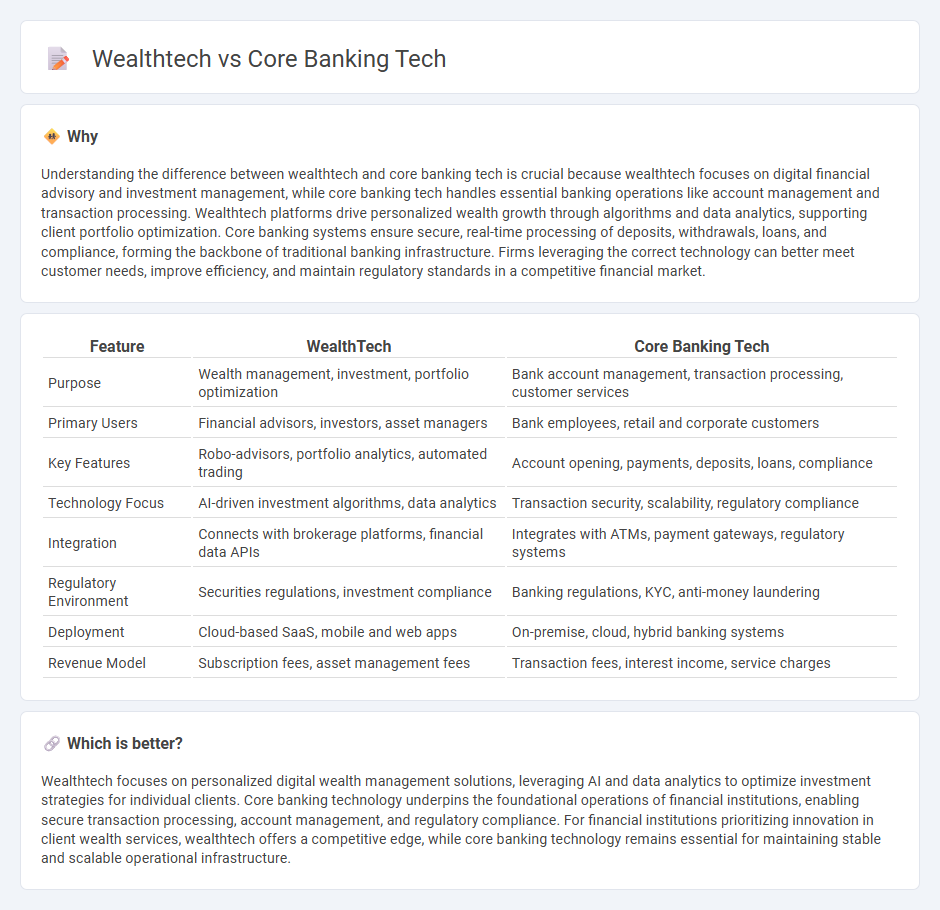

Understanding the difference between wealthtech and core banking tech is crucial because wealthtech focuses on digital financial advisory and investment management, while core banking tech handles essential banking operations like account management and transaction processing. Wealthtech platforms drive personalized wealth growth through algorithms and data analytics, supporting client portfolio optimization. Core banking systems ensure secure, real-time processing of deposits, withdrawals, loans, and compliance, forming the backbone of traditional banking infrastructure. Firms leveraging the correct technology can better meet customer needs, improve efficiency, and maintain regulatory standards in a competitive financial market.

Comparison Table

| Feature | WealthTech | Core Banking Tech |

|---|---|---|

| Purpose | Wealth management, investment, portfolio optimization | Bank account management, transaction processing, customer services |

| Primary Users | Financial advisors, investors, asset managers | Bank employees, retail and corporate customers |

| Key Features | Robo-advisors, portfolio analytics, automated trading | Account opening, payments, deposits, loans, compliance |

| Technology Focus | AI-driven investment algorithms, data analytics | Transaction security, scalability, regulatory compliance |

| Integration | Connects with brokerage platforms, financial data APIs | Integrates with ATMs, payment gateways, regulatory systems |

| Regulatory Environment | Securities regulations, investment compliance | Banking regulations, KYC, anti-money laundering |

| Deployment | Cloud-based SaaS, mobile and web apps | On-premise, cloud, hybrid banking systems |

| Revenue Model | Subscription fees, asset management fees | Transaction fees, interest income, service charges |

Which is better?

Wealthtech focuses on personalized digital wealth management solutions, leveraging AI and data analytics to optimize investment strategies for individual clients. Core banking technology underpins the foundational operations of financial institutions, enabling secure transaction processing, account management, and regulatory compliance. For financial institutions prioritizing innovation in client wealth services, wealthtech offers a competitive edge, while core banking technology remains essential for maintaining stable and scalable operational infrastructure.

Connection

Wealthtech leverages advanced software solutions to enhance investment management, while core banking technology provides the fundamental infrastructure for financial transactions and customer account management. Integration of wealthtech with core banking systems allows seamless data exchange, real-time portfolio updates, and personalized financial services within a unified platform. This connectivity enhances user experience, operational efficiency, and supports innovative product offerings in modern banks.

Key Terms

**Core Banking Tech:**

Core banking technology streamlines financial institutions' operations by enabling real-time transaction processing, centralized data management, and secure customer account access across multiple channels. This technology supports essential banking functions such as deposits, withdrawals, loan management, and compliance with regulatory frameworks like Basel III and GDPR. Explore the transformative capabilities of core banking tech to enhance operational efficiency and customer experience.

Centralized Ledger

Core banking technology relies on a centralized ledger system to manage real-time transactions, customer accounts, and regulatory compliance efficiently across multiple branches. Wealthtech platforms also use centralized ledgers but focus on integrating investment portfolios, asset management, and financial planning data to provide personalized wealth management services. Discover how these technologies optimize centralized ledgers to transform financial services.

Real-time Processing

Core banking technology excels in real-time processing by enabling instant transaction updates, continuous account monitoring, and immediate fraud detection across all customer accounts. Wealthtech platforms leverage real-time data analytics to provide personalized investment advice and portfolio adjustments, ensuring clients benefit from current market conditions without delay. Explore the latest advancements in both fields to understand how real-time processing is transforming financial services.

Source and External Links

What is Core Banking? - IBM - Core banking technology is a back-end system that connects multiple branches of a bank to enable real-time transactions and services, offering enhanced security, regulatory compliance, and operational efficiency for both banks and customers.

Top 10 Core Banking Software Solutions - DashDevs - Core banking software integrates essential banking functions like account management, transaction processing, AML/KYC, and reporting into one platform, enabling banks to automate processes and support a wide range of banking services.

What Is Core Banking: Definition, Features, Benefits - SDK.finance - Core banking systems improve operational efficiency by automating banking processes, enhance customer experience through online services, increase revenue with innovative products, and reduce risk with advanced security features.

dowidth.com

dowidth.com