Green financing supports projects with direct environmental benefits such as renewable energy and sustainable agriculture, focusing on reducing carbon footprints and preserving natural resources. Transition financing targets industries with high carbon emissions, providing capital to help them shift towards greener practices through improved technologies and operational changes. Discover how these distinct financing approaches drive sustainability in the banking sector.

Why it is important

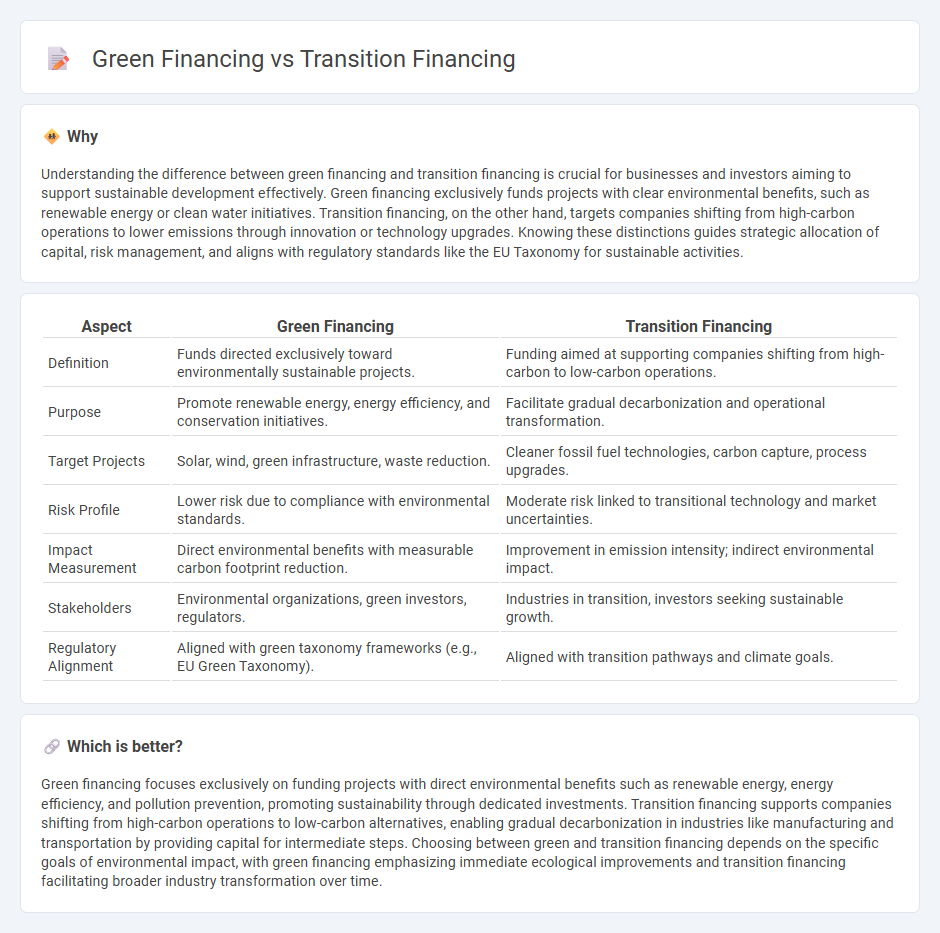

Understanding the difference between green financing and transition financing is crucial for businesses and investors aiming to support sustainable development effectively. Green financing exclusively funds projects with clear environmental benefits, such as renewable energy or clean water initiatives. Transition financing, on the other hand, targets companies shifting from high-carbon operations to lower emissions through innovation or technology upgrades. Knowing these distinctions guides strategic allocation of capital, risk management, and aligns with regulatory standards like the EU Taxonomy for sustainable activities.

Comparison Table

| Aspect | Green Financing | Transition Financing |

|---|---|---|

| Definition | Funds directed exclusively toward environmentally sustainable projects. | Funding aimed at supporting companies shifting from high-carbon to low-carbon operations. |

| Purpose | Promote renewable energy, energy efficiency, and conservation initiatives. | Facilitate gradual decarbonization and operational transformation. |

| Target Projects | Solar, wind, green infrastructure, waste reduction. | Cleaner fossil fuel technologies, carbon capture, process upgrades. |

| Risk Profile | Lower risk due to compliance with environmental standards. | Moderate risk linked to transitional technology and market uncertainties. |

| Impact Measurement | Direct environmental benefits with measurable carbon footprint reduction. | Improvement in emission intensity; indirect environmental impact. |

| Stakeholders | Environmental organizations, green investors, regulators. | Industries in transition, investors seeking sustainable growth. |

| Regulatory Alignment | Aligned with green taxonomy frameworks (e.g., EU Green Taxonomy). | Aligned with transition pathways and climate goals. |

Which is better?

Green financing focuses exclusively on funding projects with direct environmental benefits such as renewable energy, energy efficiency, and pollution prevention, promoting sustainability through dedicated investments. Transition financing supports companies shifting from high-carbon operations to low-carbon alternatives, enabling gradual decarbonization in industries like manufacturing and transportation by providing capital for intermediate steps. Choosing between green and transition financing depends on the specific goals of environmental impact, with green financing emphasizing immediate ecological improvements and transition financing facilitating broader industry transformation over time.

Connection

Green financing and transition financing are interconnected as both aim to support sustainable development by directing capital towards environmentally responsible projects and companies. Green financing focuses on funding initiatives with immediate positive environmental impacts, such as renewable energy, while transition financing provides resources for industries adapting from high-carbon to low-carbon operations. Together, they enable the banking sector to facilitate the shift to a low-carbon economy by offering tailored financial products that mitigate climate risks and promote sustainable growth.

Key Terms

**Transition Financing:**

Transition financing supports companies in high-emission industries to reduce their carbon footprint through investments in cleaner technologies and sustainable practices. It bridges the gap between traditional financing and green financing by enabling a pragmatic shift toward lower emissions while maintaining economic viability. Discover how transition financing accelerates the path to a carbon-neutral economy.

Carbon-intensive sectors

Transition financing targets carbon-intensive sectors like coal, oil, and heavy industry by supporting projects that reduce emissions through cleaner technologies and operational improvements. Green financing specifically funds renewable energy, energy efficiency, and sustainable infrastructure, promoting a low-carbon economy from the outset. Explore the nuanced roles of both financing approaches in decarbonizing high-emission industries to understand their impact and opportunities.

Emission reduction pathways

Transition financing supports companies in shifting from high-carbon operations to sustainable practices, emphasizing investment in cleaner technologies and infrastructure to achieve emission reduction targets. Green financing specifically targets projects that directly contribute to environmental sustainability, such as renewable energy, energy efficiency, and carbon capture initiatives, aligning with global emission reduction pathways like the Paris Agreement. Explore detailed emission reduction strategies and financing solutions to drive sustainable transformation in your sector.

Source and External Links

What is transition finance, and why it matters - Transition finance refers to investments aimed at decarbonizing high-emitting and hard-to-abate industries like steel, aviation, and shipping, while also addressing social impacts from decarbonization, and is seen as a multi-trillion-dollar opportunity for investors.

Four Key Transition Financing Strategies - Transition finance encompasses investment, financing, insurance, and related products and services that support an orderly, real-economy transition to net zero, structured around four strategies: financing climate solutions, aligned entities, aligning entities, and managed phase-out of high-emitting assets.

Transition Finance 101 - Transition finance has mainly involved debt instruments like bonds in hard-to-abate sectors, but equity investments from private equity, venture capital, and asset managers are expected to grow as demand for enabling the net-zero transition increases.

dowidth.com

dowidth.com