Account aggregation consolidates financial data from multiple bank accounts into a single interface, enabling users to track balances, transactions, and budgets efficiently. Digital wallets store and manage payment information, allowing seamless online and in-store transactions through smartphones or other devices. Discover the key differences and advantages of these financial tools to enhance your banking experience.

Why it is important

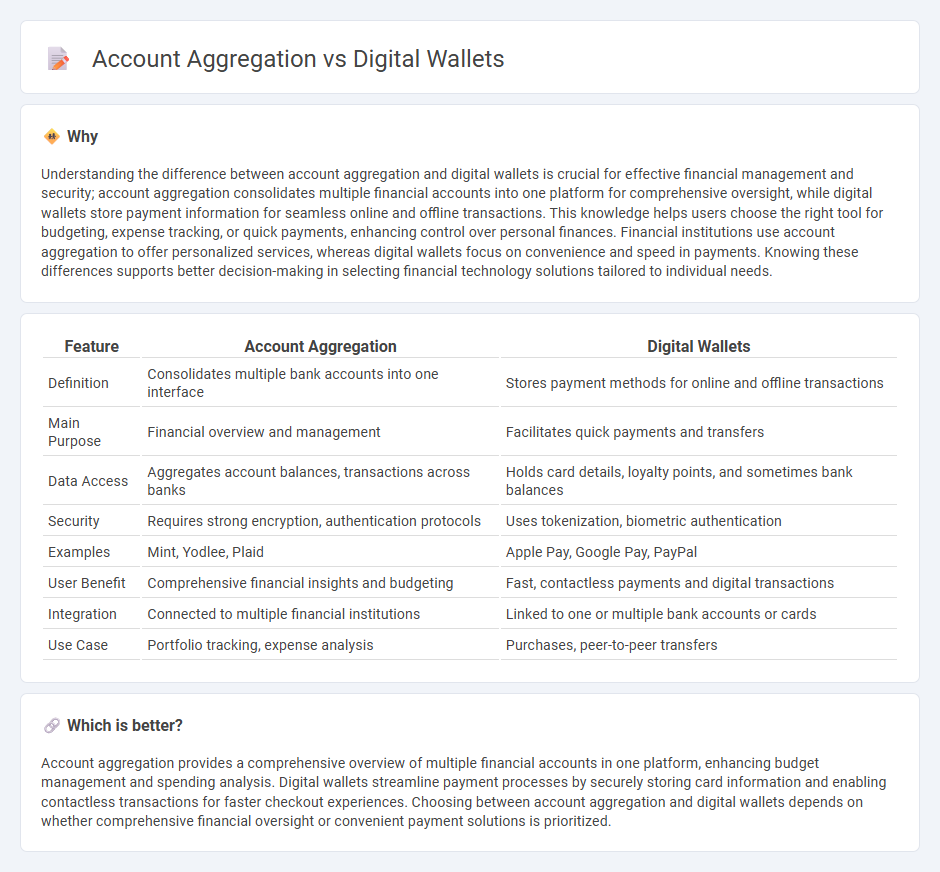

Understanding the difference between account aggregation and digital wallets is crucial for effective financial management and security; account aggregation consolidates multiple financial accounts into one platform for comprehensive oversight, while digital wallets store payment information for seamless online and offline transactions. This knowledge helps users choose the right tool for budgeting, expense tracking, or quick payments, enhancing control over personal finances. Financial institutions use account aggregation to offer personalized services, whereas digital wallets focus on convenience and speed in payments. Knowing these differences supports better decision-making in selecting financial technology solutions tailored to individual needs.

Comparison Table

| Feature | Account Aggregation | Digital Wallets |

|---|---|---|

| Definition | Consolidates multiple bank accounts into one interface | Stores payment methods for online and offline transactions |

| Main Purpose | Financial overview and management | Facilitates quick payments and transfers |

| Data Access | Aggregates account balances, transactions across banks | Holds card details, loyalty points, and sometimes bank balances |

| Security | Requires strong encryption, authentication protocols | Uses tokenization, biometric authentication |

| Examples | Mint, Yodlee, Plaid | Apple Pay, Google Pay, PayPal |

| User Benefit | Comprehensive financial insights and budgeting | Fast, contactless payments and digital transactions |

| Integration | Connected to multiple financial institutions | Linked to one or multiple bank accounts or cards |

| Use Case | Portfolio tracking, expense analysis | Purchases, peer-to-peer transfers |

Which is better?

Account aggregation provides a comprehensive overview of multiple financial accounts in one platform, enhancing budget management and spending analysis. Digital wallets streamline payment processes by securely storing card information and enabling contactless transactions for faster checkout experiences. Choosing between account aggregation and digital wallets depends on whether comprehensive financial oversight or convenient payment solutions is prioritized.

Connection

Account aggregation consolidates multiple financial accounts into a single digital platform, enhancing the functionality of digital wallets by providing a comprehensive overview of users' financial data. Digital wallets leverage aggregated account information to enable seamless payments, budgeting, and financial management in one intuitive interface. This integration improves user experience by offering real-time access to various bank accounts, credit cards, and transaction histories within a unified digital ecosystem.

Key Terms

Mobile Payments

Mobile payments leverage digital wallets to securely store and use payment information directly from smartphones, enabling instant, contactless transactions via NFC or QR codes. Account aggregation platforms consolidate multiple financial accounts into a single interface, offering users a comprehensive view of their finances but typically without direct payment functionality. Explore the differences in capabilities and benefits of these technologies to understand which solution best fits your mobile payment needs.

API Integration

Digital wallets securely store payment information and enable seamless transactions through API integration with various financial institutions and merchants. Account aggregation platforms use APIs to consolidate multiple financial accounts into a single interface, offering users a comprehensive view of their finances. Explore the advantages of API integration in digital wallets and account aggregation to enhance financial management.

Data Consolidation

Digital wallets store payment information and transaction history, enabling seamless online payments and financial management. Account aggregation consolidates data from multiple financial accounts into one interface, providing a comprehensive overview of assets, liabilities, and spending patterns. Explore the advantages of data consolidation for better financial insights and management.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - DashDevs - A digital wallet is a software-based system storing users' payment info securely, with two main types being centralized wallets (e.g., PayPal, Apple Pay) managed by institutions, and decentralized wallets (e.g., MetaMask) operating on blockchain for user-controlled assets and privacy.

What is a Digital Wallet and How to Use It? - Bill.com - A digital wallet is a secure app on your device that stores payment details and other digital documents, enabling seamless electronic payments with added security features like biometrics and real-time transaction data access.

Digital Wallets: Everything You Need to Know - N26 - Digital wallets facilitate contactless and online payments securely through encryption and biometric protection, and include crypto wallets which manage cryptocurrency access rather than currencies themselves.

dowidth.com

dowidth.com