Alternative data lending leverages unconventional information such as utility payments, social media activity, and transaction history to assess creditworthiness, offering access to credit for underserved borrowers. Neobank underwriting combines digital-first platforms with advanced algorithms and machine learning to streamline loan approvals and enhance risk assessment efficiency. Explore how these innovations are transforming lending landscapes and expanding financial inclusion.

Why it is important

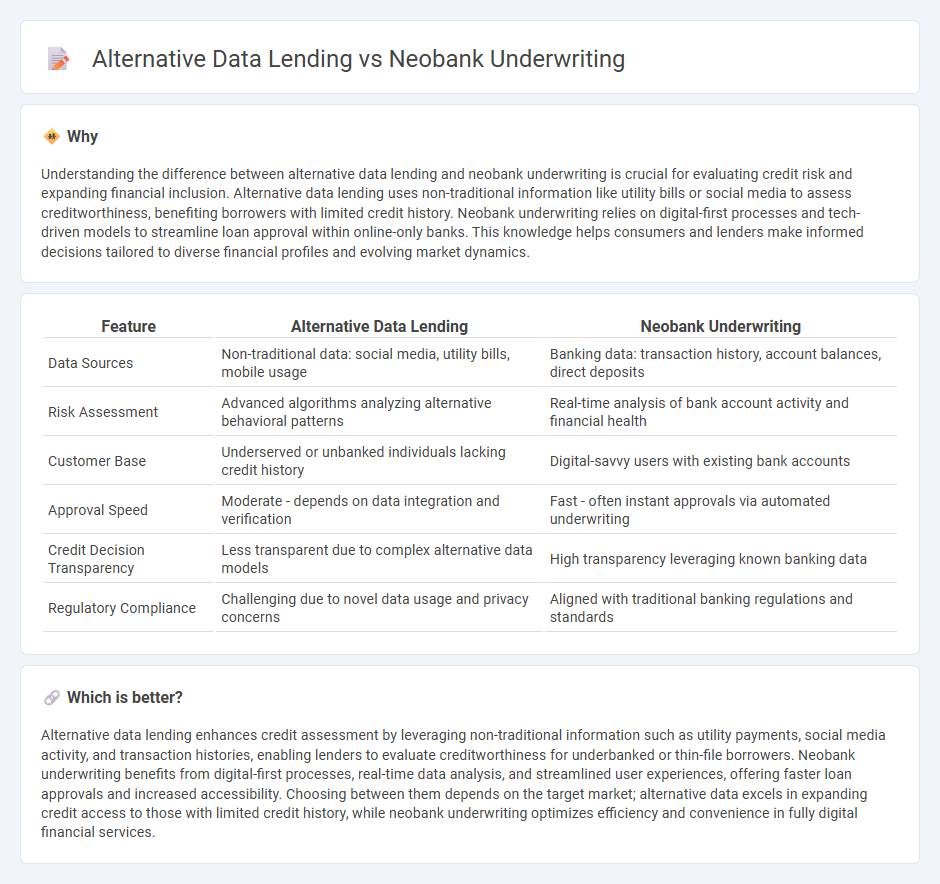

Understanding the difference between alternative data lending and neobank underwriting is crucial for evaluating credit risk and expanding financial inclusion. Alternative data lending uses non-traditional information like utility bills or social media to assess creditworthiness, benefiting borrowers with limited credit history. Neobank underwriting relies on digital-first processes and tech-driven models to streamline loan approval within online-only banks. This knowledge helps consumers and lenders make informed decisions tailored to diverse financial profiles and evolving market dynamics.

Comparison Table

| Feature | Alternative Data Lending | Neobank Underwriting |

|---|---|---|

| Data Sources | Non-traditional data: social media, utility bills, mobile usage | Banking data: transaction history, account balances, direct deposits |

| Risk Assessment | Advanced algorithms analyzing alternative behavioral patterns | Real-time analysis of bank account activity and financial health |

| Customer Base | Underserved or unbanked individuals lacking credit history | Digital-savvy users with existing bank accounts |

| Approval Speed | Moderate - depends on data integration and verification | Fast - often instant approvals via automated underwriting |

| Credit Decision Transparency | Less transparent due to complex alternative data models | High transparency leveraging known banking data |

| Regulatory Compliance | Challenging due to novel data usage and privacy concerns | Aligned with traditional banking regulations and standards |

Which is better?

Alternative data lending enhances credit assessment by leveraging non-traditional information such as utility payments, social media activity, and transaction histories, enabling lenders to evaluate creditworthiness for underbanked or thin-file borrowers. Neobank underwriting benefits from digital-first processes, real-time data analysis, and streamlined user experiences, offering faster loan approvals and increased accessibility. Choosing between them depends on the target market; alternative data excels in expanding credit access to those with limited credit history, while neobank underwriting optimizes efficiency and convenience in fully digital financial services.

Connection

Alternative data lending leverages non-traditional data sources such as social media activity, utility payments, and mobile phone usage to assess creditworthiness, enhancing neobank underwriting processes. Neobanks integrate this alternative data to offer more inclusive, efficient, and accurate credit risk evaluations, reducing reliance on conventional credit scores. This connection enables neobanks to expand lending access to underbanked populations while improving loan performance and portfolio quality.

Key Terms

Digital Onboarding

Neobank underwriting leverages advanced algorithms and digital onboarding processes to quickly assess creditworthiness using traditional financial data, streamlining client acquisition through seamless mobile interfaces. Alternative data lending enhances this approach by incorporating non-traditional information like social media activity, utility payments, and behavioral analytics to improve risk assessment accuracy for underserved segments. Discover how combining digital onboarding with alternative data can revolutionize credit access for a broader audience.

Credit Scoring Models

Neobank underwriting primarily utilizes traditional credit scoring models based on credit bureau data, payment history, and financial statements to assess borrower risk with high efficiency. Alternative data lending incorporates non-traditional data sources such as social media activity, mobile phone usage, utility payments, and transactional behavior to enhance credit scoring models, especially for thin-file or underbanked customers. Explore how combining these approaches transforms credit risk assessment and broadens financial inclusion.

Non-traditional Data Sources

Neobank underwriting leverages cutting-edge technology to assess creditworthiness using digital footprints such as transaction history, social media activity, and behavioral analytics, enhancing risk prediction beyond traditional credit scores. Alternative data lending incorporates non-traditional data sources including utility payments, rent history, and mobile phone usage patterns to evaluate borrowers who lack comprehensive credit profiles. Explore the evolving landscape of credit assessment by learning more about how non-traditional data transforms lending practices.

Source and External Links

Neobank Dave Attributes Record Performance to AI ... - Neobank Dave improved its credit performance and grew originations by using an AI-driven underwriting engine called CashAI, reducing its 28-day delinquency rate and achieving record results.

Neobanking: What It Is & How to Maintain Compliance - Neobanks must balance digital onboarding with strong security, invest in AML and KYC solutions, and employ compliance officers to ensure effective and compliant underwriting practices.

What makes a neobank? A primer can explain. - As neobanks scale and seek charters, they gain more control over underwriting and risk management, but face regulatory complexity and operational rigor compared to their tech-driven origins.

dowidth.com

dowidth.com