Loyalty fintech companies leverage advanced technology to offer personalized rewards and seamless digital experiences that enhance customer engagement in banking. Mutual banks, owned by their members, prioritize community-focused services and profit-sharing, fostering trust and long-term relationships. Explore how these two models reshape the future of banking and customer loyalty.

Why it is important

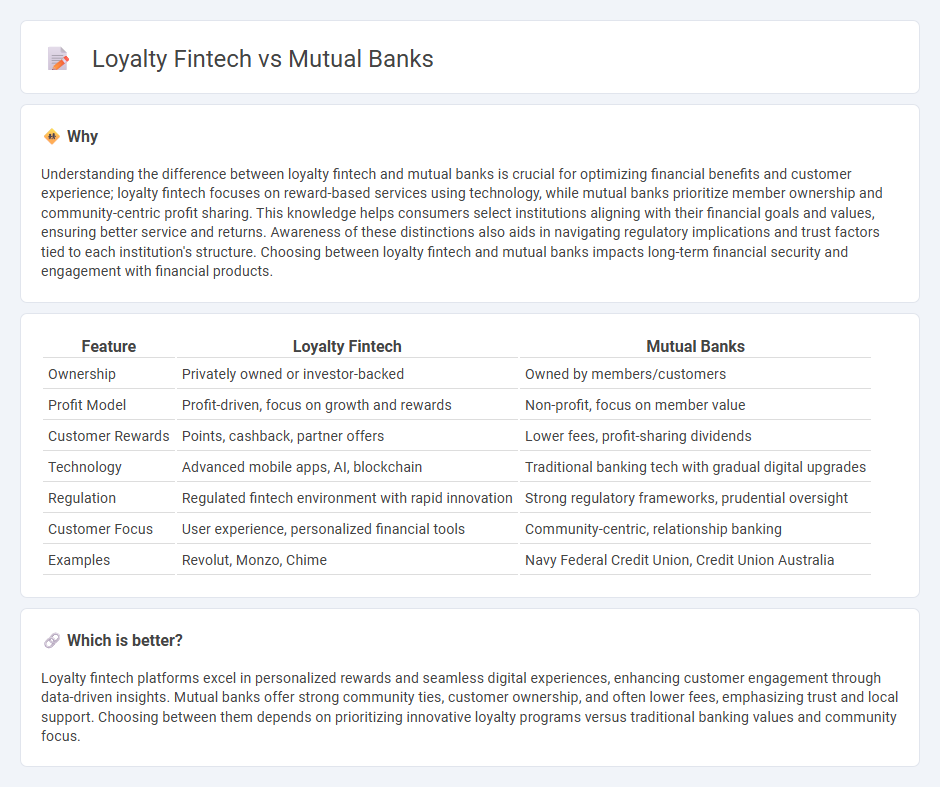

Understanding the difference between loyalty fintech and mutual banks is crucial for optimizing financial benefits and customer experience; loyalty fintech focuses on reward-based services using technology, while mutual banks prioritize member ownership and community-centric profit sharing. This knowledge helps consumers select institutions aligning with their financial goals and values, ensuring better service and returns. Awareness of these distinctions also aids in navigating regulatory implications and trust factors tied to each institution's structure. Choosing between loyalty fintech and mutual banks impacts long-term financial security and engagement with financial products.

Comparison Table

| Feature | Loyalty Fintech | Mutual Banks |

|---|---|---|

| Ownership | Privately owned or investor-backed | Owned by members/customers |

| Profit Model | Profit-driven, focus on growth and rewards | Non-profit, focus on member value |

| Customer Rewards | Points, cashback, partner offers | Lower fees, profit-sharing dividends |

| Technology | Advanced mobile apps, AI, blockchain | Traditional banking tech with gradual digital upgrades |

| Regulation | Regulated fintech environment with rapid innovation | Strong regulatory frameworks, prudential oversight |

| Customer Focus | User experience, personalized financial tools | Community-centric, relationship banking |

| Examples | Revolut, Monzo, Chime | Navy Federal Credit Union, Credit Union Australia |

Which is better?

Loyalty fintech platforms excel in personalized rewards and seamless digital experiences, enhancing customer engagement through data-driven insights. Mutual banks offer strong community ties, customer ownership, and often lower fees, emphasizing trust and local support. Choosing between them depends on prioritizing innovative loyalty programs versus traditional banking values and community focus.

Connection

Loyalty fintech platforms enhance customer engagement for mutual banks by offering tailored rewards and personalized financial services that align with cooperative principles. Mutual banks leverage fintech technologies to improve service delivery, increase member retention, and foster community trust. Integrating loyalty fintech solutions helps mutual banks differentiate themselves in the competitive banking sector while promoting long-term member relationships.

Key Terms

Ownership Structure

Mutual banks operate under a member-owned structure where customers are also shareholders, ensuring profits are reinvested for member benefits rather than external shareholders. Loyalty fintech companies, on the other hand, typically follow a corporate ownership model that prioritizes investor returns and rapid scalability, with customers participating through reward programs rather than ownership. Explore how these distinct ownership frameworks impact customer value and financial service innovation.

Member Benefits

Mutual banks prioritize member benefits by offering lower fees, higher interest rates on savings, and profit-sharing opportunities due to their member-owned structure. Loyalty fintech companies focus on enhancing member value through personalized rewards programs, cashback offers, and seamless digital experiences tailored to individual spending habits. Explore how each model maximizes member benefits to find the best fit for your financial goals.

Technology Integration

Mutual banks leverage advanced core banking systems and API-driven platforms to seamlessly integrate with fintech solutions, enhancing customer experience and operational efficiency. Loyalty fintech companies utilize blockchain and AI-powered analytics to create personalized reward programs that drive customer engagement and retention. Explore how these technologies transform financial services by deepening your understanding of their integration strategies.

Source and External Links

Mutual bank - Wikipedia - A mutual bank is a cooperative financial institution owned by its depositors or customers, focusing on serving members' interests rather than maximizing shareholder profits, with profits reinvested to benefit customers and communities.

The Mutual Banking Difference | Bank of Canton - Mutual banks operate solely to benefit their customers and communities, returning profits through better rates and community investments, and are owned by their borrowers and depositors rather than shareholders.

FAQ - America's Mutual Banks - Mutual banks have existed since the early 1800s in the U.S., include various charter types, and prioritize mutual ownership and member benefits, with about 494 mutual banks currently operating nationwide.

dowidth.com

dowidth.com