RegTech focuses on developing technologies to help financial institutions comply with regulatory requirements efficiently, using automation, AI, and big data analytics. SupTech, on the other hand, equips regulatory authorities with digital tools to monitor, supervise, and enforce compliance within the banking sector, often through real-time data and advanced analytics. Explore how these innovative solutions are transforming banking compliance and supervision today.

Why it is important

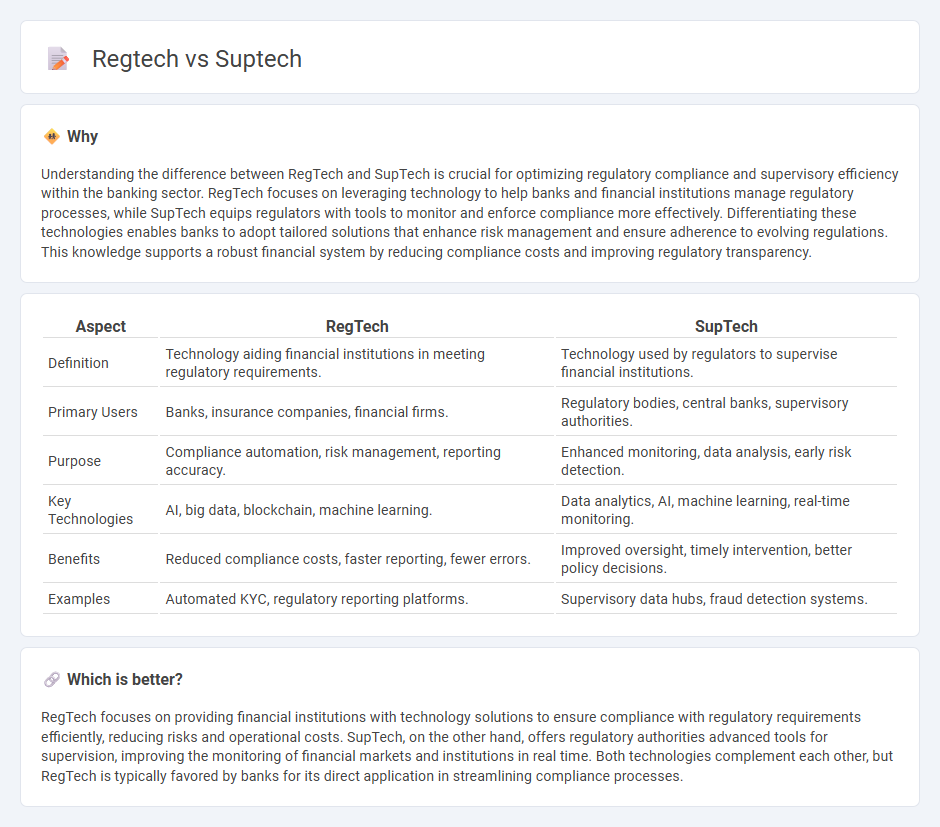

Understanding the difference between RegTech and SupTech is crucial for optimizing regulatory compliance and supervisory efficiency within the banking sector. RegTech focuses on leveraging technology to help banks and financial institutions manage regulatory processes, while SupTech equips regulators with tools to monitor and enforce compliance more effectively. Differentiating these technologies enables banks to adopt tailored solutions that enhance risk management and ensure adherence to evolving regulations. This knowledge supports a robust financial system by reducing compliance costs and improving regulatory transparency.

Comparison Table

| Aspect | RegTech | SupTech |

|---|---|---|

| Definition | Technology aiding financial institutions in meeting regulatory requirements. | Technology used by regulators to supervise financial institutions. |

| Primary Users | Banks, insurance companies, financial firms. | Regulatory bodies, central banks, supervisory authorities. |

| Purpose | Compliance automation, risk management, reporting accuracy. | Enhanced monitoring, data analysis, early risk detection. |

| Key Technologies | AI, big data, blockchain, machine learning. | Data analytics, AI, machine learning, real-time monitoring. |

| Benefits | Reduced compliance costs, faster reporting, fewer errors. | Improved oversight, timely intervention, better policy decisions. |

| Examples | Automated KYC, regulatory reporting platforms. | Supervisory data hubs, fraud detection systems. |

Which is better?

RegTech focuses on providing financial institutions with technology solutions to ensure compliance with regulatory requirements efficiently, reducing risks and operational costs. SupTech, on the other hand, offers regulatory authorities advanced tools for supervision, improving the monitoring of financial markets and institutions in real time. Both technologies complement each other, but RegTech is typically favored by banks for its direct application in streamlining compliance processes.

Connection

Regtech leverages advanced technologies like AI and blockchain to enhance regulatory compliance by automating risk management and reporting processes in banking. Suptech utilizes similar tools to enable supervisory authorities in real-time monitoring and analysis of financial institutions' activities. Both regtech and suptech drive increased transparency, efficiency, and accuracy in regulatory frameworks, fostering safer and more resilient banking environments.

Key Terms

Automation

Suptech and Regtech both leverage automation to enhance regulatory processes, with Suptech primarily focusing on automating supervisory tasks within regulatory bodies, such as data collection and risk assessment using AI and machine learning. Regtech targets automation in compliance management and reporting for financial institutions, streamlining regulatory adherence through real-time monitoring and automated reporting solutions. Explore how these automation-driven technologies transform regulatory landscapes to improve efficiency, accuracy, and compliance.

Compliance

Suptech and regtech both enhance compliance in financial sectors but differ in approach; suptech uses supervisory technology to streamline regulators' monitoring processes, ensuring real-time data analysis and risk detection, while regtech employs regulatory technology to help businesses automate compliance tasks like reporting and fraud prevention. Suptech primarily targets regulatory bodies, improving transparency and enforcement efficiency, whereas regtech focuses on companies seeking to reduce compliance costs and regulatory complexities. Explore how these technologies revolutionize compliance frameworks in financial services.

Supervision

Suptech utilizes advanced technologies such as artificial intelligence and big data analytics to enhance regulatory supervision by enabling real-time monitoring and efficient risk detection. Regtech focuses on compliance automation and regulatory reporting, simplifying adherence to legal requirements for financial institutions. Explore deeper insights into how these innovations transform financial oversight and compliance strategies.

Source and External Links

Fintech, Regtech & Suptech: The Main Differences + How to Use Them - SupTech (supervisory technology) automates and enhances supervisory processes for regulators by enabling efficient data collection, advanced analytics, and early detection of emerging risks in financial markets.

Differences Between FinTech, RegTech, and SupTech | NameScan - SupTech provides regulatory authorities with technical tools to automate data gathering, analyze large datasets, and improve risk assessment for stronger oversight of financial institutions.

What Is Suptech? - Finreg-E - SupTech is technology used by regulators to monitor, supervise, and enforce compliance through automated data analysis, risk detection, and actionable insights, thereby enhancing regulatory effectiveness.

dowidth.com

dowidth.com