Fraud orchestration integrates multiple detection tools and data sources to provide a comprehensive view of fraudulent activities, while transaction monitoring focuses on analyzing individual transactions to identify suspicious patterns. Advanced fraud orchestration platforms leverage AI and machine learning to enhance detection accuracy and streamline response processes. Explore how combining these approaches can strengthen your banking security framework.

Why it is important

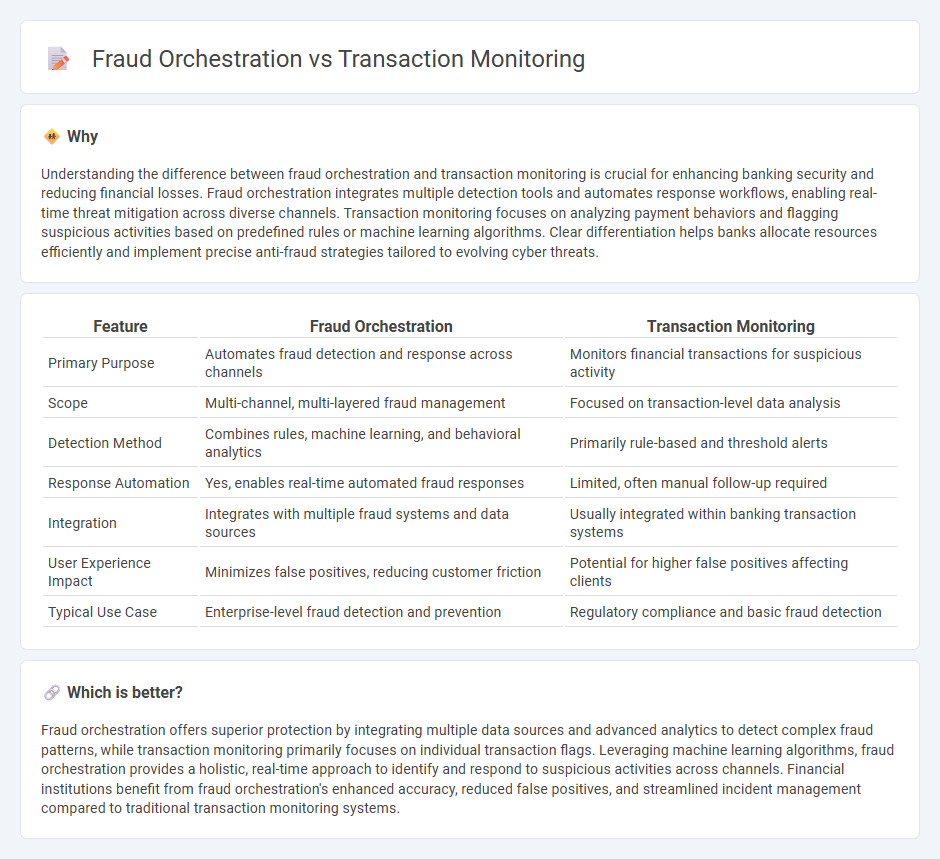

Understanding the difference between fraud orchestration and transaction monitoring is crucial for enhancing banking security and reducing financial losses. Fraud orchestration integrates multiple detection tools and automates response workflows, enabling real-time threat mitigation across diverse channels. Transaction monitoring focuses on analyzing payment behaviors and flagging suspicious activities based on predefined rules or machine learning algorithms. Clear differentiation helps banks allocate resources efficiently and implement precise anti-fraud strategies tailored to evolving cyber threats.

Comparison Table

| Feature | Fraud Orchestration | Transaction Monitoring |

|---|---|---|

| Primary Purpose | Automates fraud detection and response across channels | Monitors financial transactions for suspicious activity |

| Scope | Multi-channel, multi-layered fraud management | Focused on transaction-level data analysis |

| Detection Method | Combines rules, machine learning, and behavioral analytics | Primarily rule-based and threshold alerts |

| Response Automation | Yes, enables real-time automated fraud responses | Limited, often manual follow-up required |

| Integration | Integrates with multiple fraud systems and data sources | Usually integrated within banking transaction systems |

| User Experience Impact | Minimizes false positives, reducing customer friction | Potential for higher false positives affecting clients |

| Typical Use Case | Enterprise-level fraud detection and prevention | Regulatory compliance and basic fraud detection |

Which is better?

Fraud orchestration offers superior protection by integrating multiple data sources and advanced analytics to detect complex fraud patterns, while transaction monitoring primarily focuses on individual transaction flags. Leveraging machine learning algorithms, fraud orchestration provides a holistic, real-time approach to identify and respond to suspicious activities across channels. Financial institutions benefit from fraud orchestration's enhanced accuracy, reduced false positives, and streamlined incident management compared to traditional transaction monitoring systems.

Connection

Fraud orchestration integrates various fraud detection tools and data sources to create a unified defense system that enhances transaction monitoring processes. Transaction monitoring systematically analyzes financial activities in real-time to identify suspicious patterns, feeding critical insights into fraud orchestration platforms. The synergy between fraud orchestration and transaction monitoring enables banks to proactively detect, analyze, and respond to fraudulent transactions with increased precision and efficiency.

Key Terms

**Transaction Monitoring:**

Transaction monitoring employs advanced algorithms and real-time analytics to detect suspicious activities within payment systems, helping reduce financial crime risks. It continuously analyzes transaction patterns, flagging deviations that could indicate fraud, money laundering, or compliance breaches. Discover how transaction monitoring enhances security and regulatory compliance in financial operations.

AML (Anti-Money Laundering)

Transaction monitoring uses algorithms and rules to detect suspicious activities related to AML by analyzing financial transactions in real time or batch mode. Fraud orchestration integrates multiple fraud prevention systems, automating response workflows and enriching data for comprehensive AML risk mitigation across payment channels. Explore advanced techniques in AML to enhance compliance and reduce financial crime risks.

Suspicious Activity Reports (SARs)

Transaction monitoring continuously analyzes financial activities to identify unusual patterns indicative of fraud or money laundering, generating Suspicious Activity Reports (SARs) for regulatory compliance. Fraud orchestration integrates multiple fraud prevention technologies and workflows to streamline investigation and response efforts, enhancing the quality and accuracy of SARs filed. Explore how combining transaction monitoring and fraud orchestration optimizes SAR reporting and regulatory adherence.

Source and External Links

What is Transaction Monitoring? - Transaction monitoring is the continuous analysis of financial transactions through data collection, screening against rules and risk criteria, pattern analysis, and alerting compliance teams to detect and manage suspicious activity and ensure regulatory compliance.

The guide to effective transaction monitoring - Transaction monitoring involves real-time or post-event detection of suspicious payments and patterns of financial crime, supporting anti-money laundering and fraud prevention efforts, benefiting regulated organizations like banks and payment service providers.

What is transaction monitoring in AML? - AML transaction monitoring systematically reviews customer transactions to identify suspicious behavior indicating potential money laundering, using rule-based or AI-enhanced systems that flag transactions for further investigation and regulatory reporting.

dowidth.com

dowidth.com