Wealthtech leverages digital platforms and AI-driven tools to enhance investment management and personalized financial planning, while paytech focuses on revolutionizing payment systems through seamless transactions, mobile wallets, and blockchain innovations. Both sectors aim to optimize financial services but target distinct aspects: wealthtech prioritizes asset growth and portfolio optimization, whereas paytech emphasizes security, speed, and convenience in money transfers. Explore deeper insights into how these technologies are reshaping modern banking and financial ecosystems.

Why it is important

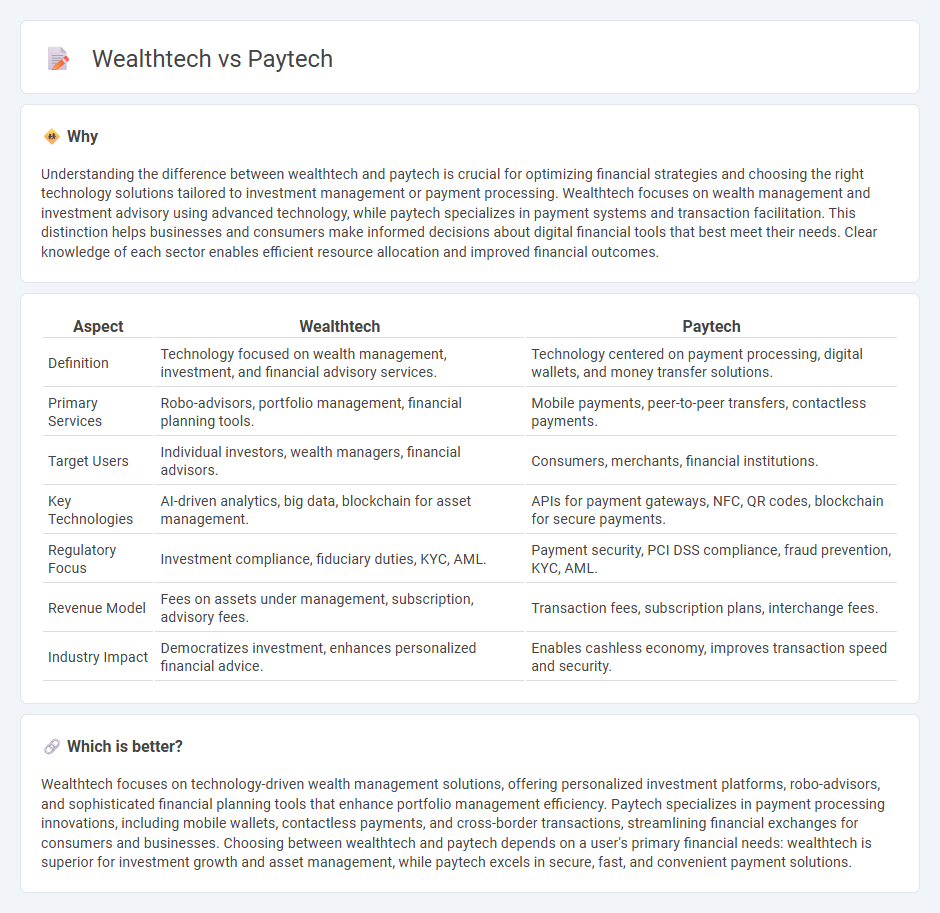

Understanding the difference between wealthtech and paytech is crucial for optimizing financial strategies and choosing the right technology solutions tailored to investment management or payment processing. Wealthtech focuses on wealth management and investment advisory using advanced technology, while paytech specializes in payment systems and transaction facilitation. This distinction helps businesses and consumers make informed decisions about digital financial tools that best meet their needs. Clear knowledge of each sector enables efficient resource allocation and improved financial outcomes.

Comparison Table

| Aspect | Wealthtech | Paytech |

|---|---|---|

| Definition | Technology focused on wealth management, investment, and financial advisory services. | Technology centered on payment processing, digital wallets, and money transfer solutions. |

| Primary Services | Robo-advisors, portfolio management, financial planning tools. | Mobile payments, peer-to-peer transfers, contactless payments. |

| Target Users | Individual investors, wealth managers, financial advisors. | Consumers, merchants, financial institutions. |

| Key Technologies | AI-driven analytics, big data, blockchain for asset management. | APIs for payment gateways, NFC, QR codes, blockchain for secure payments. |

| Regulatory Focus | Investment compliance, fiduciary duties, KYC, AML. | Payment security, PCI DSS compliance, fraud prevention, KYC, AML. |

| Revenue Model | Fees on assets under management, subscription, advisory fees. | Transaction fees, subscription plans, interchange fees. |

| Industry Impact | Democratizes investment, enhances personalized financial advice. | Enables cashless economy, improves transaction speed and security. |

Which is better?

Wealthtech focuses on technology-driven wealth management solutions, offering personalized investment platforms, robo-advisors, and sophisticated financial planning tools that enhance portfolio management efficiency. Paytech specializes in payment processing innovations, including mobile wallets, contactless payments, and cross-border transactions, streamlining financial exchanges for consumers and businesses. Choosing between wealthtech and paytech depends on a user's primary financial needs: wealthtech is superior for investment growth and asset management, while paytech excels in secure, fast, and convenient payment solutions.

Connection

Wealthtech integrates advanced digital tools to optimize investment management, while paytech streamlines payments and transactions through innovative financial technologies. Both sectors leverage blockchain, artificial intelligence, and data analytics to enhance user experience, security, and efficiency in financial services. Their convergence enables seamless wealth management with quick, secure, and transparent payment solutions, transforming traditional banking ecosystems.

Key Terms

**Paytech:**

Paytech revolutionizes financial transactions by enabling seamless digital payments through mobile wallets, contactless cards, and real-time fund transfers, driving efficiency and security in everyday commerce. Key technologies include blockchain, NFC, and AI-powered fraud detection, which optimize transaction speed and reduce financial risks. Explore more to understand how paytech innovations are transforming the future of payments and redefining consumer experiences.

Digital Payments

Paytech specializes in digital payments by streamlining transaction processes through mobile wallets, contactless payments, and real-time fund transfers, enhancing convenience and security for consumers and merchants. Wealthtech concentrates on digital wealth management, offering automated investment platforms, robo-advisors, and portfolio analytics to optimize financial growth. Explore how digital payments are revolutionizing financial technology for deeper insights.

Payment Gateways

Payment gateways in paytech streamline transaction processing by securely authorizing and facilitating payments between consumers and merchants, emphasizing speed and security. Wealthtech platforms integrate payment gateways to enable seamless investment contributions and disbursements but prioritize portfolio management and financial analytics over transaction handling. Explore how payment gateway innovations differentiate paytech and wealthtech solutions in today's digital economy.

Source and External Links

What Is Paytech | Papaya Global - Paytech refers to payments involving technology such as digital wallets, buy now pay later, account-to-account payments, cryptocurrencies, and real-time payment networks that facilitate instant, secure, and frictionless transactions.

How the rise of PayTech is reshaping the payments landscape - EY - Paytechs represent a significant part of fintech focused on transforming the payments ecosystem with innovations like open banking, real-time payments, BNPL, digital wallets, embedded payments, and digital currencies to make payments more instant and embedded in customer journeys.

paytech - White-Label Payment Gateway & Payment Orchestration - paytech offers customizable white-label payment gateway, payment orchestration, and financial management technologies designed to help fintech businesses expand market presence and improve customer payment experiences.

dowidth.com

dowidth.com