Crypto custody involves the secure storage and management of digital assets like cryptocurrencies using blockchain technology and private keys. Securities custody focuses on safeguarding traditional financial instruments such as stocks and bonds through centralized custodians and regulatory frameworks. Explore the key differences and benefits of each custody type to understand their impact on asset security and management.

Why it is important

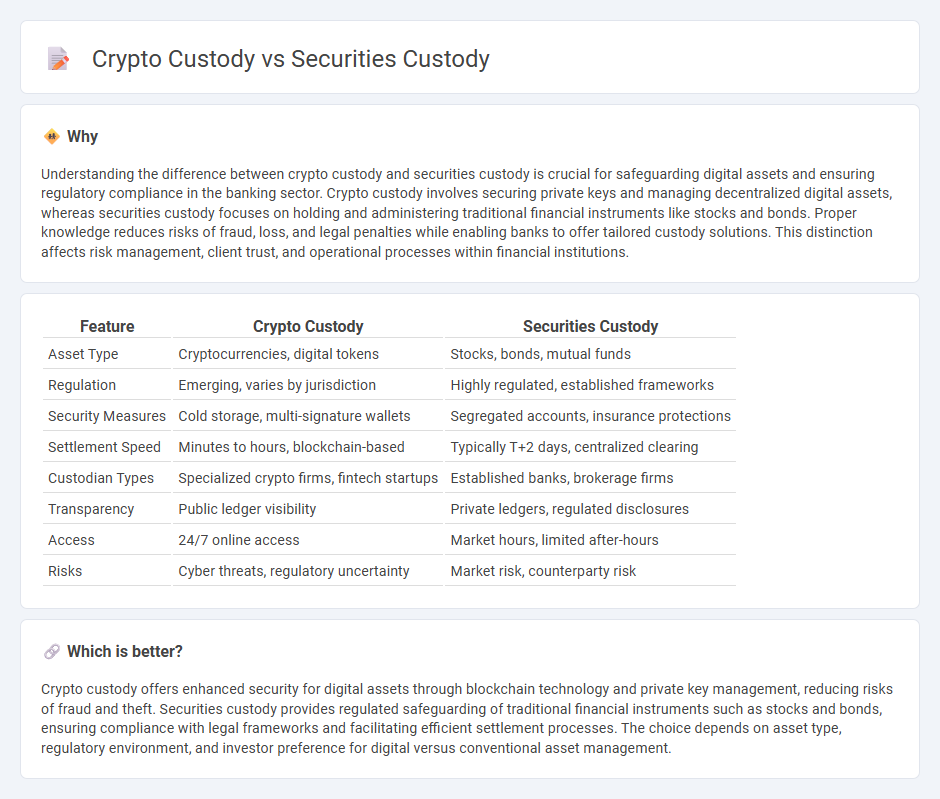

Understanding the difference between crypto custody and securities custody is crucial for safeguarding digital assets and ensuring regulatory compliance in the banking sector. Crypto custody involves securing private keys and managing decentralized digital assets, whereas securities custody focuses on holding and administering traditional financial instruments like stocks and bonds. Proper knowledge reduces risks of fraud, loss, and legal penalties while enabling banks to offer tailored custody solutions. This distinction affects risk management, client trust, and operational processes within financial institutions.

Comparison Table

| Feature | Crypto Custody | Securities Custody |

|---|---|---|

| Asset Type | Cryptocurrencies, digital tokens | Stocks, bonds, mutual funds |

| Regulation | Emerging, varies by jurisdiction | Highly regulated, established frameworks |

| Security Measures | Cold storage, multi-signature wallets | Segregated accounts, insurance protections |

| Settlement Speed | Minutes to hours, blockchain-based | Typically T+2 days, centralized clearing |

| Custodian Types | Specialized crypto firms, fintech startups | Established banks, brokerage firms |

| Transparency | Public ledger visibility | Private ledgers, regulated disclosures |

| Access | 24/7 online access | Market hours, limited after-hours |

| Risks | Cyber threats, regulatory uncertainty | Market risk, counterparty risk |

Which is better?

Crypto custody offers enhanced security for digital assets through blockchain technology and private key management, reducing risks of fraud and theft. Securities custody provides regulated safeguarding of traditional financial instruments such as stocks and bonds, ensuring compliance with legal frameworks and facilitating efficient settlement processes. The choice depends on asset type, regulatory environment, and investor preference for digital versus conventional asset management.

Connection

Crypto custody and securities custody share the fundamental role of safeguarding digital assets, utilizing secure storage solutions to protect against theft and loss. Both employ advanced encryption, multi-signature authentication, and regulatory compliance frameworks to ensure asset integrity and investor confidence. The integration of blockchain technology in crypto custody is influencing traditional securities custody by enhancing transparency and efficiency in asset management.

Key Terms

Safekeeping

Securities custody involves the secure holding and administration of traditional financial assets like stocks and bonds, emphasizing regulatory compliance and insurance protections. Crypto custody focuses on safeguarding digital assets through private keys and advanced encryption, prioritizing decentralized security measures to prevent hacks and theft. Explore more to understand the distinct safekeeping mechanisms tailored to each asset class.

Private Keys

Securities custody involves safeguarding physical or electronic certificates representing ownership, held by regulated financial institutions, whereas crypto custody centers on managing private keys that control access to digital assets on blockchain networks. Private keys are critical in crypto custody because losing them means irretrievable loss of assets, highlighting the importance of advanced cryptographic security measures like hardware wallets and multi-signature protocols. Explore the latest innovations and best practices in private key management for enhanced crypto custody solutions.

Settlement

Securities custody involves the safekeeping and settlement of traditional financial assets like stocks and bonds through regulated intermediaries, ensuring timely clearing via established systems such as the Depository Trust & Clearing Corporation (DTCC). Crypto custody manages digital assets by leveraging blockchain technology and private keys, with settlement processes occurring on decentralized ledgers, enabling near-instantaneous transfers without intermediaries. Explore more to understand the distinct settlement mechanisms that drive securities and crypto custody solutions.

Source and External Links

What is Securities Custody? - Securities custody is the safekeeping and legal responsibility of holding a client's stocks, bonds, and other assets by a custodian such as a financial institution or bank, including accurate recordkeeping of related asset activity.

17 CFR SS 275.206(4)-2 - Custody of funds or securities of clients by investment advisers - This regulation defines custody as holding or having authority over client funds or securities, requiring qualified custodians to maintain client assets in separate accounts with annual verification.

Custodian bank - Wikipedia - Custodian banks are specialized financial institutions responsible for safekeeping securities and processing transactions, including for self-directed retirement accounts that often hold alternative investments beyond securities.

dowidth.com

dowidth.com