Central bank digital currency (CBDC) is a government-issued digital form of money backed by the national central bank, offering enhanced security and regulatory oversight compared to private digital currencies like cryptocurrencies, which are decentralized and created by private entities or communities. CBDCs aim to improve payment efficiency, financial inclusion, and monetary policy implementation, while private digital currencies focus on peer-to-peer transactions and investor-driven value fluctuations. Explore the differences between CBDCs and private digital currencies to understand their impacts on the future of banking and finance.

Why it is important

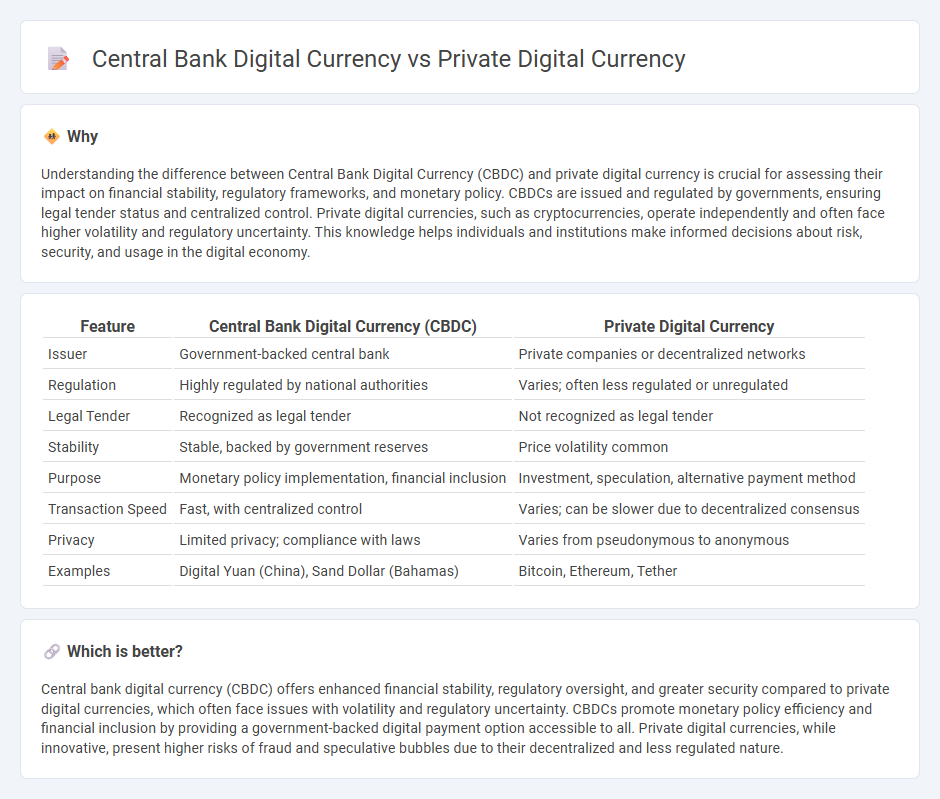

Understanding the difference between Central Bank Digital Currency (CBDC) and private digital currency is crucial for assessing their impact on financial stability, regulatory frameworks, and monetary policy. CBDCs are issued and regulated by governments, ensuring legal tender status and centralized control. Private digital currencies, such as cryptocurrencies, operate independently and often face higher volatility and regulatory uncertainty. This knowledge helps individuals and institutions make informed decisions about risk, security, and usage in the digital economy.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Private Digital Currency |

|---|---|---|

| Issuer | Government-backed central bank | Private companies or decentralized networks |

| Regulation | Highly regulated by national authorities | Varies; often less regulated or unregulated |

| Legal Tender | Recognized as legal tender | Not recognized as legal tender |

| Stability | Stable, backed by government reserves | Price volatility common |

| Purpose | Monetary policy implementation, financial inclusion | Investment, speculation, alternative payment method |

| Transaction Speed | Fast, with centralized control | Varies; can be slower due to decentralized consensus |

| Privacy | Limited privacy; compliance with laws | Varies from pseudonymous to anonymous |

| Examples | Digital Yuan (China), Sand Dollar (Bahamas) | Bitcoin, Ethereum, Tether |

Which is better?

Central bank digital currency (CBDC) offers enhanced financial stability, regulatory oversight, and greater security compared to private digital currencies, which often face issues with volatility and regulatory uncertainty. CBDCs promote monetary policy efficiency and financial inclusion by providing a government-backed digital payment option accessible to all. Private digital currencies, while innovative, present higher risks of fraud and speculative bubbles due to their decentralized and less regulated nature.

Connection

Central bank digital currency (CBDC) and private digital currency both operate on blockchain technology, facilitating faster and more secure transactions. While CBDCs are government-issued digital versions of fiat money aimed at enhancing monetary policy efficiency, private digital currencies, such as cryptocurrencies, are decentralized and typically driven by market demand. Their interaction influences financial stability, liquidity, and regulatory frameworks within the modern banking ecosystem.

Key Terms

Decentralization

Private digital currencies operate on decentralized networks using blockchain technology, enabling peer-to-peer transactions without central authority control. In contrast, central bank digital currencies (CBDCs) are centralized and issued by national banks, ensuring regulatory oversight, monetary policy control, and financial stability. Explore the nuances of decentralization in digital currencies to understand their impact on the future of finance.

Sovereign Backing

Private digital currencies, such as Bitcoin and Ethereum, operate without direct government or sovereign backing, relying instead on decentralized networks and cryptographic proof for validation and trust. Central bank digital currencies (CBDCs) represent digital forms of national currencies issued and regulated by sovereign governments, ensuring legal tender status and monetary policy control. Explore further to understand how sovereign backing shapes trust, stability, and adoption in digital currency ecosystems.

Regulation

Private digital currencies operate in largely decentralized frameworks with regulatory approaches varying significantly across jurisdictions, focusing on anti-money laundering (AML) and consumer protection. Central Bank Digital Currencies (CBDCs) are subject to stringent regulatory oversight, ensuring compliance with national monetary policies, financial stability, and legal frameworks. Explore the evolving regulatory landscape to understand how these digital currencies impact global finance.

Source and External Links

Private currency - Wikipedia - A private digital currency is issued by a private entity (individual, business, nonprofit, or decentralized group) and contrasts with government-issued fiat currencies; these include digital cryptocurrencies and digital gold currencies used as private money alternatives.

Private Crypto Versus Public Digital - Communications of the ACM - Private digital currencies such as Bitcoin and stablecoins are digital money alternatives to traditional bank systems offering potential peer-to-peer payments with lower fees and modern cryptographic technology, but they face challenges related to backing, volatility, and regulatory acceptance.

A Historical Perspective on Digital Currencies | Richmond Fed - Private digital currencies, including bitcoin and stablecoin initiatives like Diem, represent modern private tokens used as alternative money, raising ongoing policy debates regarding regulation, competition with central bank money, and financial system impacts.

dowidth.com

dowidth.com