Debt recycling involves restructuring existing loans to replace non-deductible debt with tax-deductible investment debt, enhancing cash flow and wealth building over time. Equity release allows homeowners to access the equity tied up in their property without selling it, providing tax-free funds for various financial needs. Discover how these strategies can optimize your financial planning and improve asset management.

Why it is important

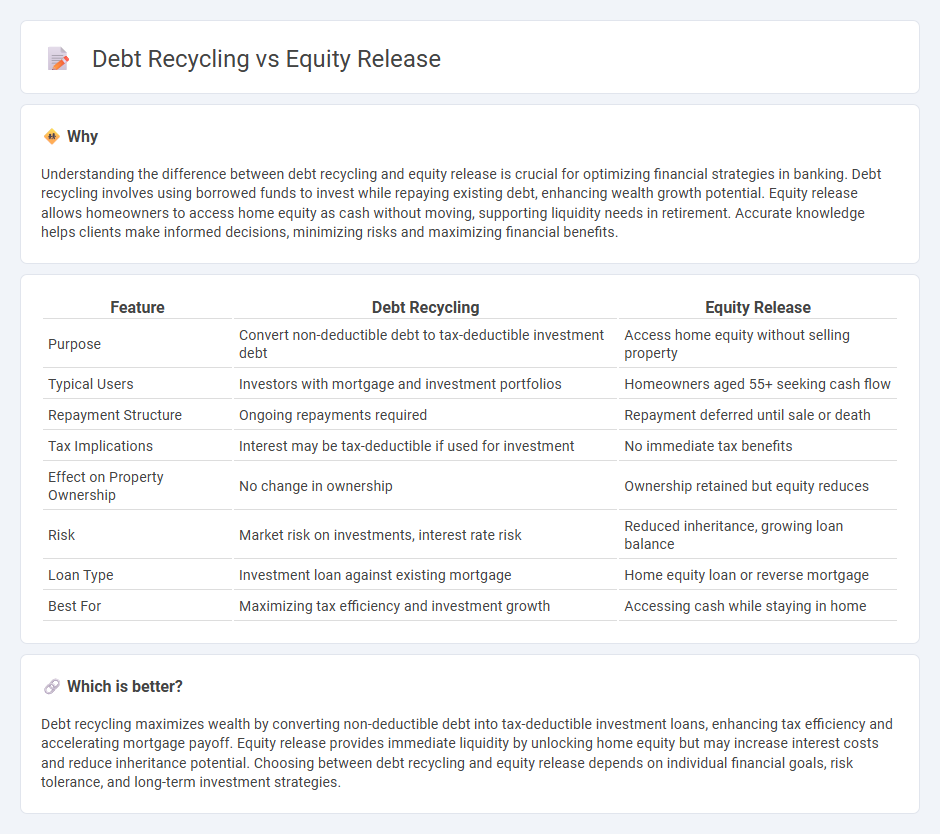

Understanding the difference between debt recycling and equity release is crucial for optimizing financial strategies in banking. Debt recycling involves using borrowed funds to invest while repaying existing debt, enhancing wealth growth potential. Equity release allows homeowners to access home equity as cash without moving, supporting liquidity needs in retirement. Accurate knowledge helps clients make informed decisions, minimizing risks and maximizing financial benefits.

Comparison Table

| Feature | Debt Recycling | Equity Release |

|---|---|---|

| Purpose | Convert non-deductible debt to tax-deductible investment debt | Access home equity without selling property |

| Typical Users | Investors with mortgage and investment portfolios | Homeowners aged 55+ seeking cash flow |

| Repayment Structure | Ongoing repayments required | Repayment deferred until sale or death |

| Tax Implications | Interest may be tax-deductible if used for investment | No immediate tax benefits |

| Effect on Property Ownership | No change in ownership | Ownership retained but equity reduces |

| Risk | Market risk on investments, interest rate risk | Reduced inheritance, growing loan balance |

| Loan Type | Investment loan against existing mortgage | Home equity loan or reverse mortgage |

| Best For | Maximizing tax efficiency and investment growth | Accessing cash while staying in home |

Which is better?

Debt recycling maximizes wealth by converting non-deductible debt into tax-deductible investment loans, enhancing tax efficiency and accelerating mortgage payoff. Equity release provides immediate liquidity by unlocking home equity but may increase interest costs and reduce inheritance potential. Choosing between debt recycling and equity release depends on individual financial goals, risk tolerance, and long-term investment strategies.

Connection

Debt recycling leverages the process of converting non-deductible personal debt into tax-deductible investment debt by using equity release strategies from homeownership. Homeowners tap into their property's equity through loans or redraw facilities to invest in income-generating assets, thereby increasing net wealth while optimizing tax benefits. This synergy between debt recycling and equity release enhances financial flexibility and accelerates wealth accumulation within banking frameworks.

Key Terms

Home Equity

Home equity release allows homeowners to access the value of their property without monthly repayments, typically through a lifetime mortgage or home reversion plan, providing tax-efficient income or lump sums. Debt recycling involves replacing non-deductible debt, such as a home loan, with tax-deductible investment loan debt by leveraging home equity to invest, aiming to improve wealth accumulation and optimize cash flow. Explore detailed comparisons and strategies to determine the best home equity approach for your financial goals.

Loan Restructuring

Equity release allows homeowners to unlock property value without monthly repayments, while debt recycling restructures existing loans to replace non-deductible debt with tax-deductible investment debt. Loan restructuring in equity release often involves reversing mortgage arrangements to provide lump sums or regular income, whereas debt recycling strategically manages loan components to maximize tax benefits and investment growth. Explore the distinctions between these financial strategies to optimize your loan restructuring approach.

Tax Efficiency

Equity release allows homeowners to unlock property value tax-free, providing cash without increasing taxable income, while debt recycling involves replacing non-deductible home loan debt with tax-deductible investment loan debt, optimizing tax outcomes by leveraging interest deductions. Debt recycling's strategic use of investment loans maximizes tax efficiency by converting personal debt into potentially deductible debt, enhancing wealth accumulation over time. Explore detailed comparisons and tailored strategies to maximize tax benefits effectively.

Source and External Links

What is equity release? - MoneyHelper - Equity release is a type of mortgage that lets homeowners aged 55+ access the money tied up in their home without having to move, either as a lump sum or in smaller amounts, with the loan (plus interest) repaid when the homeowner dies or moves into long-term care.

Should you equity-release? - Money Saving Expert - Equity release unlocks the value of your property and converts it into cash, allowing you to stay in your home while receiving funds as a lump sum or in stages ("drawdown"), though it is an expensive borrowing option and reduces the inheritance for your heirs.

Equity release | What is it and is it right for you? - Aviva - Equity release lets you take cash from your home without moving, mainly through a lifetime mortgage (a loan secured against your property, repaid upon death or moving into care) or a home reversion plan (where you sell all or part of your home at less than market value for cash but continue living there).

dowidth.com

dowidth.com