Personal finance automation leverages advanced algorithms to streamline budgeting, saving, and investment management for individuals, optimizing cash flow and financial goals. Business loan origination systems utilize automated workflows and credit risk analytics to accelerate loan approval processes, improving lender efficiency and borrower experience. Explore how these technologies transform financial management and credit access.

Why it is important

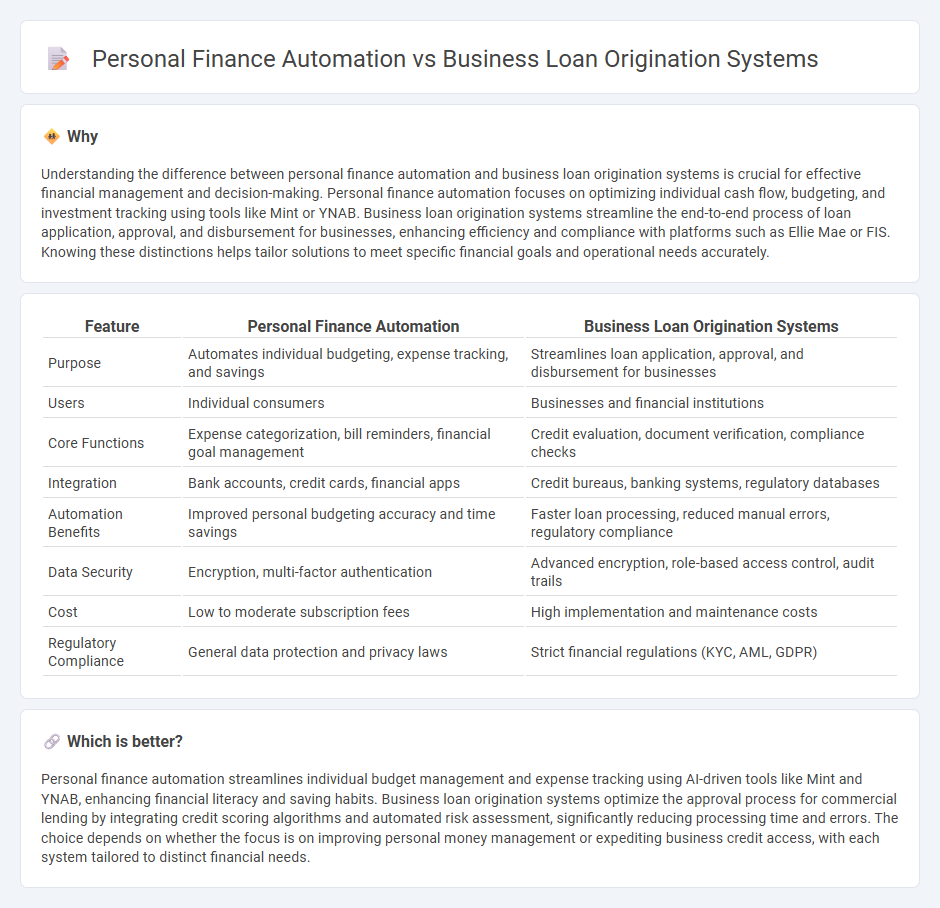

Understanding the difference between personal finance automation and business loan origination systems is crucial for effective financial management and decision-making. Personal finance automation focuses on optimizing individual cash flow, budgeting, and investment tracking using tools like Mint or YNAB. Business loan origination systems streamline the end-to-end process of loan application, approval, and disbursement for businesses, enhancing efficiency and compliance with platforms such as Ellie Mae or FIS. Knowing these distinctions helps tailor solutions to meet specific financial goals and operational needs accurately.

Comparison Table

| Feature | Personal Finance Automation | Business Loan Origination Systems |

|---|---|---|

| Purpose | Automates individual budgeting, expense tracking, and savings | Streamlines loan application, approval, and disbursement for businesses |

| Users | Individual consumers | Businesses and financial institutions |

| Core Functions | Expense categorization, bill reminders, financial goal management | Credit evaluation, document verification, compliance checks |

| Integration | Bank accounts, credit cards, financial apps | Credit bureaus, banking systems, regulatory databases |

| Automation Benefits | Improved personal budgeting accuracy and time savings | Faster loan processing, reduced manual errors, regulatory compliance |

| Data Security | Encryption, multi-factor authentication | Advanced encryption, role-based access control, audit trails |

| Cost | Low to moderate subscription fees | High implementation and maintenance costs |

| Regulatory Compliance | General data protection and privacy laws | Strict financial regulations (KYC, AML, GDPR) |

Which is better?

Personal finance automation streamlines individual budget management and expense tracking using AI-driven tools like Mint and YNAB, enhancing financial literacy and saving habits. Business loan origination systems optimize the approval process for commercial lending by integrating credit scoring algorithms and automated risk assessment, significantly reducing processing time and errors. The choice depends on whether the focus is on improving personal money management or expediting business credit access, with each system tailored to distinct financial needs.

Connection

Personal finance automation leverages data integration and real-time analytics to streamline individual financial management, which directly benefits business loan origination systems by providing accurate credit profiles and spending behavior insights. This synergy enhances risk assessment models and accelerates decision-making processes, reducing loan approval times. Consequently, lenders can offer tailored loan products with improved precision, increasing customer satisfaction and operational efficiency in banking.

Key Terms

**Business Loan Origination Systems:**

Business loan origination systems streamline the process of evaluating, approving, and managing business credit applications through automation, risk assessment algorithms, and compliance checks, significantly reducing turnaround time for lenders. These systems integrate with financial databases, credit bureaus, and document management tools to ensure accurate underwriting and efficient loan processing for small and medium enterprises (SMEs). Explore how these advanced platforms transform lending workflows and enhance business financing efficiency.

Credit Underwriting

Business loan origination systems utilize advanced credit underwriting algorithms to assess commercial credit risk by analyzing financial statements, cash flow data, and industry-specific factors, enhancing decision accuracy. Personal finance automation tools apply credit underwriting mainly for individual creditworthiness, relying on credit scores, income verification, and spending patterns. Explore the latest innovations in credit underwriting to optimize lending efficiency and risk management.

Workflow Automation

Business loan origination systems streamline the end-to-end lending process through automated credit assessments, document management, and regulatory compliance, significantly reducing manual tasks. Personal finance automation centers on managing individual expenses, budgeting, and savings with tools like AI-driven expense tracking and automatic bill payments, enhancing financial discipline. Explore how workflow automation transforms both sectors by boosting operational efficiency and accuracy.

Source and External Links

FIS Commercial Loan Origination - Offers a highly configurable platform to enhance customer engagement, risk analysis, and profitability optimization throughout the credit life cycle.

Moody's Lending Suite - Provides a comprehensive solution for modernizing the commercial loan origination process with enhanced data analysis and risk management.

Baker Hill Commercial Loan Origination System - Streamlines commercial lending processes by integrating data, enhancing transparency, and promoting collaboration.

dowidth.com

dowidth.com