Synthetic identity fraud involves creating fake identities by combining real and fabricated information to open fraudulent bank accounts, while transaction laundering disguises illicit transactions as legitimate payments through third-party merchants. Both types of fraud undermine banking security and lead to significant financial losses, with synthetic identity fraud often harder to detect due to the fabricated personas. Explore more to understand how these threats impact banking and ways to safeguard against them.

Why it is important

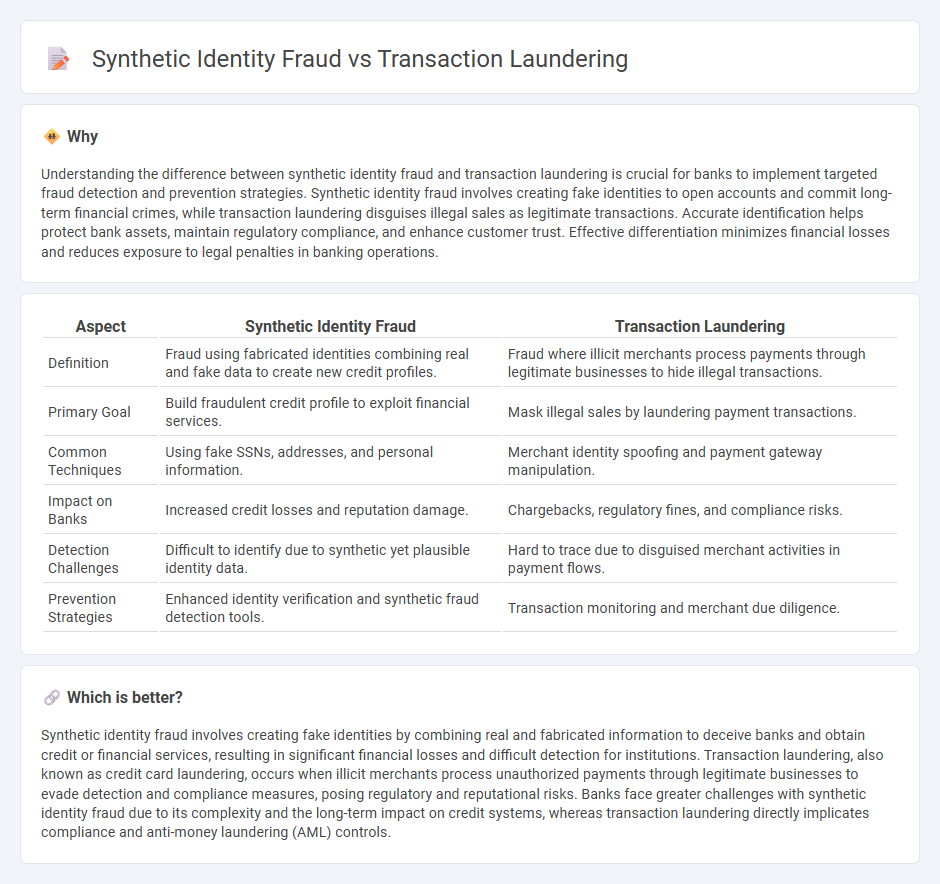

Understanding the difference between synthetic identity fraud and transaction laundering is crucial for banks to implement targeted fraud detection and prevention strategies. Synthetic identity fraud involves creating fake identities to open accounts and commit long-term financial crimes, while transaction laundering disguises illegal sales as legitimate transactions. Accurate identification helps protect bank assets, maintain regulatory compliance, and enhance customer trust. Effective differentiation minimizes financial losses and reduces exposure to legal penalties in banking operations.

Comparison Table

| Aspect | Synthetic Identity Fraud | Transaction Laundering |

|---|---|---|

| Definition | Fraud using fabricated identities combining real and fake data to create new credit profiles. | Fraud where illicit merchants process payments through legitimate businesses to hide illegal transactions. |

| Primary Goal | Build fraudulent credit profile to exploit financial services. | Mask illegal sales by laundering payment transactions. |

| Common Techniques | Using fake SSNs, addresses, and personal information. | Merchant identity spoofing and payment gateway manipulation. |

| Impact on Banks | Increased credit losses and reputation damage. | Chargebacks, regulatory fines, and compliance risks. |

| Detection Challenges | Difficult to identify due to synthetic yet plausible identity data. | Hard to trace due to disguised merchant activities in payment flows. |

| Prevention Strategies | Enhanced identity verification and synthetic fraud detection tools. | Transaction monitoring and merchant due diligence. |

Which is better?

Synthetic identity fraud involves creating fake identities by combining real and fabricated information to deceive banks and obtain credit or financial services, resulting in significant financial losses and difficult detection for institutions. Transaction laundering, also known as credit card laundering, occurs when illicit merchants process unauthorized payments through legitimate businesses to evade detection and compliance measures, posing regulatory and reputational risks. Banks face greater challenges with synthetic identity fraud due to its complexity and the long-term impact on credit systems, whereas transaction laundering directly implicates compliance and anti-money laundering (AML) controls.

Connection

Synthetic identity fraud and transaction laundering intersect through the exploitation of fabricated or compromised identities to facilitate illicit financial flows. Criminals create synthetic identities by combining real and fake information, enabling them to open bank accounts and process fraudulent transactions that mask the origin of illegally obtained funds. This synergy allows laundering schemes to bypass traditional banking controls, increasing the risk of undetected money laundering in financial institutions.

Key Terms

**Transaction Laundering:**

Transaction laundering occurs when illicit merchants process unauthorized transactions through legitimate payment gateways to disguise illegal sales, often bypassing fraud detection systems. This practice jeopardizes merchant accounts, leads to significant financial losses for banks, and complicates compliance with anti-money laundering (AML) regulations. Explore more about effective strategies to detect and prevent transaction laundering in financial institutions.

Front Company

Transaction laundering involves processing payments through a legitimate front company to disguise illegal sales, while synthetic identity fraud uses fabricated identities to open accounts or make transactions. Front companies facilitate transaction laundering by appearing legitimate to payment processors, masking the true nature of illicit activities. Explore the techniques and prevention strategies to better understand how front companies are exploited in these fraud schemes.

Shell Website

Transaction laundering involves processing unauthorized sales through legitimate merchant accounts, often seen in e-commerce and Shell website operations, undermining payment systems. Synthetic identity fraud uses fabricated personal information to create fraudulent accounts, posing risks to Shell's customer verification processes and digital security. Explore more about how Shell combats these threats and secures its online platforms.

Source and External Links

What is Transaction Laundering? - Sanction Scanner - Transaction laundering is an electronic money laundering method where illegal merchants disguise illicit transactions by processing sales through a legitimate vendor's payment credentials, making it appear as though the funds come from a legal business.

What is Transaction Laundering? - AML Watcher - Transaction laundering involves illegal merchants processing illicit funds through legitimate e-commerce platforms, using fake invoices, manipulated transaction data, and layered bank transfers to obscure the funds' origin.

The Growing Threat of Transaction Laundering | Legal Solutions - Transaction laundering is a streamlined form of money laundering where one merchant processes credit card payments through another merchant's account, commonly used for selling counterfeit goods, illegal drugs, and unlicensed services, while violating agreements with acquiring banks.

dowidth.com

dowidth.com