Negative interest rates occur when central banks set benchmark rates below zero, causing depositors to pay to keep money in savings accounts, which can stimulate spending and investment during economic downturns. In contrast, positive interest rates reward savers with returns, encouraging capital accumulation and lending, typical in stable or growing economies. Explore the impacts of these contrasting monetary policies on banking strategies and economic health.

Why it is important

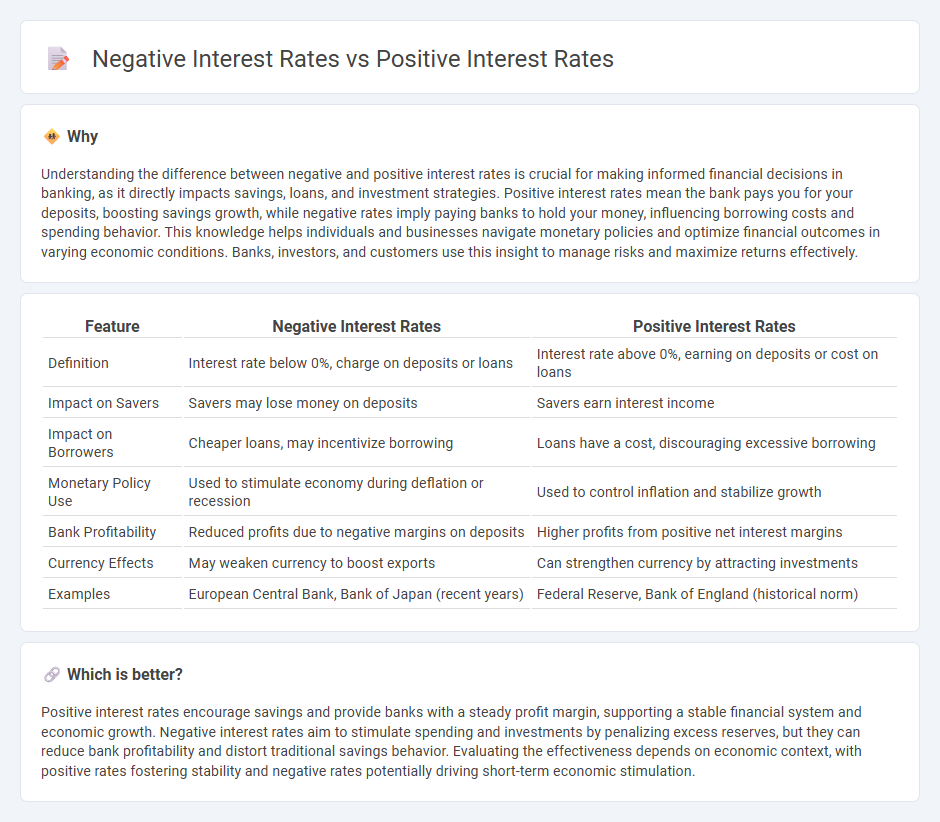

Understanding the difference between negative and positive interest rates is crucial for making informed financial decisions in banking, as it directly impacts savings, loans, and investment strategies. Positive interest rates mean the bank pays you for your deposits, boosting savings growth, while negative rates imply paying banks to hold your money, influencing borrowing costs and spending behavior. This knowledge helps individuals and businesses navigate monetary policies and optimize financial outcomes in varying economic conditions. Banks, investors, and customers use this insight to manage risks and maximize returns effectively.

Comparison Table

| Feature | Negative Interest Rates | Positive Interest Rates |

|---|---|---|

| Definition | Interest rate below 0%, charge on deposits or loans | Interest rate above 0%, earning on deposits or cost on loans |

| Impact on Savers | Savers may lose money on deposits | Savers earn interest income |

| Impact on Borrowers | Cheaper loans, may incentivize borrowing | Loans have a cost, discouraging excessive borrowing |

| Monetary Policy Use | Used to stimulate economy during deflation or recession | Used to control inflation and stabilize growth |

| Bank Profitability | Reduced profits due to negative margins on deposits | Higher profits from positive net interest margins |

| Currency Effects | May weaken currency to boost exports | Can strengthen currency by attracting investments |

| Examples | European Central Bank, Bank of Japan (recent years) | Federal Reserve, Bank of England (historical norm) |

Which is better?

Positive interest rates encourage savings and provide banks with a steady profit margin, supporting a stable financial system and economic growth. Negative interest rates aim to stimulate spending and investments by penalizing excess reserves, but they can reduce bank profitability and distort traditional savings behavior. Evaluating the effectiveness depends on economic context, with positive rates fostering stability and negative rates potentially driving short-term economic stimulation.

Connection

Negative interest rates and positive interest rates represent opposite monetary policy tools used by central banks to influence economic activity and inflation. Negative interest rates encourage borrowing and spending by charging banks for holding excess reserves, while positive interest rates promote saving and help control inflation by making borrowing more expensive. Both rates impact lending behaviors, investment decisions, and overall financial market stability.

Key Terms

Monetary Policy

Positive interest rates encourage saving and moderate borrowing, supporting economic growth and controlling inflation by making loans more costly. Negative interest rates, implemented by central banks during deflationary or recessionary periods, aim to stimulate spending and investment by charging banks to hold excess reserves, thereby promoting liquidity. Discover more about how these contrasting monetary policy tools influence global financial stability and economic cycles.

Inflation

Positive interest rates encourage saving and reduce consumer spending, which helps to curb inflation by decreasing demand for goods and services. Negative interest rates, by contrast, incentivize borrowing and spending, aiming to boost economic activity but risk accelerating inflation by increasing demand. Explore the impact of interest rate policies on inflation trends and economic stability to better understand financial strategies.

Deposit Incentives

Positive interest rates encourage deposits by offering savers a guaranteed return, boosting bank reserves and economic stability. Negative interest rates, conversely, discourage holding cash in banks by charging fees on deposits, motivating consumers and businesses to spend or invest instead. Explore how these contrasting mechanisms impact financial behavior and economic growth in greater detail.

Source and External Links

Positive Interest Rate Policy (PIRP) Definition - A strategy where central banks set target interest rates above zero percent to manage inflation and economic growth.

Positive 'Real' Interest Rates are a Game Changer (Part One) - Discusses how positive real interest rates have implications for the economy and financial markets, particularly in the context of the US.

The Importance of Positive Interest Rates in Financial Stability - Explains why positive interest rates are crucial for maintaining financial stability and preventing economic imbalances.

dowidth.com

dowidth.com