Super apps integrate multiple financial services including payments, loans, and investments within a single platform, enhancing user convenience and engagement. Internet banking primarily focuses on online access to traditional banking functions such as account management, transfers, and bill payments. Explore the evolving landscape of digital finance to understand the advantages and limitations of both platforms.

Why it is important

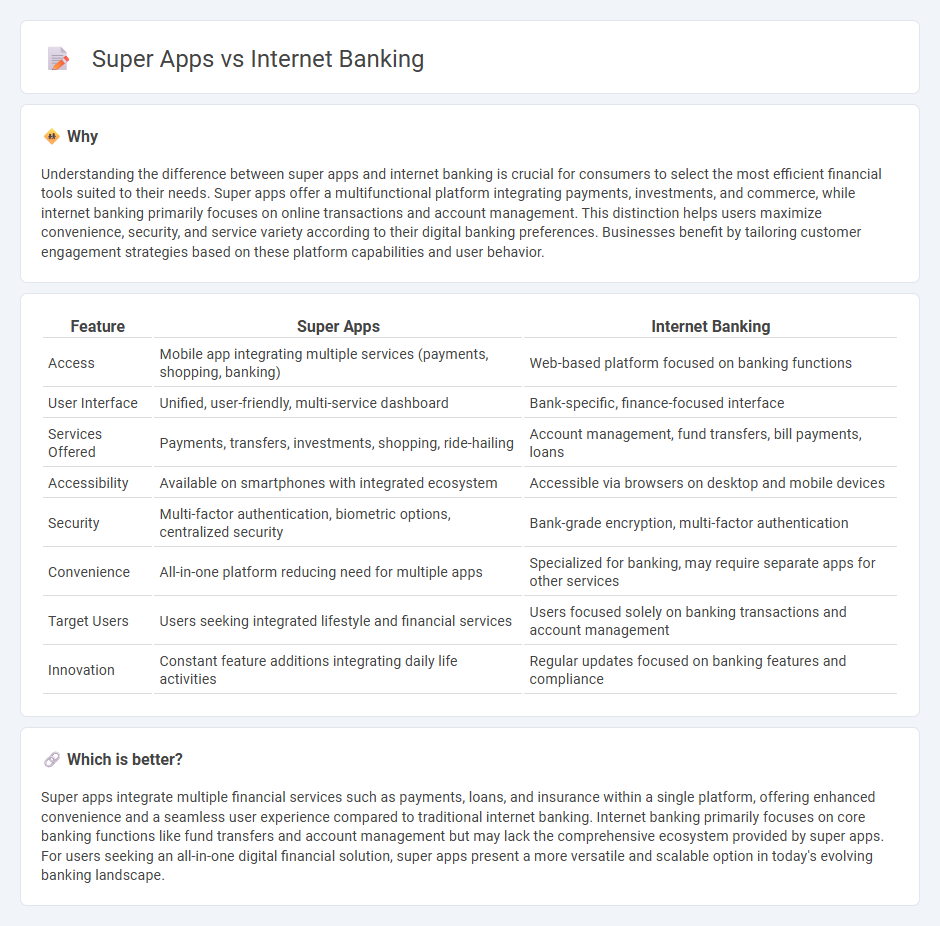

Understanding the difference between super apps and internet banking is crucial for consumers to select the most efficient financial tools suited to their needs. Super apps offer a multifunctional platform integrating payments, investments, and commerce, while internet banking primarily focuses on online transactions and account management. This distinction helps users maximize convenience, security, and service variety according to their digital banking preferences. Businesses benefit by tailoring customer engagement strategies based on these platform capabilities and user behavior.

Comparison Table

| Feature | Super Apps | Internet Banking |

|---|---|---|

| Access | Mobile app integrating multiple services (payments, shopping, banking) | Web-based platform focused on banking functions |

| User Interface | Unified, user-friendly, multi-service dashboard | Bank-specific, finance-focused interface |

| Services Offered | Payments, transfers, investments, shopping, ride-hailing | Account management, fund transfers, bill payments, loans |

| Accessibility | Available on smartphones with integrated ecosystem | Accessible via browsers on desktop and mobile devices |

| Security | Multi-factor authentication, biometric options, centralized security | Bank-grade encryption, multi-factor authentication |

| Convenience | All-in-one platform reducing need for multiple apps | Specialized for banking, may require separate apps for other services |

| Target Users | Users seeking integrated lifestyle and financial services | Users focused solely on banking transactions and account management |

| Innovation | Constant feature additions integrating daily life activities | Regular updates focused on banking features and compliance |

Which is better?

Super apps integrate multiple financial services such as payments, loans, and insurance within a single platform, offering enhanced convenience and a seamless user experience compared to traditional internet banking. Internet banking primarily focuses on core banking functions like fund transfers and account management but may lack the comprehensive ecosystem provided by super apps. For users seeking an all-in-one digital financial solution, super apps present a more versatile and scalable option in today's evolving banking landscape.

Connection

Super apps integrate internet banking features to provide seamless financial services within a single platform, enhancing user convenience and engagement. By embedding banking functionalities like fund transfers, bill payments, and loan applications, super apps offer real-time, secure access to banking services without switching apps. This convergence drives digital transformation in banking by increasing customer retention and expanding financial inclusivity.

Key Terms

Digital Wallet

Digital wallets in internet banking provide secure, streamlined access to funds for online transactions, bill payments, and fund transfers, emphasizing security features like encryption and two-factor authentication. Super apps integrate digital wallet functions with additional services including ride-hailing, food delivery, and social networking, offering a multifunctional platform that enhances user convenience and engagement. Explore the evolving roles of digital wallets within these platforms to understand their impact on financial services and everyday digital interactions.

Multi-service Integration

Internet banking primarily offers financial services such as money transfers, bill payments, and account management through a dedicated banking platform, ensuring secure and specialized user experiences. Super apps integrate multiple services beyond banking, including e-commerce, ride-hailing, and food delivery, creating a unified ecosystem that enhances convenience and user engagement. Explore how multi-service integration reshapes digital financial landscapes to better serve diverse consumer needs.

User Authentication

User authentication in internet banking typically relies on multi-factor authentication (MFA) methods such as passwords, OTPs, and biometric verification to ensure secure access to accounts. Super apps integrate diverse services beyond banking, using advanced authentication technologies, including facial recognition and behavioral biometrics, to streamline user experience while maintaining security across multiple platforms. Explore how evolving authentication techniques enhance convenience and protection in both internet banking and super apps.

Source and External Links

Online banking - Wikipedia - Internet banking provides personal and corporate services such as making electronic payments, viewing balances, transferring funds, and ordering checks, accessible via secure websites with customer credentials setup.

Online banking | Sign up and log in - U.S. Bank - Online and mobile banking allow users to manage accounts, deposit checks, pay bills, transfer funds, set savings goals, and monitor credit using devices like desktops and smartphones with strong security protections.

Online Banking - HSBC Bank USA - HSBC offers free, secure personal online banking with features including real-time payments, account transfers, electronic statements, and $0 liability online fraud protection.

dowidth.com

dowidth.com