Wealthtech leverages advanced algorithms and digital platforms to provide personalized investment management and financial planning solutions, enhancing client wealth growth and optimization. API banking enables seamless integration of banking services and data through secure APIs, facilitating innovative financial products and improved customer experiences. Explore how wealthtech and API banking transform the financial landscape and empower smarter money management.

Why it is important

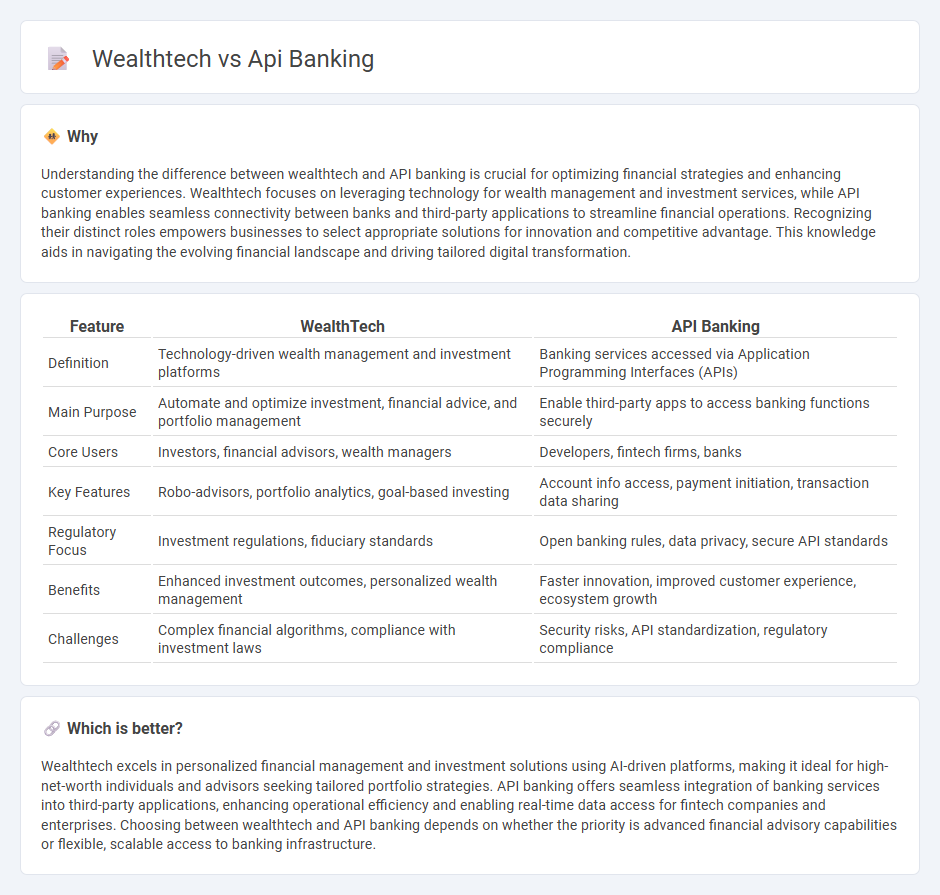

Understanding the difference between wealthtech and API banking is crucial for optimizing financial strategies and enhancing customer experiences. Wealthtech focuses on leveraging technology for wealth management and investment services, while API banking enables seamless connectivity between banks and third-party applications to streamline financial operations. Recognizing their distinct roles empowers businesses to select appropriate solutions for innovation and competitive advantage. This knowledge aids in navigating the evolving financial landscape and driving tailored digital transformation.

Comparison Table

| Feature | WealthTech | API Banking |

|---|---|---|

| Definition | Technology-driven wealth management and investment platforms | Banking services accessed via Application Programming Interfaces (APIs) |

| Main Purpose | Automate and optimize investment, financial advice, and portfolio management | Enable third-party apps to access banking functions securely |

| Core Users | Investors, financial advisors, wealth managers | Developers, fintech firms, banks |

| Key Features | Robo-advisors, portfolio analytics, goal-based investing | Account info access, payment initiation, transaction data sharing |

| Regulatory Focus | Investment regulations, fiduciary standards | Open banking rules, data privacy, secure API standards |

| Benefits | Enhanced investment outcomes, personalized wealth management | Faster innovation, improved customer experience, ecosystem growth |

| Challenges | Complex financial algorithms, compliance with investment laws | Security risks, API standardization, regulatory compliance |

Which is better?

Wealthtech excels in personalized financial management and investment solutions using AI-driven platforms, making it ideal for high-net-worth individuals and advisors seeking tailored portfolio strategies. API banking offers seamless integration of banking services into third-party applications, enhancing operational efficiency and enabling real-time data access for fintech companies and enterprises. Choosing between wealthtech and API banking depends on whether the priority is advanced financial advisory capabilities or flexible, scalable access to banking infrastructure.

Connection

Wealthtech leverages API banking to integrate financial data, enabling seamless access to investment portfolios and real-time banking services. APIs facilitate secure data exchange between fintech platforms and traditional banks, enhancing personalized wealth management solutions. This connectivity drives innovation in automated advisory, streamlined transactions, and improved customer experience within the wealth management ecosystem.

Key Terms

**API Banking:**

API banking leverages Application Programming Interfaces to enable seamless integration of banking services into third-party applications, enhancing customer experience and operational efficiency. This technology facilitates real-time access to banking data, automated transactions, and personalized financial solutions, driving innovation in the fintech ecosystem. Explore more about how API banking is transforming digital finance and service delivery.

Open Banking

API banking leverages open banking protocols to enable seamless integration of financial services across platforms, enhancing user experience and enabling real-time data sharing. Wealthtech utilizes open banking APIs to provide personalized investment advice, automated portfolio management, and streamlined asset aggregation, driving smarter financial decision-making. Explore how open banking transforms both API banking and wealthtech solutions to empower users with innovative financial tools.

Payment Integration

API banking streamlines payment integration by enabling secure, real-time data exchange between financial institutions and third-party applications, enhancing transaction efficiency and customer experience. Wealthtech leverages payment integration to offer seamless investment transfers, automated portfolio funding, and tailored financial planning tools for clients. Explore how these innovative technologies revolutionize financial services through advanced payment solutions.

Source and External Links

Banking application programming interfaces (APIs) - Stripe - API banking enables financial institutions to offer modular, interoperable services through standardized APIs that allow third-party developers and other banks to interact with payments, identity verification, and data sharing functionalities, fostering rapid innovation and partnerships with fintechs.

Banking APIs: Definition, Examples and Benefits | Priority Commerce - Banking APIs connect companies to banks to seamlessly integrate financial services such as transaction processing, payment gateways, customer data management, and risk assessment, enabling real-time operations and personalized financial experiences.

API Banking and Banking as a Service | Deloitte US - API banking exposes bank services via secured internet APIs to allow external parties to access customer accounts, initiate transactions, and receive real-time data, while Banking as a Service (BaaS) lets nonbank companies provide banking features without licensing, revolutionizing money movement and payment services.

dowidth.com

dowidth.com