Account aggregation consolidates financial data from multiple sources into a single platform, enhancing customer insight and decision-making. Customer onboarding involves verifying identities and setting up accounts, ensuring regulatory compliance and a seamless user experience. Explore how these processes transform modern banking operations.

Why it is important

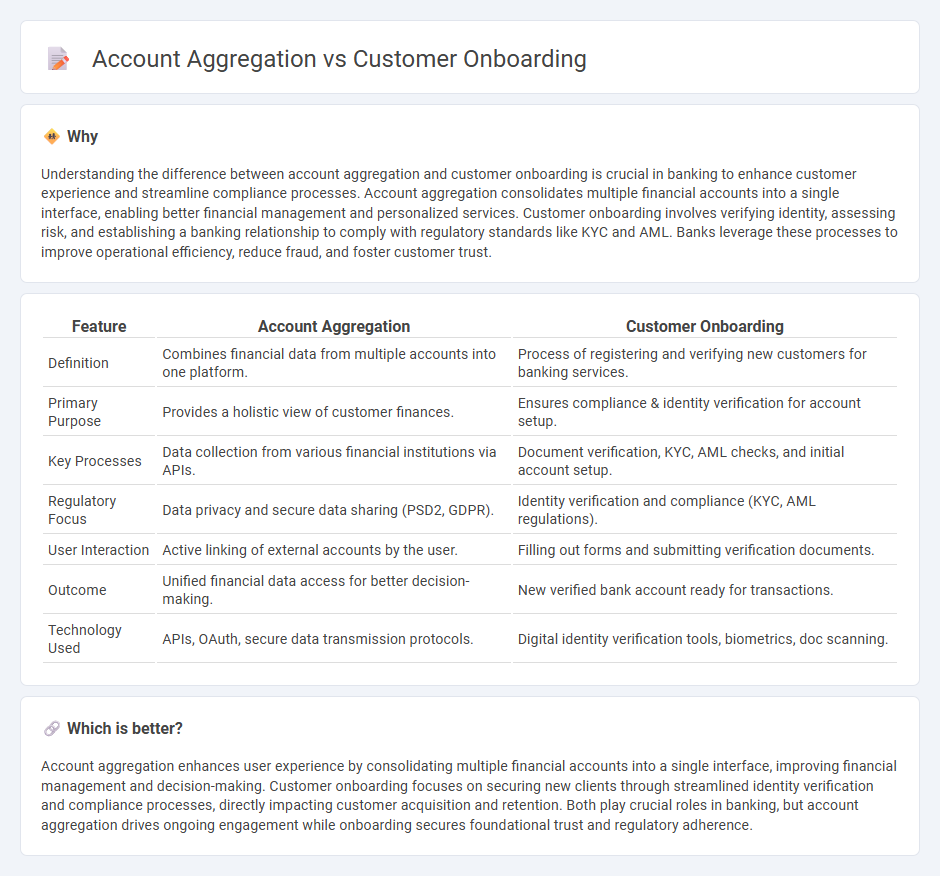

Understanding the difference between account aggregation and customer onboarding is crucial in banking to enhance customer experience and streamline compliance processes. Account aggregation consolidates multiple financial accounts into a single interface, enabling better financial management and personalized services. Customer onboarding involves verifying identity, assessing risk, and establishing a banking relationship to comply with regulatory standards like KYC and AML. Banks leverage these processes to improve operational efficiency, reduce fraud, and foster customer trust.

Comparison Table

| Feature | Account Aggregation | Customer Onboarding |

|---|---|---|

| Definition | Combines financial data from multiple accounts into one platform. | Process of registering and verifying new customers for banking services. |

| Primary Purpose | Provides a holistic view of customer finances. | Ensures compliance & identity verification for account setup. |

| Key Processes | Data collection from various financial institutions via APIs. | Document verification, KYC, AML checks, and initial account setup. |

| Regulatory Focus | Data privacy and secure data sharing (PSD2, GDPR). | Identity verification and compliance (KYC, AML regulations). |

| User Interaction | Active linking of external accounts by the user. | Filling out forms and submitting verification documents. |

| Outcome | Unified financial data access for better decision-making. | New verified bank account ready for transactions. |

| Technology Used | APIs, OAuth, secure data transmission protocols. | Digital identity verification tools, biometrics, doc scanning. |

Which is better?

Account aggregation enhances user experience by consolidating multiple financial accounts into a single interface, improving financial management and decision-making. Customer onboarding focuses on securing new clients through streamlined identity verification and compliance processes, directly impacting customer acquisition and retention. Both play crucial roles in banking, but account aggregation drives ongoing engagement while onboarding secures foundational trust and regulatory adherence.

Connection

Account aggregation enhances customer onboarding by streamlining data collection and verification processes, enabling banks to quickly access consolidated financial information. This integration reduces onboarding time, improves accuracy, and provides a seamless experience for new customers. Efficient account aggregation supports compliance with KYC regulations and enables personalized banking services from the start.

Key Terms

Customer Onboarding:

Customer onboarding streamlines the process of integrating new users by verifying identities, collecting essential data, and setting up personalized accounts, ensuring a seamless and secure user experience. This process reduces friction and enhances customer satisfaction through tailored communication and efficient verification methods. Explore comprehensive strategies and latest tools to optimize customer onboarding for your business growth.

Know Your Customer (KYC)

Customer onboarding involves verifying identity, collecting crucial personal data, and assessing risk to comply with Know Your Customer (KYC) regulations, ensuring secure access to financial services. Account aggregation gathers financial information from multiple accounts, enhancing user experience but still relying on robust KYC processes for authentication and fraud prevention. Explore deeper insights on how KYC frameworks impact both customer onboarding and account aggregation methods.

Customer Due Diligence (CDD)

Customer onboarding involves the verification and validation of new clients to comply with regulatory Customer Due Diligence (CDD) standards, ensuring identities are authenticated and risks assessed. Account aggregation consolidates financial data from multiple accounts to provide a comprehensive view but requires stringent CDD to maintain data security and regulatory compliance. Explore further to understand how advanced CDD technologies enhance both processes effectively.

Source and External Links

Complete Guide to Customer Onboarding: Steps + Best Practices - Customer onboarding involves a structured process starting with a personalized welcome and guided introduction, followed by structured learning pathways such as live sessions, self-paced courses, and milestones to engage and educate customers effectively.

Your complete guide to customer onboarding - Creating a customer onboarding process includes personalized welcome emails, product tutorials, and a mutual engagement plan to align expectations and ensure accountability, which enhances customer experience and reduces churn risk.

Customer onboarding guide: 11 templates + best practices - Effective onboarding requires assigning responsibility (often customer success teams), setting SMART goals to guide efforts, and delivering a seamless, supportive experience that drives customer success and retention.

dowidth.com

dowidth.com