Wealthtech focuses on leveraging technology to enhance investment management, personalized financial planning, and asset allocation for individuals and institutions. Lendtech revolutionizes the lending process through digital platforms that streamline credit evaluation, loan origination, and risk assessment. Discover how these fintech innovations are reshaping the future of financial services.

Why it is important

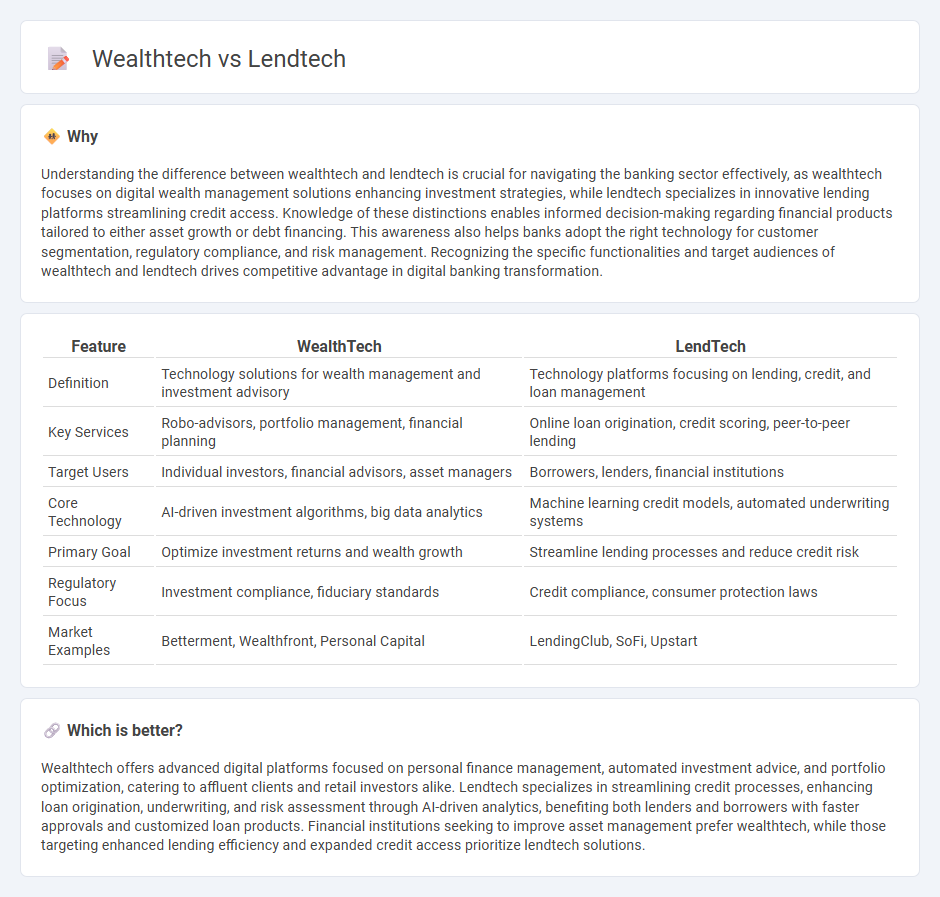

Understanding the difference between wealthtech and lendtech is crucial for navigating the banking sector effectively, as wealthtech focuses on digital wealth management solutions enhancing investment strategies, while lendtech specializes in innovative lending platforms streamlining credit access. Knowledge of these distinctions enables informed decision-making regarding financial products tailored to either asset growth or debt financing. This awareness also helps banks adopt the right technology for customer segmentation, regulatory compliance, and risk management. Recognizing the specific functionalities and target audiences of wealthtech and lendtech drives competitive advantage in digital banking transformation.

Comparison Table

| Feature | WealthTech | LendTech |

|---|---|---|

| Definition | Technology solutions for wealth management and investment advisory | Technology platforms focusing on lending, credit, and loan management |

| Key Services | Robo-advisors, portfolio management, financial planning | Online loan origination, credit scoring, peer-to-peer lending |

| Target Users | Individual investors, financial advisors, asset managers | Borrowers, lenders, financial institutions |

| Core Technology | AI-driven investment algorithms, big data analytics | Machine learning credit models, automated underwriting systems |

| Primary Goal | Optimize investment returns and wealth growth | Streamline lending processes and reduce credit risk |

| Regulatory Focus | Investment compliance, fiduciary standards | Credit compliance, consumer protection laws |

| Market Examples | Betterment, Wealthfront, Personal Capital | LendingClub, SoFi, Upstart |

Which is better?

Wealthtech offers advanced digital platforms focused on personal finance management, automated investment advice, and portfolio optimization, catering to affluent clients and retail investors alike. Lendtech specializes in streamlining credit processes, enhancing loan origination, underwriting, and risk assessment through AI-driven analytics, benefiting both lenders and borrowers with faster approvals and customized loan products. Financial institutions seeking to improve asset management prefer wealthtech, while those targeting enhanced lending efficiency and expanded credit access prioritize lendtech solutions.

Connection

Wealthtech and lendtech intersect by leveraging advanced financial technologies to optimize asset management and credit lending processes. Wealthtech platforms utilize data analytics and AI to tailor investment strategies, which can be integrated with lendtech solutions that assess borrower risk and automate loan approvals. This synergy enhances financial inclusion by providing personalized wealth growth opportunities alongside accessible credit services.

Key Terms

**Lendtech:**

Lendtech leverages advanced algorithms and AI to revolutionize the lending process by improving credit scoring, automating loan approvals, and reducing default risks. It provides borrowers with faster access to funds while enabling lenders to enhance risk management and operational efficiency. Explore how lendtech innovations are transforming financial services and empowering both lenders and borrowers.

Credit Scoring

Lendtech leverages advanced credit scoring algorithms to evaluate borrower risk by analyzing alternative data such as transaction history and social behavior, enhancing lending decisions and reducing default rates. Wealthtech integrates credit scoring within broader financial planning tools, offering personalized investment advice while assessing creditworthiness to optimize asset allocation strategies. Discover how these technologies transform financial services and revolutionize credit risk management.

Loan Origination

Lendtech and wealthtech serve distinct purposes within financial technology, with lendtech primarily optimizing loan origination through automated credit assessment, digital application processes, and faster underwriting. Wealthtech focuses on investment management, employing AI-driven portfolio optimization and robo-advisors rather than loan workflows. Explore the evolving capabilities of lendtech to understand its transformative impact on seamless loan origination.

Source and External Links

LendTech Market Size, Share, Trends | CAGR of 24.9% - LendTech, short for Lending Technology, refers to digital platforms and AI-driven tools used to streamline and improve loan processes; the global market is rapidly growing and expected to reach USD 145.1 billion by 2034 with a CAGR of 24.9% due to demand for faster, convenient loans and advanced credit risk assessments.

LendTech Market Research | Lending Technology - LendTech uses sophisticated algorithms and big data analytics to match lenders and borrowers efficiently, offering secure, real-time communication and personalized lending solutions based on granular customer data such as credit scores and social media activity.

What is LendTech? - LendTech is the digital means to deliver loans and banking services securely online, increasingly replacing traditional banking for loan origination and management, with a large percentage of consumers now using FinTech lending apps for faster, more accessible financial services.

dowidth.com

dowidth.com