Alternative credit data offers insights into consumer creditworthiness by leveraging non-traditional information sources such as utility payments, rental history, and social behavior, enhancing risk assessment beyond conventional metrics. Transaction data, derived from bank account activity and payment patterns, provides real-time, granular details on spending behavior and financial health. Explore how integrating alternative credit data with transaction data transforms lending decisions and financial inclusion.

Why it is important

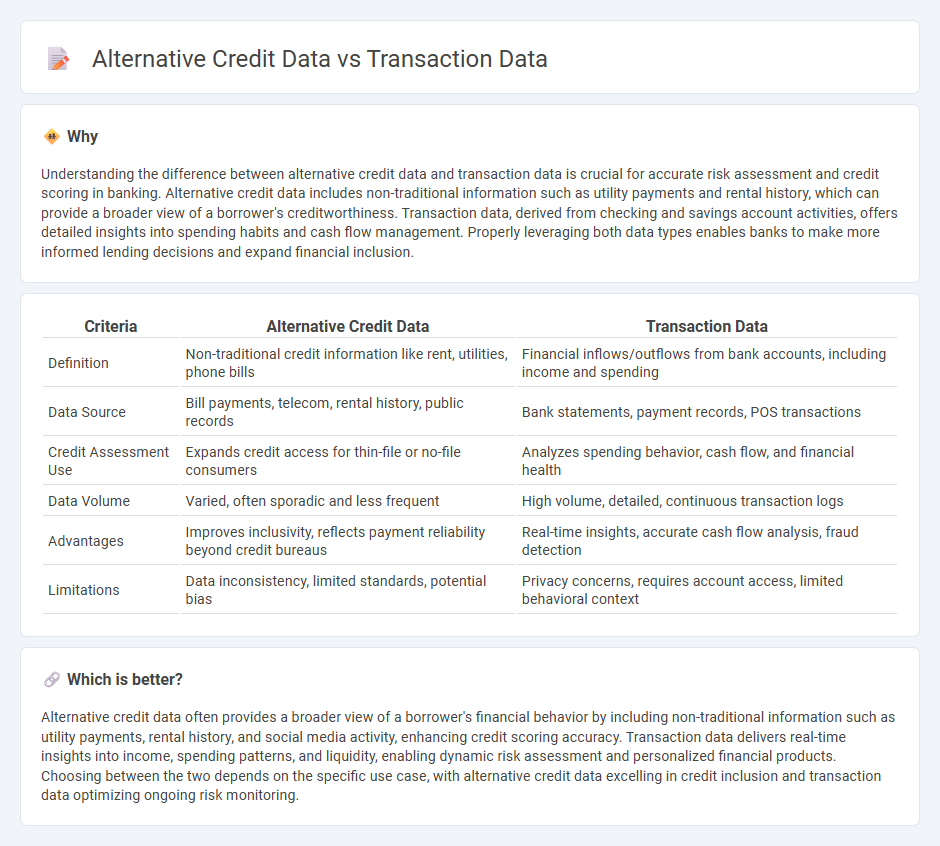

Understanding the difference between alternative credit data and transaction data is crucial for accurate risk assessment and credit scoring in banking. Alternative credit data includes non-traditional information such as utility payments and rental history, which can provide a broader view of a borrower's creditworthiness. Transaction data, derived from checking and savings account activities, offers detailed insights into spending habits and cash flow management. Properly leveraging both data types enables banks to make more informed lending decisions and expand financial inclusion.

Comparison Table

| Criteria | Alternative Credit Data | Transaction Data |

|---|---|---|

| Definition | Non-traditional credit information like rent, utilities, phone bills | Financial inflows/outflows from bank accounts, including income and spending |

| Data Source | Bill payments, telecom, rental history, public records | Bank statements, payment records, POS transactions |

| Credit Assessment Use | Expands credit access for thin-file or no-file consumers | Analyzes spending behavior, cash flow, and financial health |

| Data Volume | Varied, often sporadic and less frequent | High volume, detailed, continuous transaction logs |

| Advantages | Improves inclusivity, reflects payment reliability beyond credit bureaus | Real-time insights, accurate cash flow analysis, fraud detection |

| Limitations | Data inconsistency, limited standards, potential bias | Privacy concerns, requires account access, limited behavioral context |

Which is better?

Alternative credit data often provides a broader view of a borrower's financial behavior by including non-traditional information such as utility payments, rental history, and social media activity, enhancing credit scoring accuracy. Transaction data delivers real-time insights into income, spending patterns, and liquidity, enabling dynamic risk assessment and personalized financial products. Choosing between the two depends on the specific use case, with alternative credit data excelling in credit inclusion and transaction data optimizing ongoing risk monitoring.

Connection

Alternative credit data, including utility payments and rental histories, enrich traditional credit assessments by providing lenders with a broader view of consumer financial behavior beyond conventional credit reports. Transaction data derived from banking activities offers real-time insights into spending patterns, cash flow, and financial stability, which complement alternative data to enhance credit risk evaluation. Integrating these diverse data sources optimizes credit scoring models, enabling more accurate predictions of creditworthiness and expanding access to credit for underserved populations.

Key Terms

Payment History

Transaction data offers detailed insights into an individual's spending patterns, purchase frequency, and cash flow, providing a granular view of financial behavior. Alternative credit data emphasizes payment history by capturing utility bills, rent payments, and subscription services, which often reflect creditworthiness for those with limited traditional credit records. Explore further to understand how combining these data types enhances credit risk assessment.

Utility Bills

Utility bills serve as a crucial alternative credit data source, providing detailed transaction data reflecting consistent payment behavior over time. Unlike traditional credit reports, utility bill payments offer insights into the repayment reliability of individuals lacking conventional credit history. Explore how integrating utility bill data can revolutionize credit scoring models and enhance financial inclusion.

Bank Statements

Bank statements provide detailed transaction data that reflects an individual's income, expenses, and spending habits, offering banks a direct view of financial behavior. Alternative credit data supplements this by including non-traditional indicators such as utility payments and rental history, which can enhance credit assessments for those with limited formal credit records. Discover how leveraging both data types from bank statements can improve credit decision-making accuracy.

Source and External Links

What is transactional data? | Definition from TechTarget - Transactional data is information collected from transactions, including details like unique identifiers and timestamps, capturing events such as sales, purchases, and payments, typically managed in relational or NoSQL databases following ACID properties for consistency and durability.

What is Transactional Data? - Explanation & Examples - Secoda - Transactional data records the who, what, when, and where of transactions such as sales, purchases, and payments, crucial for analyzing business performance and managed through robust systems to handle large volumes efficiently.

What is Transactional Data? | TIBCO - Transactional data captures specifics like transaction time, location, price, payment method, and discounts at the point of sale, assigned with unique transaction IDs, and differs from analytical and master data by representing raw transaction events.

dowidth.com

dowidth.com