Neo brokerage platforms leverage advanced technology to offer low-cost, user-friendly investment services accessible to a broad audience, emphasizing digital tools and streamlined account management. Private banking delivers personalized wealth management, exclusive financial planning, and bespoke investment solutions tailored to high-net-worth individuals, focusing on confidentiality and expert advisory. Explore the distinct advantages and features of neo brokerage versus private banking to determine the best fit for your financial goals.

Why it is important

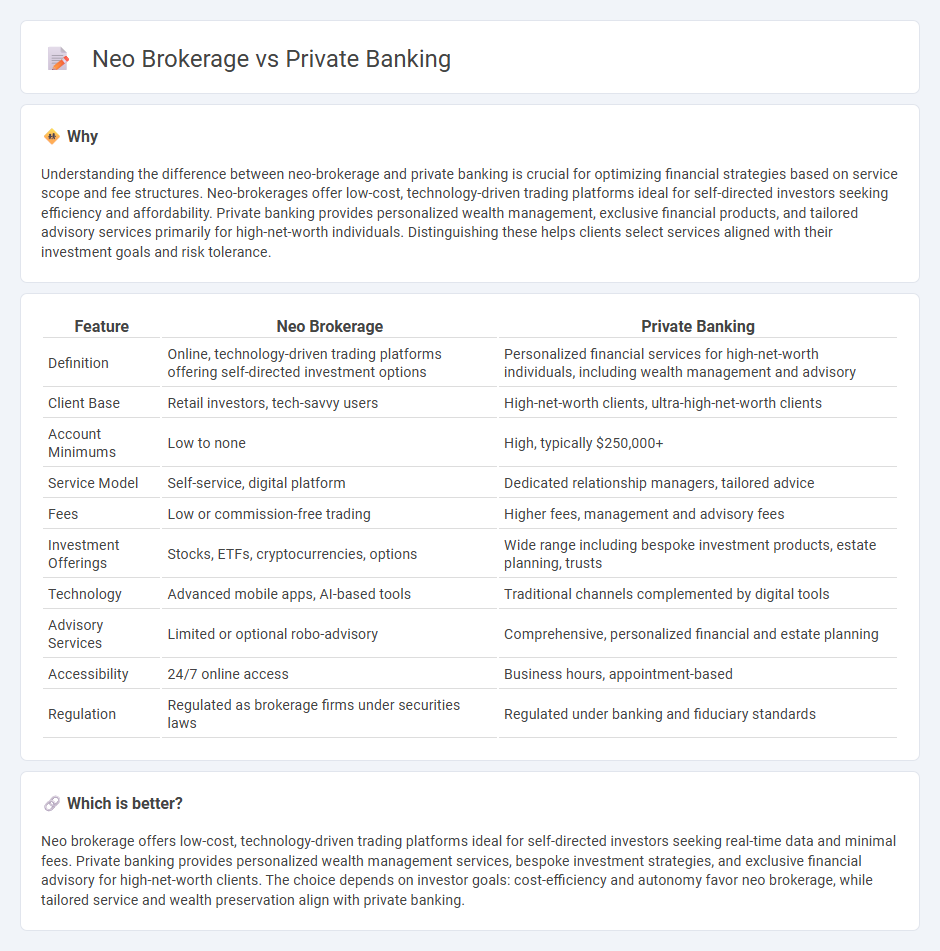

Understanding the difference between neo-brokerage and private banking is crucial for optimizing financial strategies based on service scope and fee structures. Neo-brokerages offer low-cost, technology-driven trading platforms ideal for self-directed investors seeking efficiency and affordability. Private banking provides personalized wealth management, exclusive financial products, and tailored advisory services primarily for high-net-worth individuals. Distinguishing these helps clients select services aligned with their investment goals and risk tolerance.

Comparison Table

| Feature | Neo Brokerage | Private Banking |

|---|---|---|

| Definition | Online, technology-driven trading platforms offering self-directed investment options | Personalized financial services for high-net-worth individuals, including wealth management and advisory |

| Client Base | Retail investors, tech-savvy users | High-net-worth clients, ultra-high-net-worth clients |

| Account Minimums | Low to none | High, typically $250,000+ |

| Service Model | Self-service, digital platform | Dedicated relationship managers, tailored advice |

| Fees | Low or commission-free trading | Higher fees, management and advisory fees |

| Investment Offerings | Stocks, ETFs, cryptocurrencies, options | Wide range including bespoke investment products, estate planning, trusts |

| Technology | Advanced mobile apps, AI-based tools | Traditional channels complemented by digital tools |

| Advisory Services | Limited or optional robo-advisory | Comprehensive, personalized financial and estate planning |

| Accessibility | 24/7 online access | Business hours, appointment-based |

| Regulation | Regulated as brokerage firms under securities laws | Regulated under banking and fiduciary standards |

Which is better?

Neo brokerage offers low-cost, technology-driven trading platforms ideal for self-directed investors seeking real-time data and minimal fees. Private banking provides personalized wealth management services, bespoke investment strategies, and exclusive financial advisory for high-net-worth clients. The choice depends on investor goals: cost-efficiency and autonomy favor neo brokerage, while tailored service and wealth preservation align with private banking.

Connection

Neo brokerage platforms leverage advanced technology and digital interfaces to offer personalized investment services, closely aligning with the tailored wealth management strategies of private banking. Both sectors emphasize customer-centricity, using data analytics and AI to optimize portfolio management and enhance client experience. This convergence enables seamless integration of real-time trading capabilities with exclusive advisory services, driving innovation in banking.

Key Terms

Wealth Management

Private banking offers personalized wealth management with dedicated advisors, tailored investment portfolios, and exclusive financial products for high-net-worth individuals. Neo brokerages leverage digital platforms, lower fees, and automated tools to provide accessible investment opportunities and real-time portfolio management. Explore how these models redefine wealth management strategies to suit diverse client needs and objectives.

Digital Trading Platforms

Digital trading platforms in private banking offer personalized wealth management with tailored investment strategies and direct advisor interactions. Neo brokerages emphasize low-cost, user-friendly interfaces and real-time market access, attracting tech-savvy retail investors. Discover the unique advantages of each platform to optimize your trading experience.

Personalized Advisory

Private banking offers highly personalized advisory services tailored to high-net-worth individuals, leveraging deep client relationships and bespoke investment strategies. Neo-brokerages emphasize algorithm-driven insights and real-time data, providing scalable advisory options but often with less personalized human interaction. Explore how these distinct approaches cater to different investor needs and preferences.

Source and External Links

Private banking - Wikipedia - Private banking refers to a suite of personalized banking, investment, and financial services primarily for high-net-worth individuals (HNWIs), often requiring minimum assets of $500,000 to $1 million, with customers segmented by wealth tiers such as HNW, VHNWI, and UHNWI; it has evolved with technology and global trends and now sometimes operates under the broader term "wealth management."

Private Banking and Wealth Management | First National Bank - Private banking provides customized financial advice and products, including specialized checking, savings, mortgages, loans, and investment planning, delivered by personal bankers focused on supporting financial success and legacy planning for affluent clients.

Private Banking | Old National Bank - Old National Bank offers private banking services with dedicated bankers who provide high-touch, personalized banking and lending solutions, including preferred interest rates, fee waivers, exclusive perks, flexible lending options, and credit discounts at no cost to qualifying clients.

dowidth.com

dowidth.com