Open banking enables third-party developers to access banking data through secure APIs, fostering innovation and personalized financial services. Platform banking expands this concept by integrating multiple financial products and services into a unified digital ecosystem, enhancing customer experience and operational efficiency. Explore how these models transform banking strategies and customer engagement.

Why it is important

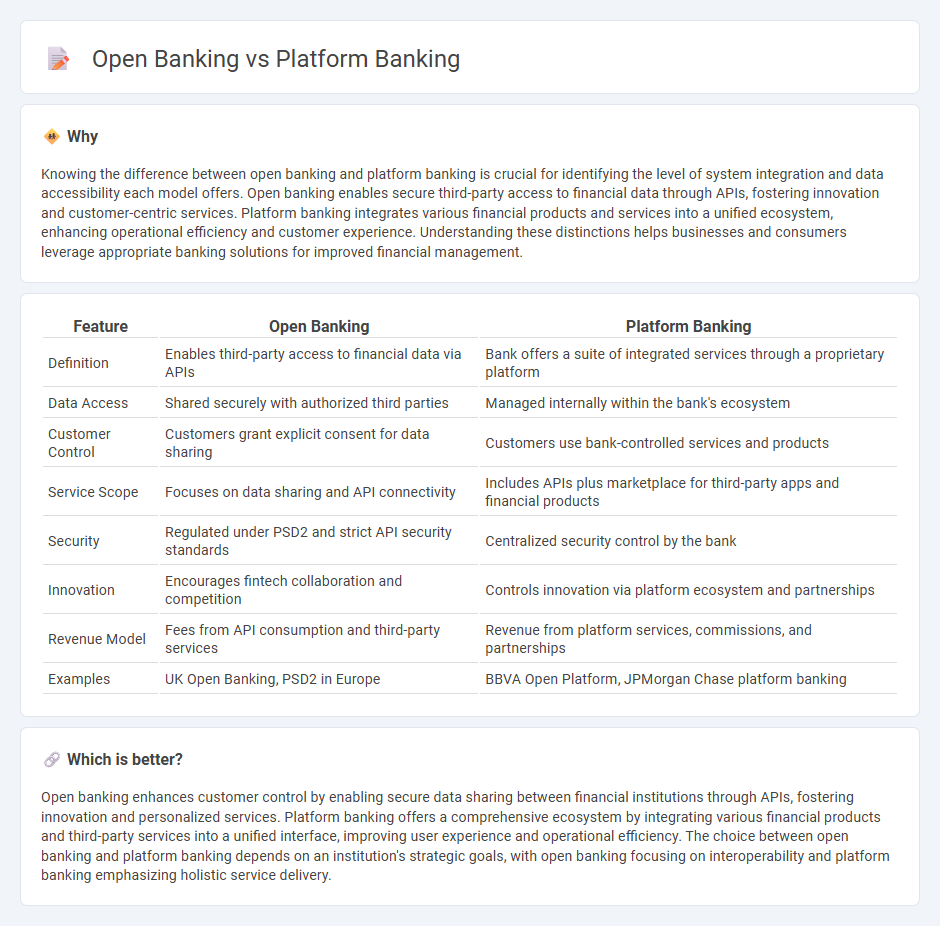

Knowing the difference between open banking and platform banking is crucial for identifying the level of system integration and data accessibility each model offers. Open banking enables secure third-party access to financial data through APIs, fostering innovation and customer-centric services. Platform banking integrates various financial products and services into a unified ecosystem, enhancing operational efficiency and customer experience. Understanding these distinctions helps businesses and consumers leverage appropriate banking solutions for improved financial management.

Comparison Table

| Feature | Open Banking | Platform Banking |

|---|---|---|

| Definition | Enables third-party access to financial data via APIs | Bank offers a suite of integrated services through a proprietary platform |

| Data Access | Shared securely with authorized third parties | Managed internally within the bank's ecosystem |

| Customer Control | Customers grant explicit consent for data sharing | Customers use bank-controlled services and products |

| Service Scope | Focuses on data sharing and API connectivity | Includes APIs plus marketplace for third-party apps and financial products |

| Security | Regulated under PSD2 and strict API security standards | Centralized security control by the bank |

| Innovation | Encourages fintech collaboration and competition | Controls innovation via platform ecosystem and partnerships |

| Revenue Model | Fees from API consumption and third-party services | Revenue from platform services, commissions, and partnerships |

| Examples | UK Open Banking, PSD2 in Europe | BBVA Open Platform, JPMorgan Chase platform banking |

Which is better?

Open banking enhances customer control by enabling secure data sharing between financial institutions through APIs, fostering innovation and personalized services. Platform banking offers a comprehensive ecosystem by integrating various financial products and third-party services into a unified interface, improving user experience and operational efficiency. The choice between open banking and platform banking depends on an institution's strategic goals, with open banking focusing on interoperability and platform banking emphasizing holistic service delivery.

Connection

Open banking facilitates secure data sharing between financial institutions and third-party providers through APIs, enabling innovative financial services. Platform banking builds on open banking by creating integrated ecosystems where banks offer diverse services and partner solutions within a single digital platform. This connection enhances customer experience by providing seamless access to a wide range of financial products and personalized services.

Key Terms

APIs

Platform banking leverages APIs to integrate various financial services, creating a unified ecosystem for seamless customer experiences and enhanced data sharing. Open banking emphasizes standardized APIs that enable third-party developers to access customer data securely, fostering innovation and competition. Explore further to understand how API-driven models transform the financial landscape and enhance service delivery.

Third-party Providers

Platform banking integrates third-party providers (TPPs) directly into a bank's ecosystem, enabling seamless access to services like lending, payments, and account management through a single interface. Open banking, driven by regulatory frameworks such as PSD2 in Europe, mandates banks to securely share customer data with authorized TPPs via APIs, promoting competition and innovation. Explore the evolving roles of third-party providers in shaping the future of financial services to understand their impact on platform and open banking.

Data Sharing

Platform banking integrates various financial services through APIs, enabling seamless data sharing among banks, fintechs, and third-party providers for enhanced customer experience. Open banking mandates regulated, secure data sharing protocols that give customers control over their financial data, promoting transparency and innovation. Discover how these approaches revolutionize financial ecosystems by exploring their unique data sharing capabilities.

Source and External Links

Platform banking...and how it enhances financial services - Platform banking is when banks integrate fintech services via APIs to expand and specialize their financial offerings for customers, moving beyond traditional, siloed banking models.

Platform Banking: Revolutionizing Financial Services in Digital Age - Platform banking transforms banks into digital marketplaces, enabling a unified and seamless customer experience by connecting various financial services and partners through open, API-driven ecosystems.

What Is a Banking Platform and Why Is It the Key to SME Growth in ... - A banking platform is a digital ecosystem that connects banks, fintechs, and customers, offering personalized, agile services and disrupting the traditional, product-siloed approach to banking.

dowidth.com

dowidth.com