Composable banking enables financial institutions to build customized banking solutions by integrating modular components through APIs, offering flexibility and scalability. Open banking focuses on securely sharing customer data with third-party providers to foster innovation and enhance service offerings within regulatory frameworks. Discover how these transformative banking models can redefine your financial services strategy.

Why it is important

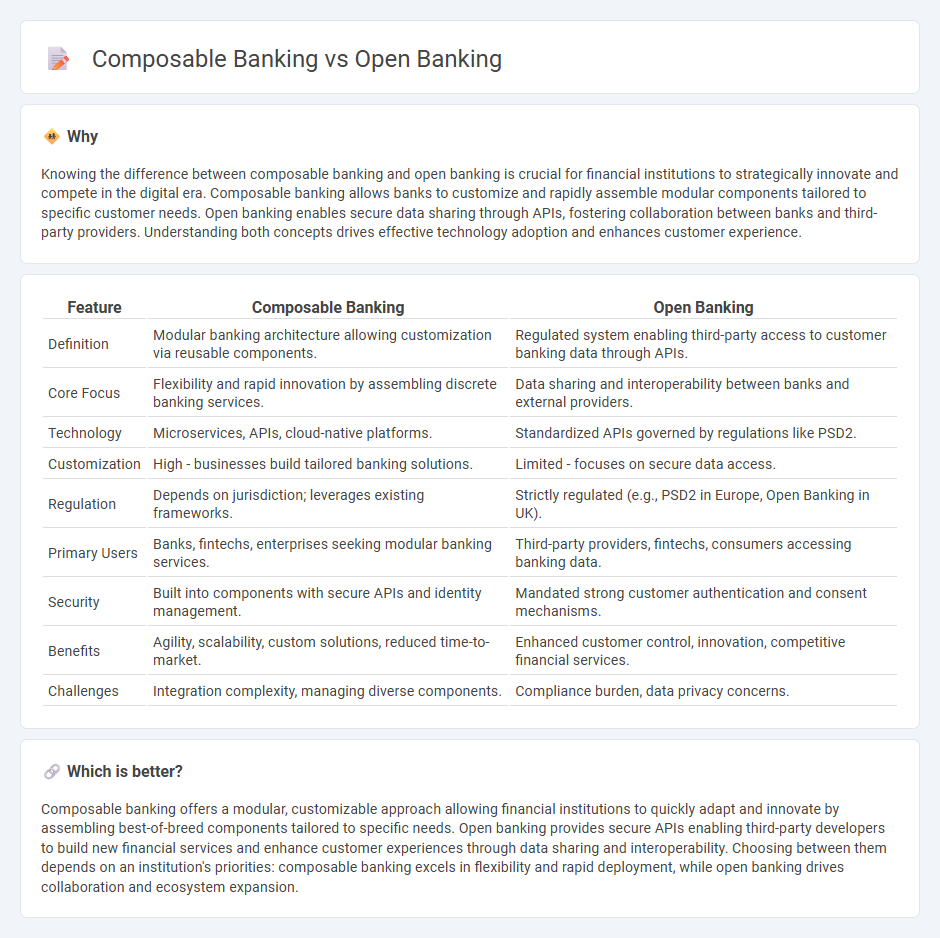

Knowing the difference between composable banking and open banking is crucial for financial institutions to strategically innovate and compete in the digital era. Composable banking allows banks to customize and rapidly assemble modular components tailored to specific customer needs. Open banking enables secure data sharing through APIs, fostering collaboration between banks and third-party providers. Understanding both concepts drives effective technology adoption and enhances customer experience.

Comparison Table

| Feature | Composable Banking | Open Banking |

|---|---|---|

| Definition | Modular banking architecture allowing customization via reusable components. | Regulated system enabling third-party access to customer banking data through APIs. |

| Core Focus | Flexibility and rapid innovation by assembling discrete banking services. | Data sharing and interoperability between banks and external providers. |

| Technology | Microservices, APIs, cloud-native platforms. | Standardized APIs governed by regulations like PSD2. |

| Customization | High - businesses build tailored banking solutions. | Limited - focuses on secure data access. |

| Regulation | Depends on jurisdiction; leverages existing frameworks. | Strictly regulated (e.g., PSD2 in Europe, Open Banking in UK). |

| Primary Users | Banks, fintechs, enterprises seeking modular banking services. | Third-party providers, fintechs, consumers accessing banking data. |

| Security | Built into components with secure APIs and identity management. | Mandated strong customer authentication and consent mechanisms. |

| Benefits | Agility, scalability, custom solutions, reduced time-to-market. | Enhanced customer control, innovation, competitive financial services. |

| Challenges | Integration complexity, managing diverse components. | Compliance burden, data privacy concerns. |

Which is better?

Composable banking offers a modular, customizable approach allowing financial institutions to quickly adapt and innovate by assembling best-of-breed components tailored to specific needs. Open banking provides secure APIs enabling third-party developers to build new financial services and enhance customer experiences through data sharing and interoperability. Choosing between them depends on an institution's priorities: composable banking excels in flexibility and rapid deployment, while open banking drives collaboration and ecosystem expansion.

Connection

Composable banking leverages modular financial services and APIs to enable banks to rapidly innovate and customize offerings. Open banking provides secure access to customer data and third-party services through standardized APIs, facilitating seamless integration within composable banking frameworks. Together, they empower financial institutions to create flexible, customer-centric solutions while enhancing interoperability and scalability across the banking ecosystem.

Key Terms

APIs

Open banking relies on standardized APIs to securely share customer financial data between banks and third-party providers, enabling innovative financial services. Composable banking leverages modular, API-driven components that allow financial institutions to customize and rapidly deploy tailored banking solutions. Explore how APIs transform banking architectures by learning more about the strategic differences between open and composable banking.

Modularity

Open banking enables secure data sharing through APIs, facilitating third-party integration, while composable banking emphasizes full modularity by allowing financial institutions to assemble customizable components tailored to specific needs. This modular architecture enhances agility, accelerates innovation, and improves customer experiences by enabling seamless interoperability and flexible service deployment. Discover how modularity transforms banking by exploring detailed comparisons and practical use cases.

Data Sharing

Open banking enables secure data sharing among authorized third-party providers via standardized APIs, enhancing consumer control over financial information. Composable banking leverages modular components to integrate diverse data sources flexibly, promoting tailored financial ecosystems beyond traditional open banking frameworks. Explore how these innovations reshape data sharing in modern finance.

Source and External Links

Open banking (Wikipedia) - Open banking allows customers to share their financial information securely and electronically with other banks or authorized financial organizations.

What is open banking? (Plaid) - Open banking is a system that lets consumers securely share their banking, transaction, and financial data with third-party providers via standardized APIs, enabling real-time data exchange and fostering innovation in financial services.

Open banking explained (Stripe) - Open banking is a financial services model where third-party providers can access consumer data from traditional banking systems, offering businesses opportunities for improved operations, personalized services, and streamlined payments.

dowidth.com

dowidth.com