Negative interest rates occur when central banks set borrowing costs below zero, encouraging spending and investment by penalizing banks for holding excess reserves. The policy rate, typically the benchmark interest rate set by central banks, influences inflation and economic growth by guiding lending and borrowing costs in the broader economy. Explore the impact of negative interest rates versus traditional policy rates on financial markets and economic stability.

Why it is important

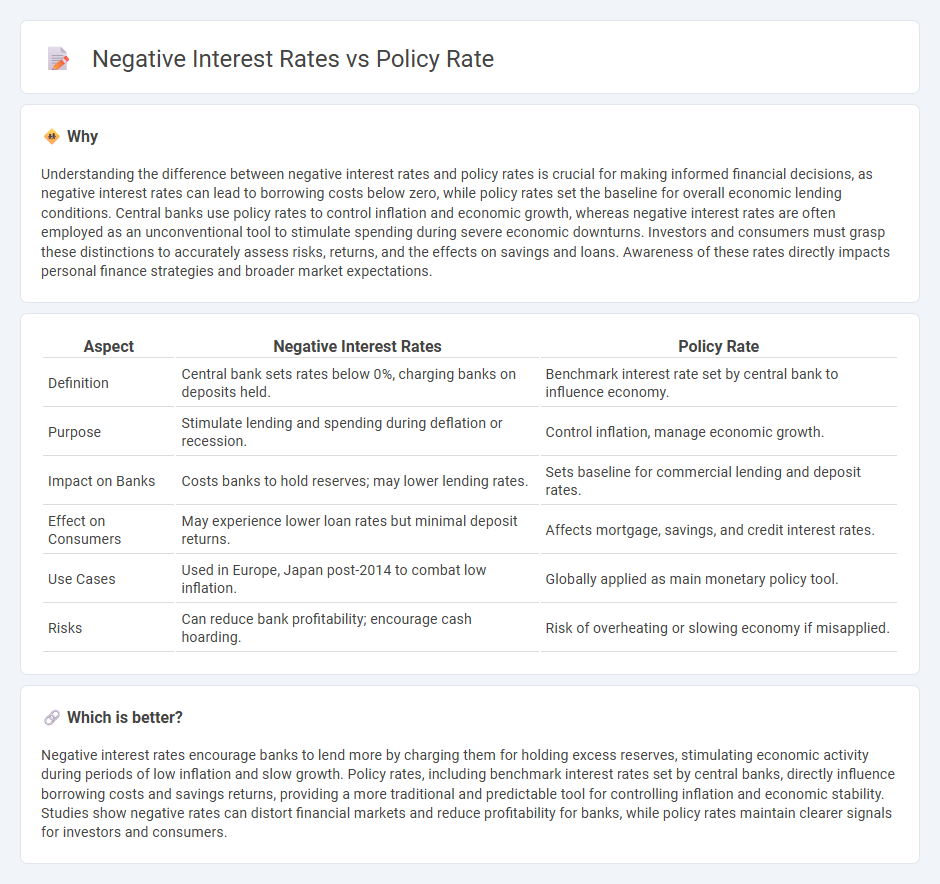

Understanding the difference between negative interest rates and policy rates is crucial for making informed financial decisions, as negative interest rates can lead to borrowing costs below zero, while policy rates set the baseline for overall economic lending conditions. Central banks use policy rates to control inflation and economic growth, whereas negative interest rates are often employed as an unconventional tool to stimulate spending during severe economic downturns. Investors and consumers must grasp these distinctions to accurately assess risks, returns, and the effects on savings and loans. Awareness of these rates directly impacts personal finance strategies and broader market expectations.

Comparison Table

| Aspect | Negative Interest Rates | Policy Rate |

|---|---|---|

| Definition | Central bank sets rates below 0%, charging banks on deposits held. | Benchmark interest rate set by central bank to influence economy. |

| Purpose | Stimulate lending and spending during deflation or recession. | Control inflation, manage economic growth. |

| Impact on Banks | Costs banks to hold reserves; may lower lending rates. | Sets baseline for commercial lending and deposit rates. |

| Effect on Consumers | May experience lower loan rates but minimal deposit returns. | Affects mortgage, savings, and credit interest rates. |

| Use Cases | Used in Europe, Japan post-2014 to combat low inflation. | Globally applied as main monetary policy tool. |

| Risks | Can reduce bank profitability; encourage cash hoarding. | Risk of overheating or slowing economy if misapplied. |

Which is better?

Negative interest rates encourage banks to lend more by charging them for holding excess reserves, stimulating economic activity during periods of low inflation and slow growth. Policy rates, including benchmark interest rates set by central banks, directly influence borrowing costs and savings returns, providing a more traditional and predictable tool for controlling inflation and economic stability. Studies show negative rates can distort financial markets and reduce profitability for banks, while policy rates maintain clearer signals for investors and consumers.

Connection

Negative interest rates occur when central banks set policy rates below zero to stimulate economic activity by encouraging lending and spending. This unconventional monetary policy aims to counter deflationary pressures and boost inflation by making borrowing cheaper and holding cash less attractive. The policy rate directly influences commercial banks' lending rates, thereby impacting overall financial conditions and economic growth.

Key Terms

Monetary Policy

Monetary policy uses policy rates as a primary tool to control inflation and influence economic growth, with central banks adjusting positive rates to manage borrowing costs and liquidity. Negative interest rates represent an unconventional monetary policy where central banks set nominal rates below zero to encourage spending and investment during economic downturns. Explore how these contrasting mechanisms impact financial markets and economic stability in greater detail.

Central Bank

Central banks set policy rates to influence economic activity, usually keeping them above zero to encourage lending and control inflation. Negative interest rates occur when policy rates drop below zero, incentivizing banks to lend money rather than hold excess reserves, often during severe economic downturns. Explore how central banks use these tools to stabilize markets and stimulate growth.

Interest Rate Transmission

Interest rate transmission mechanisms differ significantly between positive policy rates and negative interest rates, as central banks aim to influence lending behaviors and economic activity. Negative interest rates encourage banks to lend more by reducing the cost of holding reserves, whereas positive policy rates typically constrain borrowing and spending to control inflation. Explore the intricate effects these interest rate strategies have on monetary policy and financial markets.

Source and External Links

Economy at a Glance - Policy Rate - This webpage provides an overview of the federal funds rate, explaining its role in the economy and how the Federal Reserve influences it through monetary policy.

United States Fed Funds Interest Rate - This page displays the current federal funds rate in the United States, along with historical data and recent news related to interest rate decisions.

Policy Interest Rates - This webpage discusses the impact of policy interest rates on economies, including their effects on borrowing costs, inflation, and employment, and offers insights into their role in shaping economic conditions.

dowidth.com

dowidth.com