Account aggregation consolidates financial data from multiple bank accounts and institutions into a single platform, providing users with a comprehensive overview of their finances. Transaction categorization organizes each transaction into specific groups such as groceries, utilities, or entertainment, enabling detailed spending analysis and budgeting. Explore the benefits and differences between account aggregation and transaction categorization to optimize your financial management.

Why it is important

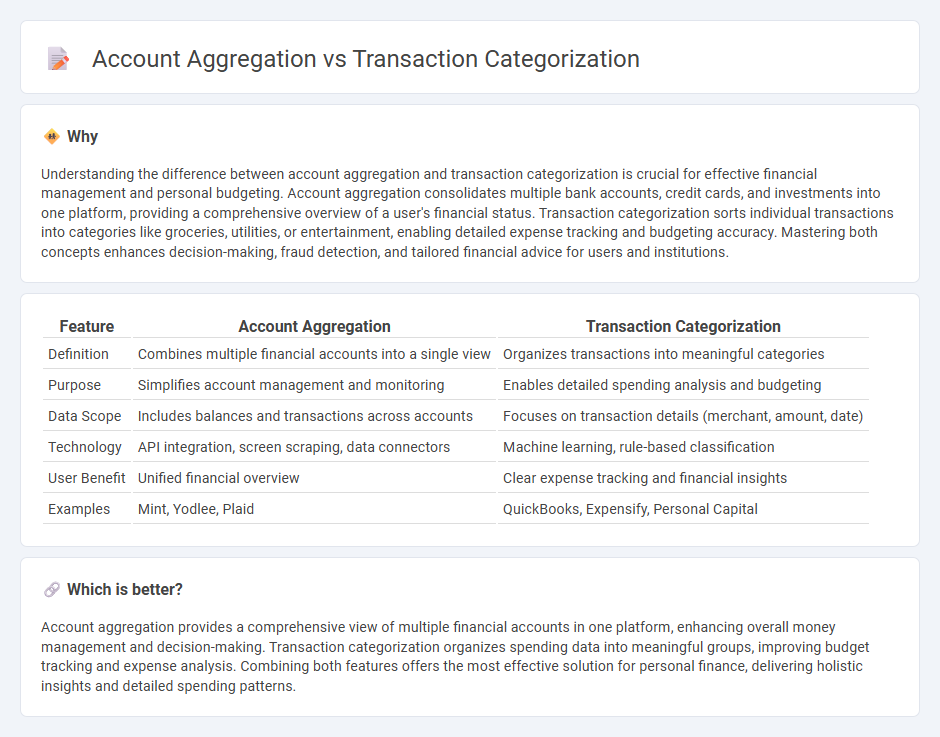

Understanding the difference between account aggregation and transaction categorization is crucial for effective financial management and personal budgeting. Account aggregation consolidates multiple bank accounts, credit cards, and investments into one platform, providing a comprehensive overview of a user's financial status. Transaction categorization sorts individual transactions into categories like groceries, utilities, or entertainment, enabling detailed expense tracking and budgeting accuracy. Mastering both concepts enhances decision-making, fraud detection, and tailored financial advice for users and institutions.

Comparison Table

| Feature | Account Aggregation | Transaction Categorization |

|---|---|---|

| Definition | Combines multiple financial accounts into a single view | Organizes transactions into meaningful categories |

| Purpose | Simplifies account management and monitoring | Enables detailed spending analysis and budgeting |

| Data Scope | Includes balances and transactions across accounts | Focuses on transaction details (merchant, amount, date) |

| Technology | API integration, screen scraping, data connectors | Machine learning, rule-based classification |

| User Benefit | Unified financial overview | Clear expense tracking and financial insights |

| Examples | Mint, Yodlee, Plaid | QuickBooks, Expensify, Personal Capital |

Which is better?

Account aggregation provides a comprehensive view of multiple financial accounts in one platform, enhancing overall money management and decision-making. Transaction categorization organizes spending data into meaningful groups, improving budget tracking and expense analysis. Combining both features offers the most effective solution for personal finance, delivering holistic insights and detailed spending patterns.

Connection

Account aggregation consolidates financial data from multiple accounts into a single platform, enabling comprehensive transaction tracking. Transaction categorization organizes these aggregated transactions into meaningful groups such as expenses, income, or investments, enhancing financial analysis and budgeting. The seamless integration of both processes improves user experience by providing clear insights and simplifying money management across various banking services.

Key Terms

**Transaction Categorization:**

Transaction categorization involves organizing bank and credit card transactions into meaningful categories such as groceries, utilities, or entertainment, enabling users to gain clearer insights into their spending habits. Accurate categorization leverages advanced algorithms and AI to analyze transaction data, improving budget management and financial decision-making. Explore how transaction categorization enhances personal finance tools and business analytics for comprehensive money management.

Merchant Identification

Merchant identification in transaction categorization involves accurately labeling each purchase based on the merchant's name and category, enhancing expense analysis and budget management. Account aggregation, however, consolidates financial data from multiple accounts into a unified view, improving overall financial insights but not refining merchant-specific details. Explore deeper to understand how merchant identification can optimize transaction categorization in your financial tools.

Expense Classification

Expense classification involves categorizing individual transactions into predefined groups such as groceries, utilities, or entertainment to provide detailed spending insights. Account aggregation consolidates financial data from multiple bank accounts and credit cards into a single platform, enabling a comprehensive view of one's financial status. Explore how integrating transaction categorization with account aggregation enhances personal finance management.

Source and External Links

What is Transaction Categorization, and How Does it Work? - FOCAL - Transaction categorization is the process of organizing financial transactions into categories like assets, liabilities, income, and expenses, often using automation and machine learning to improve accuracy and analysis.

Why Automatic Transaction Categorization Is Vital for Your Treasury Management - Automated transaction categorization systematically classifies financial transactions into predefined categories based on rules and metadata, enabling treasury teams to gain meaningful insights efficiently.

What is transaction categorization? - Stripe - Transaction categorization classifies financial activities into detailed categories to improve financial reporting and decision-making, with examples spanning personal and business finance such as housing, utilities, revenue, and operating expenses.

dowidth.com

dowidth.com