RegTech leverages advanced technologies like AI and blockchain to enhance regulatory compliance, risk management, and fraud detection in the banking sector. TradeTech focuses on optimizing trade finance processes, including digital documentation, supply chain transparency, and transaction efficiency through automation. Explore how these innovations are transforming banking operations and driving industry growth.

Why it is important

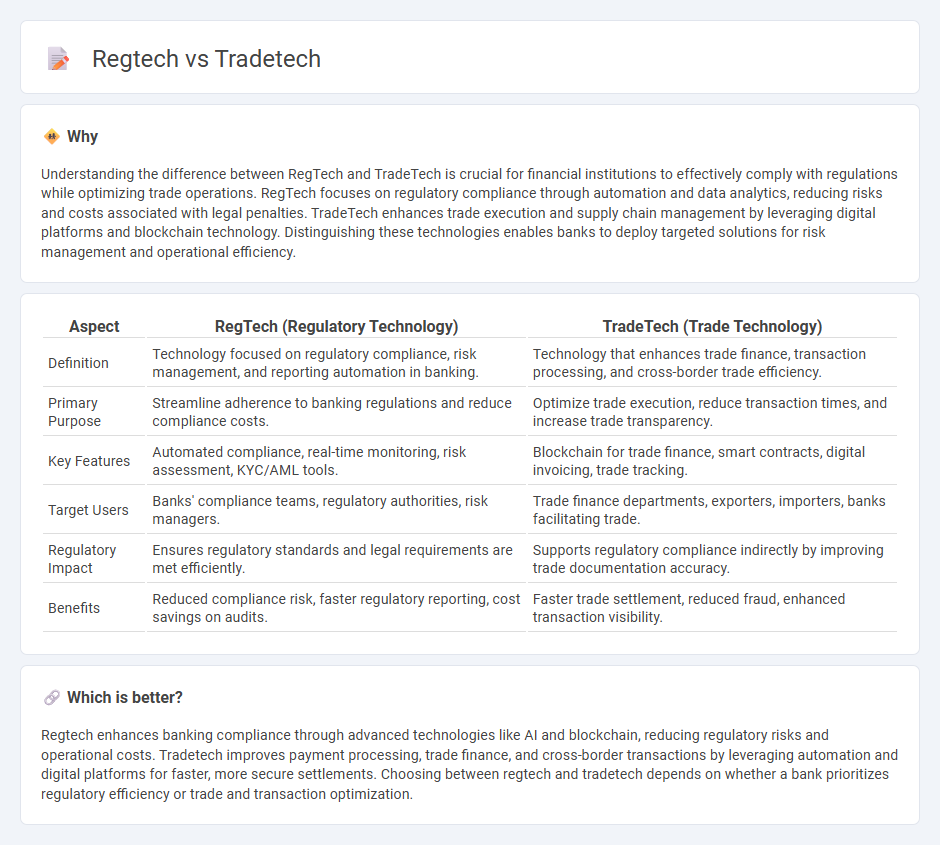

Understanding the difference between RegTech and TradeTech is crucial for financial institutions to effectively comply with regulations while optimizing trade operations. RegTech focuses on regulatory compliance through automation and data analytics, reducing risks and costs associated with legal penalties. TradeTech enhances trade execution and supply chain management by leveraging digital platforms and blockchain technology. Distinguishing these technologies enables banks to deploy targeted solutions for risk management and operational efficiency.

Comparison Table

| Aspect | RegTech (Regulatory Technology) | TradeTech (Trade Technology) |

|---|---|---|

| Definition | Technology focused on regulatory compliance, risk management, and reporting automation in banking. | Technology that enhances trade finance, transaction processing, and cross-border trade efficiency. |

| Primary Purpose | Streamline adherence to banking regulations and reduce compliance costs. | Optimize trade execution, reduce transaction times, and increase trade transparency. |

| Key Features | Automated compliance, real-time monitoring, risk assessment, KYC/AML tools. | Blockchain for trade finance, smart contracts, digital invoicing, trade tracking. |

| Target Users | Banks' compliance teams, regulatory authorities, risk managers. | Trade finance departments, exporters, importers, banks facilitating trade. |

| Regulatory Impact | Ensures regulatory standards and legal requirements are met efficiently. | Supports regulatory compliance indirectly by improving trade documentation accuracy. |

| Benefits | Reduced compliance risk, faster regulatory reporting, cost savings on audits. | Faster trade settlement, reduced fraud, enhanced transaction visibility. |

Which is better?

Regtech enhances banking compliance through advanced technologies like AI and blockchain, reducing regulatory risks and operational costs. Tradetech improves payment processing, trade finance, and cross-border transactions by leveraging automation and digital platforms for faster, more secure settlements. Choosing between regtech and tradetech depends on whether a bank prioritizes regulatory efficiency or trade and transaction optimization.

Connection

Regtech enhances compliance processes by automating regulatory reporting and risk management, which is crucial for tradetech platforms handling complex cross-border transactions. Tradetech leverages these regtech solutions to ensure secure, transparent, and efficient trade finance operations while adhering to evolving legal standards. This integration reduces fraud risk and accelerates digital trade ecosystem adoption within global banking networks.

Key Terms

Automation

Tradetech leverages automation to streamline complex international trade processes such as documentation, compliance checks, and supply chain management, significantly reducing manual errors and processing time. Regtech automates regulatory compliance tasks by utilizing AI and machine learning to monitor transactions, detect risks, and ensure adherence to financial regulations efficiently. Explore the distinct advancements in automation within tradetech and regtech to understand their impact on global trade and regulatory landscapes.

Compliance

TradeTech streamlines trading operations through automation, data analytics, and regulatory integration, enhancing transaction efficiency and market transparency. RegTech focuses on compliance management by leveraging AI, machine learning, and real-time monitoring to reduce regulatory risks and ensure adherence to evolving financial regulations. Explore how these technologies transform compliance frameworks for improved regulatory outcomes.

Transaction Processing

TradeTech enhances transaction processing by automating trade execution, settlement, and clearing across financial markets, reducing errors and increasing efficiency. RegTech focuses on compliance in transaction processing, employing advanced analytics and real-time monitoring to detect and prevent fraudulent activities and regulatory breaches. Explore how integrating TradeTech and RegTech can optimize transaction processing while ensuring regulatory compliance.

Source and External Links

TradeTech: Catalysing Innovation - The World Economic Forum - TradeTech refers to innovative technologies like robotics, AI, machine learning, and automation that are transforming global trade by improving logistics, finance, carbon reduction, and compliance, with a focus on collaboration and overcoming ecosystem challenges.

Trade Tech: Logistics Management and Supply Chain Management - TradeTech offers advanced solutions to optimize logistics and supply chain management, boosting efficiency and competitiveness for businesses.

TradeTech Solutions - TradeTech Solutions provides a universal platform that connects the supply chain at all levels, offering real-time order tracking and management tools designed to simplify business operations and enhance sales and inventory control.

dowidth.com

dowidth.com