Instant payments enable real-time fund transfers, providing immediate availability and streamlined transactions for consumers and businesses. In contrast, SWIFT transfers, while globally accepted and secure, typically involve longer processing times and higher fees for cross-border payments. Explore the differences between instant payments and SWIFT transfers to determine the best solution for your banking needs.

Why it is important

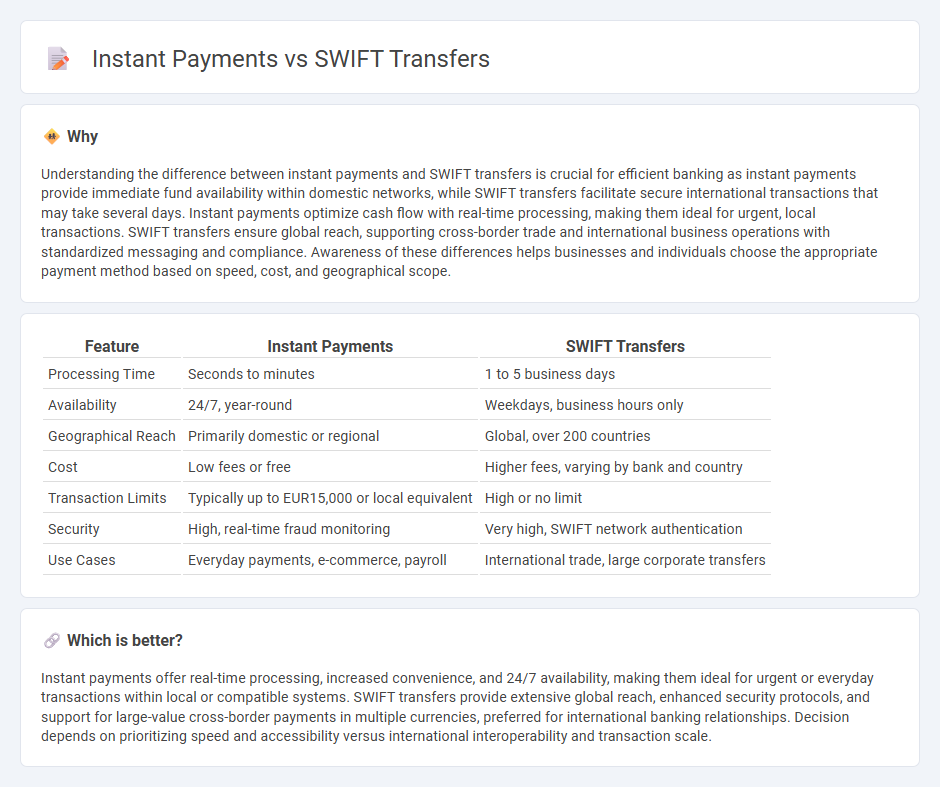

Understanding the difference between instant payments and SWIFT transfers is crucial for efficient banking as instant payments provide immediate fund availability within domestic networks, while SWIFT transfers facilitate secure international transactions that may take several days. Instant payments optimize cash flow with real-time processing, making them ideal for urgent, local transactions. SWIFT transfers ensure global reach, supporting cross-border trade and international business operations with standardized messaging and compliance. Awareness of these differences helps businesses and individuals choose the appropriate payment method based on speed, cost, and geographical scope.

Comparison Table

| Feature | Instant Payments | SWIFT Transfers |

|---|---|---|

| Processing Time | Seconds to minutes | 1 to 5 business days |

| Availability | 24/7, year-round | Weekdays, business hours only |

| Geographical Reach | Primarily domestic or regional | Global, over 200 countries |

| Cost | Low fees or free | Higher fees, varying by bank and country |

| Transaction Limits | Typically up to EUR15,000 or local equivalent | High or no limit |

| Security | High, real-time fraud monitoring | Very high, SWIFT network authentication |

| Use Cases | Everyday payments, e-commerce, payroll | International trade, large corporate transfers |

Which is better?

Instant payments offer real-time processing, increased convenience, and 24/7 availability, making them ideal for urgent or everyday transactions within local or compatible systems. SWIFT transfers provide extensive global reach, enhanced security protocols, and support for large-value cross-border payments in multiple currencies, preferred for international banking relationships. Decision depends on prioritizing speed and accessibility versus international interoperability and transaction scale.

Connection

Instant payments and SWIFT transfers are connected through their role in facilitating cross-border and domestic fund movements efficiently. SWIFT transfers, governed by the Society for Worldwide Interbank Financial Telecommunication, provide secure messaging for international bank payments, while instant payments enable near real-time settlement of transactions. Integration of SWIFT's global network with instant payment systems enhances liquidity management and accelerates global financial flows.

Key Terms

Source and External Links

What is SWIFT Payment? How It Works and How Long It Takes - SWIFT payments are electronic international transfers that send payment instructions from the payer's bank to the recipient's bank; the process requires recipient bank details, payment amount, purpose, and personal ID, and typically takes from several hours up to a few days depending on various factors.

SWIFT transfers and Payment System - CurrencyTransfer - SWIFT transfers require identity verification, involve sending money to your bank for conversion at a locked-in exchange rate, and usually take one to four working days for the funds to reach the recipient's bank.

SWIFT payments: A comprehensive guide - Payoneer - SWIFT payments enable international electronic money transfers through intermediary banks using standardized communication, are useful for large or regular payments, but often involve multiple fees and can take several days to complete.

dowidth.com

dowidth.com