Stablecoin rails enable instant, low-cost cross-border payments by leveraging blockchain technology, offering enhanced transparency and security. Open Banking APIs facilitate seamless data sharing between financial institutions, promoting innovation and personalized banking services through standardized interfaces. Explore how these emerging technologies are reshaping the future of finance.

Why it is important

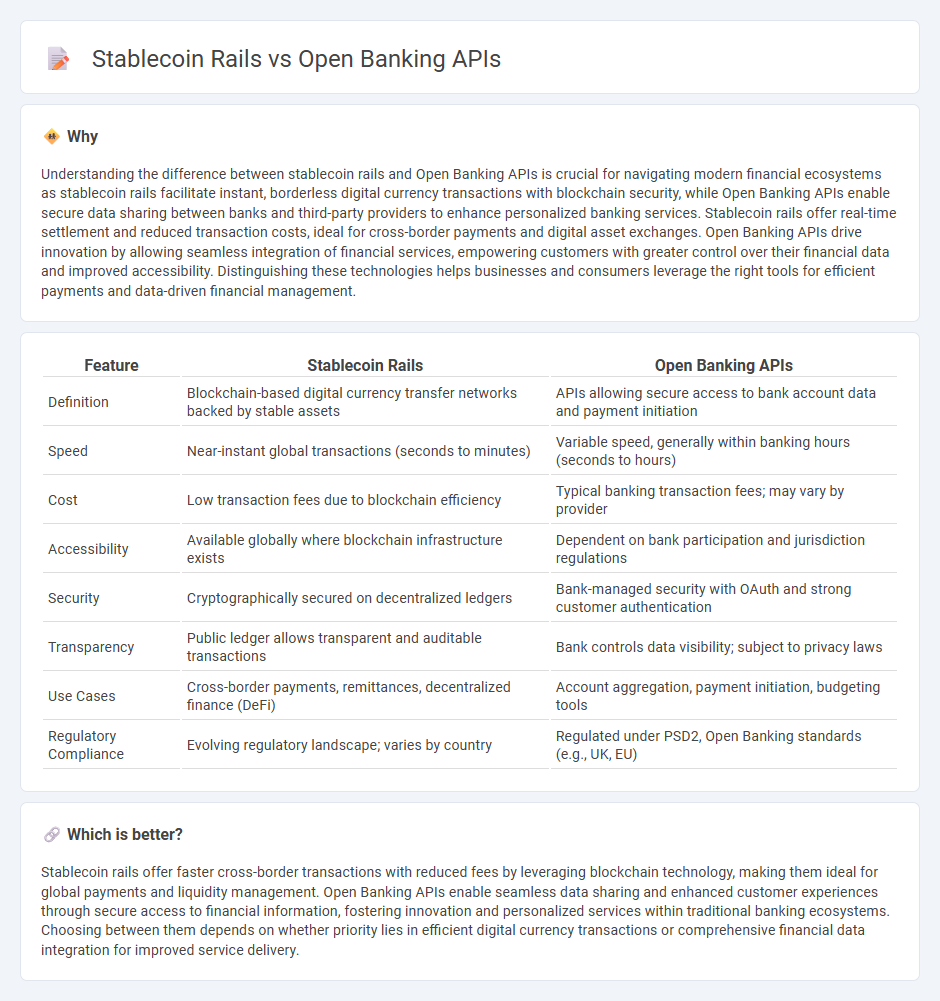

Understanding the difference between stablecoin rails and Open Banking APIs is crucial for navigating modern financial ecosystems as stablecoin rails facilitate instant, borderless digital currency transactions with blockchain security, while Open Banking APIs enable secure data sharing between banks and third-party providers to enhance personalized banking services. Stablecoin rails offer real-time settlement and reduced transaction costs, ideal for cross-border payments and digital asset exchanges. Open Banking APIs drive innovation by allowing seamless integration of financial services, empowering customers with greater control over their financial data and improved accessibility. Distinguishing these technologies helps businesses and consumers leverage the right tools for efficient payments and data-driven financial management.

Comparison Table

| Feature | Stablecoin Rails | Open Banking APIs |

|---|---|---|

| Definition | Blockchain-based digital currency transfer networks backed by stable assets | APIs allowing secure access to bank account data and payment initiation |

| Speed | Near-instant global transactions (seconds to minutes) | Variable speed, generally within banking hours (seconds to hours) |

| Cost | Low transaction fees due to blockchain efficiency | Typical banking transaction fees; may vary by provider |

| Accessibility | Available globally where blockchain infrastructure exists | Dependent on bank participation and jurisdiction regulations |

| Security | Cryptographically secured on decentralized ledgers | Bank-managed security with OAuth and strong customer authentication |

| Transparency | Public ledger allows transparent and auditable transactions | Bank controls data visibility; subject to privacy laws |

| Use Cases | Cross-border payments, remittances, decentralized finance (DeFi) | Account aggregation, payment initiation, budgeting tools |

| Regulatory Compliance | Evolving regulatory landscape; varies by country | Regulated under PSD2, Open Banking standards (e.g., UK, EU) |

Which is better?

Stablecoin rails offer faster cross-border transactions with reduced fees by leveraging blockchain technology, making them ideal for global payments and liquidity management. Open Banking APIs enable seamless data sharing and enhanced customer experiences through secure access to financial information, fostering innovation and personalized services within traditional banking ecosystems. Choosing between them depends on whether priority lies in efficient digital currency transactions or comprehensive financial data integration for improved service delivery.

Connection

Stablecoin rails leverage blockchain technology to enable fast, low-cost cross-border payments, enhancing liquidity and transparency within financial systems. Open Banking APIs facilitate seamless integration between banks and third-party providers, allowing real-time access to account data and payment initiation. Together, they create a connected ecosystem where stablecoins can be easily managed, transferred, and utilized through interoperable banking platforms, driving innovation in digital finance.

Key Terms

Data Access

Open Banking APIs enable secure, standardized access to consumer financial data, fostering innovation in payment services and personalized financial management. Stablecoin rails provide a decentralized infrastructure for instant, low-cost digital asset transfers, emphasizing transaction speed and cross-border capabilities. Discover how these technologies transform financial ecosystems by exploring their data access mechanisms in depth.

Programmable Money

Open Banking APIs enable seamless access to financial data and services, fostering innovation in payment initiation and account aggregation. Stablecoin rails provide programmable money with rapid settlement, enhanced security, and reduced reliance on traditional banking infrastructure. Explore how these technologies transform digital finance and programmable money frameworks.

Interoperability

Open Banking APIs enable seamless integration of financial services by allowing third-party developers secure access to banking data and payment functionalities, fostering an open ecosystem for innovation. Stablecoin rails provide a blockchain-based infrastructure that facilitates instant, cross-border transactions with reduced fees and enhanced transparency, promoting efficient interoperability between traditional finance and digital assets. Explore how these technologies are transforming payment interoperability and financial ecosystems worldwide.

Source and External Links

What is an open banking API? How apps and accounts connect - Plaid - Open banking APIs enable third-party apps to securely access consumer-permissioned bank data via dedicated endpoints, allowing functionalities such as balance checks and transaction history through data aggregators acting as API bridges between fintech apps and banks.

Open banking APIs explained | Stripe - Open banking APIs create standardized, secure channels for banks and third-party providers to exchange data, enabling developers to build products like personal finance tools, payment initiation services, credit scoring, fraud detection, and more.

What Is an API in open banking? - GoCardless - Open banking APIs act as secure middlemen linking financial institutions and fintech services, allowing consumer-authorized data sharing to power applications such as budgeting and instant payments.

dowidth.com

dowidth.com