Alternative credit data, including rental payment history, offers lenders a broader view of a borrower's creditworthiness beyond traditional credit scores. Rental payment records provide consistent, timely repayment evidence, filling gaps for individuals with limited credit profiles. Explore how integrating these data sources enhances lending decisions and financial inclusion.

Why it is important

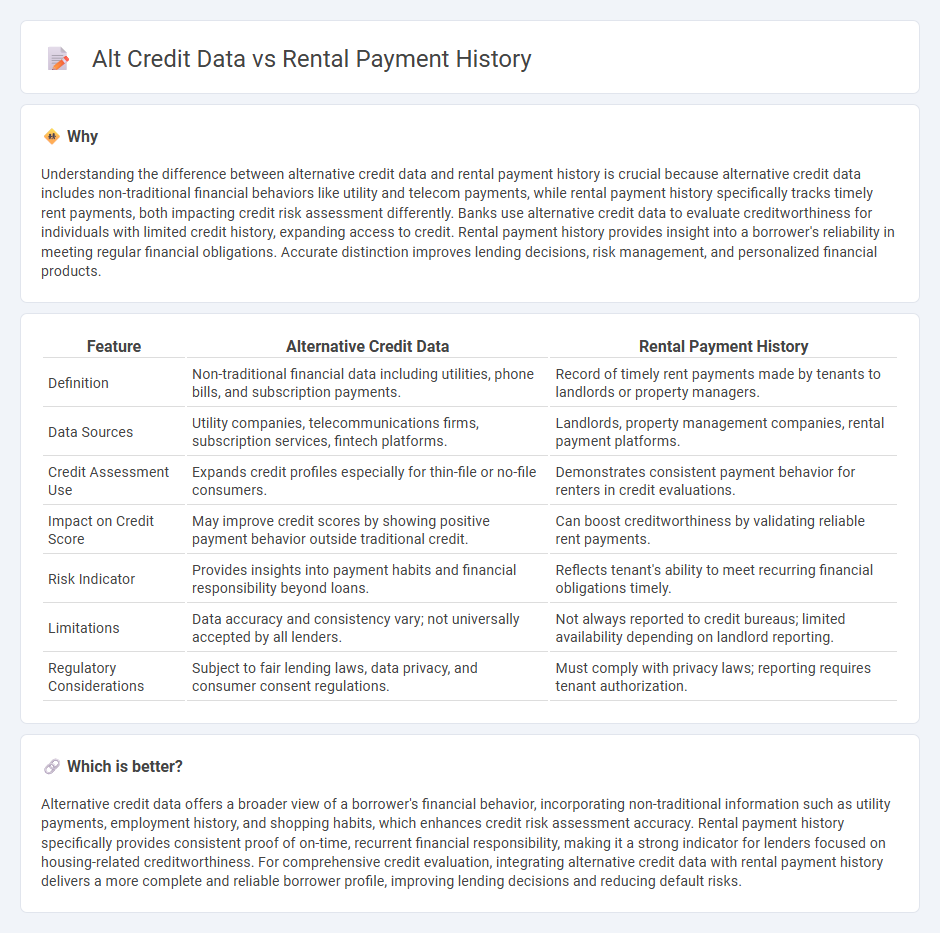

Understanding the difference between alternative credit data and rental payment history is crucial because alternative credit data includes non-traditional financial behaviors like utility and telecom payments, while rental payment history specifically tracks timely rent payments, both impacting credit risk assessment differently. Banks use alternative credit data to evaluate creditworthiness for individuals with limited credit history, expanding access to credit. Rental payment history provides insight into a borrower's reliability in meeting regular financial obligations. Accurate distinction improves lending decisions, risk management, and personalized financial products.

Comparison Table

| Feature | Alternative Credit Data | Rental Payment History |

|---|---|---|

| Definition | Non-traditional financial data including utilities, phone bills, and subscription payments. | Record of timely rent payments made by tenants to landlords or property managers. |

| Data Sources | Utility companies, telecommunications firms, subscription services, fintech platforms. | Landlords, property management companies, rental payment platforms. |

| Credit Assessment Use | Expands credit profiles especially for thin-file or no-file consumers. | Demonstrates consistent payment behavior for renters in credit evaluations. |

| Impact on Credit Score | May improve credit scores by showing positive payment behavior outside traditional credit. | Can boost creditworthiness by validating reliable rent payments. |

| Risk Indicator | Provides insights into payment habits and financial responsibility beyond loans. | Reflects tenant's ability to meet recurring financial obligations timely. |

| Limitations | Data accuracy and consistency vary; not universally accepted by all lenders. | Not always reported to credit bureaus; limited availability depending on landlord reporting. |

| Regulatory Considerations | Subject to fair lending laws, data privacy, and consumer consent regulations. | Must comply with privacy laws; reporting requires tenant authorization. |

Which is better?

Alternative credit data offers a broader view of a borrower's financial behavior, incorporating non-traditional information such as utility payments, employment history, and shopping habits, which enhances credit risk assessment accuracy. Rental payment history specifically provides consistent proof of on-time, recurrent financial responsibility, making it a strong indicator for lenders focused on housing-related creditworthiness. For comprehensive credit evaluation, integrating alternative credit data with rental payment history delivers a more complete and reliable borrower profile, improving lending decisions and reducing default risks.

Connection

Alternative credit data, including rental payment history, enhances traditional banking credit assessments by providing a more comprehensive view of an individual's financial reliability. Rental payment history offers concrete evidence of consistent, timely payments, which can help banks evaluate creditworthiness for customers lacking conventional credit records. Integrating this data improves risk management and supports more inclusive lending practices by enabling banks to extend credit to underserved populations.

Key Terms

Rental Payment Reporting

Rental payment history provides a traditional record of on-time rent payments, which lenders use to assess creditworthiness, while alternative credit data encompasses non-traditional sources like utility bills, phone payments, and rental payment reporting. Rental payment reporting specifically enhances credit profiles by including verified rent payment information in credit reports, benefiting individuals with limited credit history. Discover how rental payment reporting can improve credit scores and increase access to financial opportunities.

Alternative Credit Scoring

Rental payment history offers a reliable indicator of financial responsibility by demonstrating consistent, on-time payments that traditional credit scores may overlook. Alternative credit scoring models increasingly integrate rental data alongside utilities and subscription payments to provide a more comprehensive credit profile for consumers with limited credit history. Explore how leveraging rental payment history can improve credit access and financial inclusion through alternative credit scoring methods.

Credit Bureau Integration

Rental payment history offers a reliable indicator of financial responsibility by reflecting timely monthly payments, which can be integrated into credit bureau reports to enhance traditional credit scoring models. Alternative credit data, such as utility bills, phone payments, and other recurring expenses, when combined with rental history, provide a more comprehensive view of a consumer's creditworthiness, especially for those with limited credit profiles. Explore how credit bureaus are leveraging rental and alt credit data integration to improve credit access and risk assessment for a broader population.

Source and External Links

Rent Payment History Assessment included in Loan Product Advisor - Rent payment history can positively impact credit risk assessment when verified through a third-party service and shared with Loan Product Advisor during mortgage loan evaluation.

How to Check and Obtain Your Rental History Report - RentSpree - You can obtain your rental history report for free annually under the Fair Credit Reporting Act, which includes rent payment records, evictions, lease details, and landlord feedback to help tenants proactively manage their rental reputation.

How to Check Your Rental History Report Like a Landlord - Rental history reports detail past tenant behavior such as timely payments and evictions, compiled by tenant screening companies or landlords to assess rental applications.

dowidth.com

dowidth.com