Personal financial management tools focus on budgeting, expense tracking, and savings goals tailored for individual users, while business financial management tools offer features such as invoicing, payroll, cash flow analysis, and tax preparation designed for small to large enterprises. These tools integrate with banking systems to provide real-time financial insights, ensuring accurate decision-making for personal or corporate finances. Explore how selecting the right financial management tool can optimize your financial health by learning more about their distinct functionalities.

Why it is important

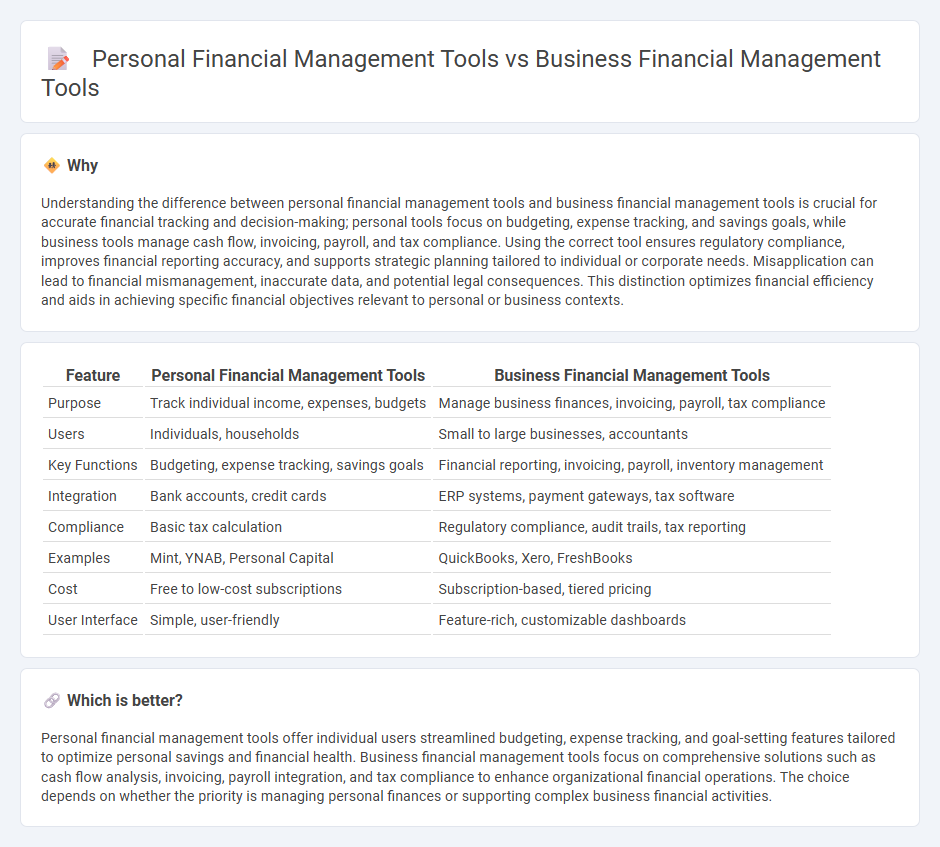

Understanding the difference between personal financial management tools and business financial management tools is crucial for accurate financial tracking and decision-making; personal tools focus on budgeting, expense tracking, and savings goals, while business tools manage cash flow, invoicing, payroll, and tax compliance. Using the correct tool ensures regulatory compliance, improves financial reporting accuracy, and supports strategic planning tailored to individual or corporate needs. Misapplication can lead to financial mismanagement, inaccurate data, and potential legal consequences. This distinction optimizes financial efficiency and aids in achieving specific financial objectives relevant to personal or business contexts.

Comparison Table

| Feature | Personal Financial Management Tools | Business Financial Management Tools |

|---|---|---|

| Purpose | Track individual income, expenses, budgets | Manage business finances, invoicing, payroll, tax compliance |

| Users | Individuals, households | Small to large businesses, accountants |

| Key Functions | Budgeting, expense tracking, savings goals | Financial reporting, invoicing, payroll, inventory management |

| Integration | Bank accounts, credit cards | ERP systems, payment gateways, tax software |

| Compliance | Basic tax calculation | Regulatory compliance, audit trails, tax reporting |

| Examples | Mint, YNAB, Personal Capital | QuickBooks, Xero, FreshBooks |

| Cost | Free to low-cost subscriptions | Subscription-based, tiered pricing |

| User Interface | Simple, user-friendly | Feature-rich, customizable dashboards |

Which is better?

Personal financial management tools offer individual users streamlined budgeting, expense tracking, and goal-setting features tailored to optimize personal savings and financial health. Business financial management tools focus on comprehensive solutions such as cash flow analysis, invoicing, payroll integration, and tax compliance to enhance organizational financial operations. The choice depends on whether the priority is managing personal finances or supporting complex business financial activities.

Connection

Personal financial management tools and business financial management tools are connected through their shared use of data analytics, budgeting features, and expense tracking to optimize cash flow and financial decision-making. Both types of tools leverage automated reporting and real-time financial insights to improve planning accuracy and resource allocation. Integration between personal and business financial systems enhances overall financial visibility and supports comprehensive wealth management strategies.

Key Terms

**Business Financial Management Tools:**

Business financial management tools streamline accounting, budgeting, and cash flow forecasting to enhance decision-making and improve operational efficiency. These tools often include features like invoicing, payroll management, expense tracking, and financial reporting tailored to the needs of organizations. Explore more about top business financial management software to optimize your company's finances and drive growth.

Cash Flow Management

Business financial management tools prioritize comprehensive cash flow analysis, forecasting, and integration with accounting systems to support operational and strategic decision-making. Personal financial management tools typically emphasize budgeting, expense tracking, and simple cash flow monitoring to help individuals manage their day-to-day finances effectively. Explore more to discover which cash flow management solutions best suit your financial needs.

Invoice Processing

Business financial management tools streamline invoice processing with automation features, allowing companies to handle large volumes of invoices, enforce approval workflows, and integrate with accounting software for real-time expense tracking. Personal financial management tools focus on tracking individual expenses and bills but lack advanced invoice processing capabilities such as vendor management or bulk payments. Explore detailed comparisons to understand which solution fits your invoice management needs best.

Source and External Links

Top 10 Financial Management Tools for Businesses - Rippling - Rippling is an all-in-one platform combining HR, IT, and finance to automate expense management, spending policies, and real-time cash flow visibility for businesses.

5 Essential Financial Planning Tools for Small Businesses | CO - Prophix and Datarails offer small businesses user-friendly financial planning with automation, AI, and integration capabilities to streamline budgeting, reporting, and analysis.

Top Financial Management Software Solutions in 2025 - Tipalti - Tipalti delivers finance automation including accounts payable, mass payments, and expense management with mobile apps and global reimbursement infrastructure.

dowidth.com

dowidth.com