Loyalty fintech companies leverage advanced digital technologies and personalized reward programs to enhance customer engagement more effectively than traditional financial institutions, which often rely on legacy systems and standardized loyalty schemes. These fintech platforms use real-time data analytics and AI-driven insights to tailor offers, resulting in higher customer retention rates and satisfaction. Discover how loyalty fintech is transforming banking relationships by exploring its innovative strategies and benefits.

Why it is important

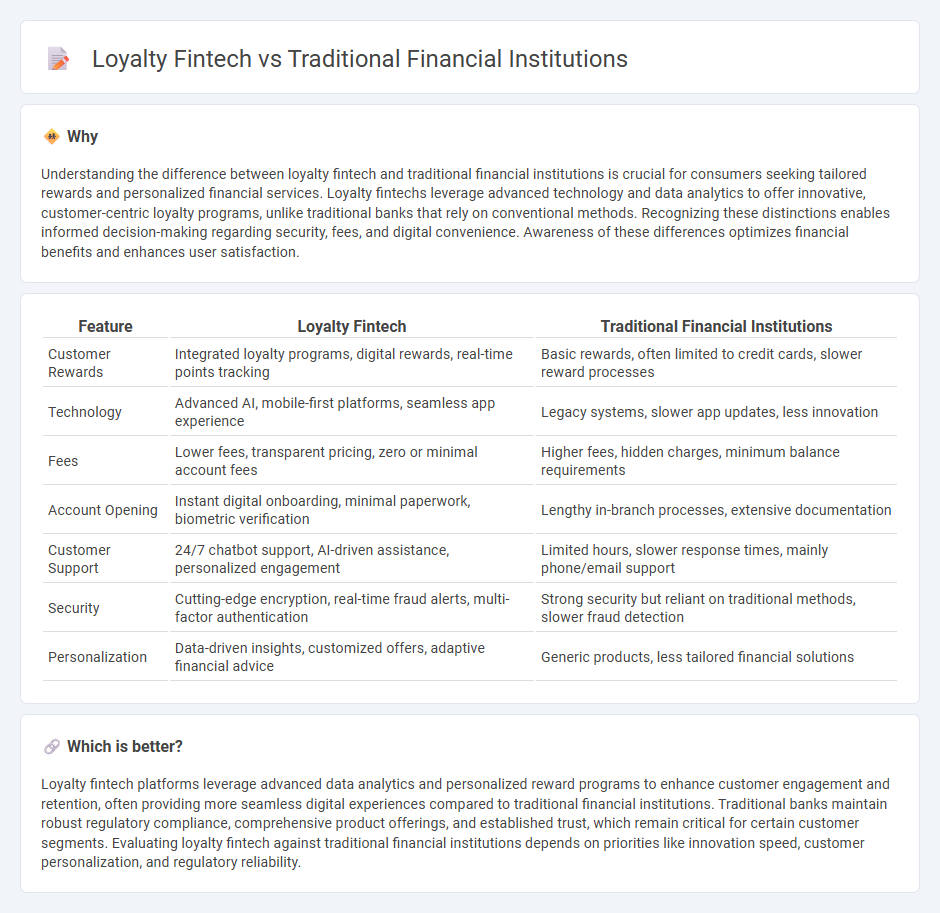

Understanding the difference between loyalty fintech and traditional financial institutions is crucial for consumers seeking tailored rewards and personalized financial services. Loyalty fintechs leverage advanced technology and data analytics to offer innovative, customer-centric loyalty programs, unlike traditional banks that rely on conventional methods. Recognizing these distinctions enables informed decision-making regarding security, fees, and digital convenience. Awareness of these differences optimizes financial benefits and enhances user satisfaction.

Comparison Table

| Feature | Loyalty Fintech | Traditional Financial Institutions |

|---|---|---|

| Customer Rewards | Integrated loyalty programs, digital rewards, real-time points tracking | Basic rewards, often limited to credit cards, slower reward processes |

| Technology | Advanced AI, mobile-first platforms, seamless app experience | Legacy systems, slower app updates, less innovation |

| Fees | Lower fees, transparent pricing, zero or minimal account fees | Higher fees, hidden charges, minimum balance requirements |

| Account Opening | Instant digital onboarding, minimal paperwork, biometric verification | Lengthy in-branch processes, extensive documentation |

| Customer Support | 24/7 chatbot support, AI-driven assistance, personalized engagement | Limited hours, slower response times, mainly phone/email support |

| Security | Cutting-edge encryption, real-time fraud alerts, multi-factor authentication | Strong security but reliant on traditional methods, slower fraud detection |

| Personalization | Data-driven insights, customized offers, adaptive financial advice | Generic products, less tailored financial solutions |

Which is better?

Loyalty fintech platforms leverage advanced data analytics and personalized reward programs to enhance customer engagement and retention, often providing more seamless digital experiences compared to traditional financial institutions. Traditional banks maintain robust regulatory compliance, comprehensive product offerings, and established trust, which remain critical for certain customer segments. Evaluating loyalty fintech against traditional financial institutions depends on priorities like innovation speed, customer personalization, and regulatory reliability.

Connection

Loyalty programs in fintech and traditional financial institutions leverage advanced data analytics and customer behavior insights to enhance user engagement and retention. Fintech firms utilize personalized rewards and seamless digital experiences, while traditional banks integrate these strategies into existing customer trust frameworks and regulatory compliance. The synergy between fintech innovation and established financial infrastructure creates a comprehensive loyalty ecosystem that drives customer satisfaction and long-term value.

Key Terms

Branch Banking

Traditional financial institutions excel in branch banking by offering personalized, face-to-face services and comprehensive financial products. Loyalty fintech companies enhance branch banking experiences through digital rewards and customer engagement tools, driving higher retention and satisfaction. Explore how integrating loyalty fintech innovations can transform branch banking for seamless customer loyalty and growth.

Digital Wallets

Traditional financial institutions offer digital wallets primarily as extensions of their existing banking services, emphasizing security, regulatory compliance, and integration with payment networks like Visa and Mastercard. Loyalty fintechs specialize in enhancing customer engagement by integrating rewards, personalized offers, and real-time analytics directly within their digital wallet platforms, leveraging blockchain and AI technologies for seamless, gamified experiences. Explore how these innovations in digital wallets are reshaping customer interactions and financial ecosystems.

Customer Retention Programs

Traditional financial institutions rely on established customer retention programs such as reward points, cashback offers, and tiered loyalty levels to enhance client engagement and prevent churn. Loyalty fintech companies leverage advanced technologies including AI-driven personalization, blockchain-based rewards, and seamless omnichannel experiences to provide more dynamic and data-centric retention strategies. Explore how these innovative loyalty fintech solutions are transforming customer retention in financial services.

Source and External Links

Online vs Traditional Banking: What's Your Best Option? - Traditional financial institutions are banks with physical branches offering a broad range of services including savings, checking, loans, and face-to-face customer support during banking hours.

6 Types of Major Financial Institutions in North America - Traditional financial institutions include retail and commercial banks that are federally regulated, provide checking and savings accounts, loans, credit cards, and investment services, and offer government-backed deposit insurance.

Digital Banks vs. Traditional Banks vs. Fintechs: What Sets ... - Traditional banks are established financial institutions with comprehensive financial services and stability, contrasting with digital banks and fintechs that focus on innovation and agility.

dowidth.com

dowidth.com