Blockchain remittance offers faster, transparent, and lower-cost international transfers compared to the traditional SWIFT network, which relies on intermediaries and operates within banking hours. While SWIFT remains the global standard for secure cross-border payments, blockchain technology leverages decentralized ledgers to reduce settlement times from days to minutes. Explore the advantages and challenges of blockchain remittance versus SWIFT to understand the future of global banking transactions.

Why it is important

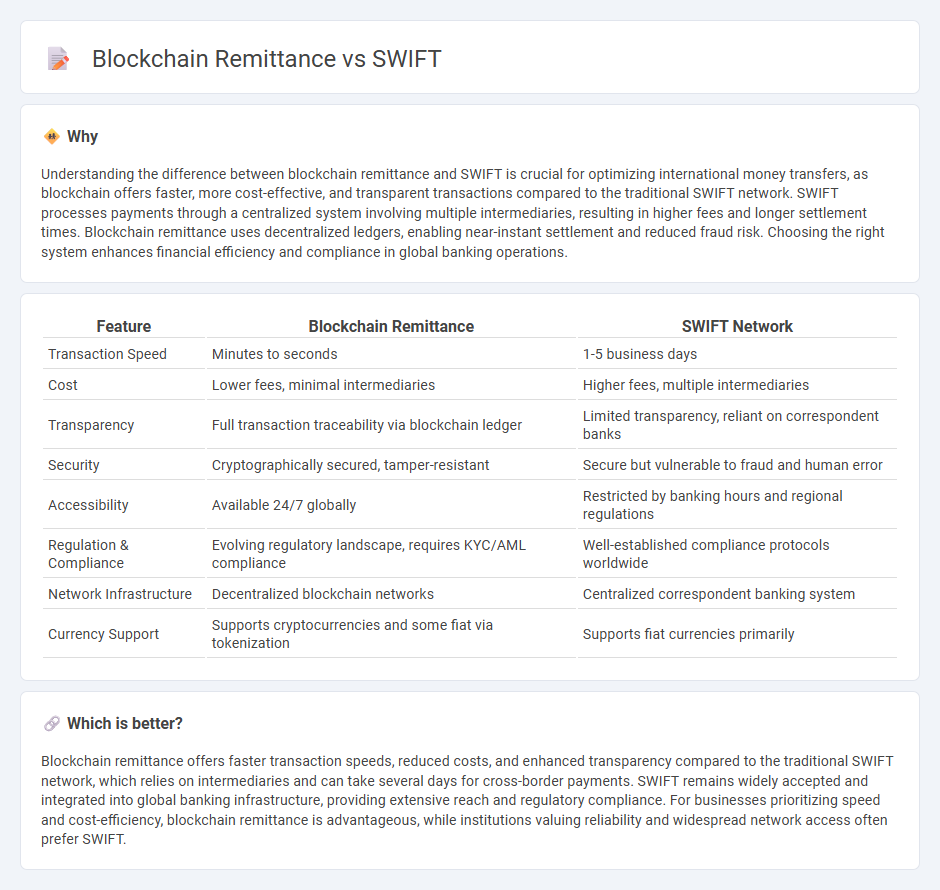

Understanding the difference between blockchain remittance and SWIFT is crucial for optimizing international money transfers, as blockchain offers faster, more cost-effective, and transparent transactions compared to the traditional SWIFT network. SWIFT processes payments through a centralized system involving multiple intermediaries, resulting in higher fees and longer settlement times. Blockchain remittance uses decentralized ledgers, enabling near-instant settlement and reduced fraud risk. Choosing the right system enhances financial efficiency and compliance in global banking operations.

Comparison Table

| Feature | Blockchain Remittance | SWIFT Network |

|---|---|---|

| Transaction Speed | Minutes to seconds | 1-5 business days |

| Cost | Lower fees, minimal intermediaries | Higher fees, multiple intermediaries |

| Transparency | Full transaction traceability via blockchain ledger | Limited transparency, reliant on correspondent banks |

| Security | Cryptographically secured, tamper-resistant | Secure but vulnerable to fraud and human error |

| Accessibility | Available 24/7 globally | Restricted by banking hours and regional regulations |

| Regulation & Compliance | Evolving regulatory landscape, requires KYC/AML compliance | Well-established compliance protocols worldwide |

| Network Infrastructure | Decentralized blockchain networks | Centralized correspondent banking system |

| Currency Support | Supports cryptocurrencies and some fiat via tokenization | Supports fiat currencies primarily |

Which is better?

Blockchain remittance offers faster transaction speeds, reduced costs, and enhanced transparency compared to the traditional SWIFT network, which relies on intermediaries and can take several days for cross-border payments. SWIFT remains widely accepted and integrated into global banking infrastructure, providing extensive reach and regulatory compliance. For businesses prioritizing speed and cost-efficiency, blockchain remittance is advantageous, while institutions valuing reliability and widespread network access often prefer SWIFT.

Connection

Blockchain remittance enhances cross-border payments by offering faster transaction settlements and reduced fees compared to traditional SWIFT transfers. SWIFT remains the global standard for secure communication between banks, while blockchain technology introduces decentralized ledgers that improve transparency and traceability in remittance processes. Integrating blockchain with the SWIFT network can streamline international banking operations, increase security, and lower costs for global money transfers.

Key Terms

Intermediaries

SWIFT relies heavily on multiple intermediaries such as correspondent banks that facilitate the transfer of funds across borders, often incurring higher costs and longer processing times. Blockchain remittance minimizes the role of intermediaries by enabling peer-to-peer transactions through decentralized ledgers, significantly reducing fees and settlement periods. Discover how the reduction of intermediaries in blockchain remittance is revolutionizing cross-border payments.

Settlement Speed

SWIFT remittance relies on traditional banking infrastructure, often taking 1-5 business days to settle cross-border payments depending on correspondent banks and intermediaries involved. Blockchain remittance leverages decentralized ledger technology, enabling near-instant settlement times typically within minutes by eliminating intermediaries and enabling direct peer-to-peer value transfer. Explore the advantages of blockchain for faster international remittances and its impact on global payment ecosystems.

Transparency

Blockchain remittance offers superior transparency by enabling real-time tracking and immutable transaction records, contrasting sharply with SWIFT's traditional banking system, which often lacks immediate visibility. SWIFT transactions rely on intermediary banks, causing delays and limited transparency for end-users. Explore how blockchain's transparent ledger revolutionizes remittance efficiency and trust.

Source and External Links

SWIFT - SWIFT is a cooperative that operates a secure messaging network for transmitting payment instructions between financial institutions worldwide, without holding funds or performing settlements.

Swift: Homepage - SWIFT provides global standards, secure messaging, and interoperable solutions for payments, securities, and risk/compliance in the financial industry.

Swift.org - Swift is a high-performance, expressive programming language for iOS, macOS, and other platforms, designed for safety and speed, with full interoperability with C and C++.

dowidth.com

dowidth.com