Fraud orchestration integrates advanced analytics and machine learning to detect, prevent, and respond to fraudulent activities in real-time, enhancing security across banking systems. Customer due diligence involves thorough verification of customer identities and ongoing monitoring to ensure compliance with anti-money laundering (AML) regulations and reduce risk exposure. Explore how these critical processes work together to fortify financial institutions against evolving threats.

Why it is important

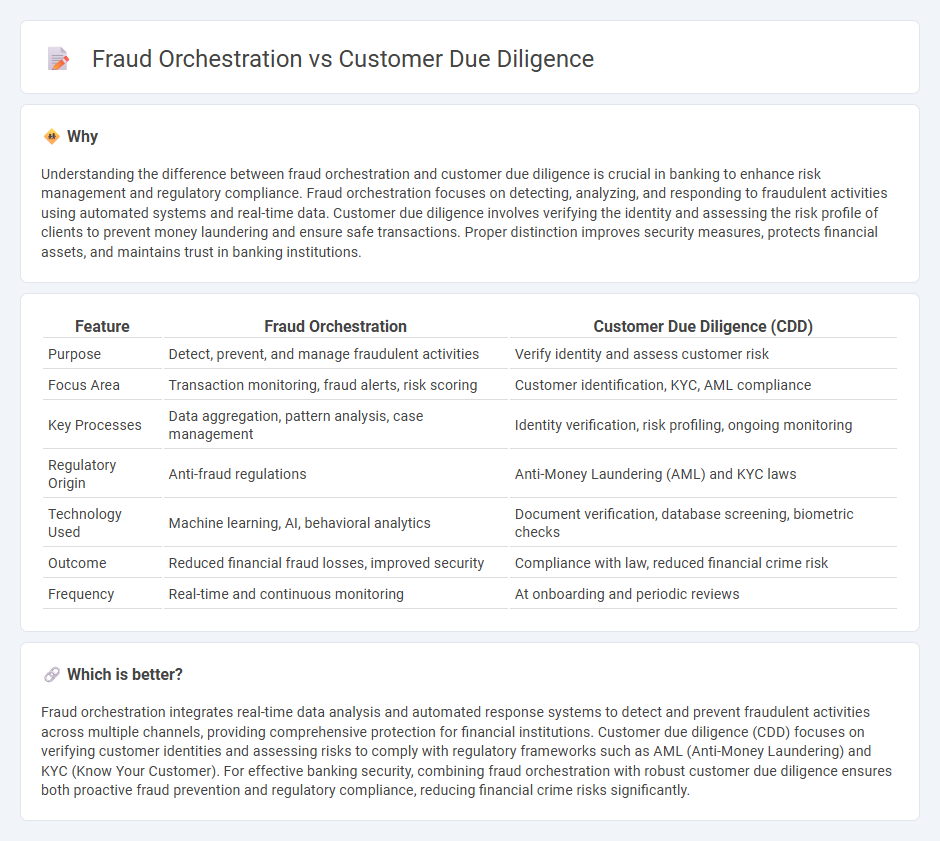

Understanding the difference between fraud orchestration and customer due diligence is crucial in banking to enhance risk management and regulatory compliance. Fraud orchestration focuses on detecting, analyzing, and responding to fraudulent activities using automated systems and real-time data. Customer due diligence involves verifying the identity and assessing the risk profile of clients to prevent money laundering and ensure safe transactions. Proper distinction improves security measures, protects financial assets, and maintains trust in banking institutions.

Comparison Table

| Feature | Fraud Orchestration | Customer Due Diligence (CDD) |

|---|---|---|

| Purpose | Detect, prevent, and manage fraudulent activities | Verify identity and assess customer risk |

| Focus Area | Transaction monitoring, fraud alerts, risk scoring | Customer identification, KYC, AML compliance |

| Key Processes | Data aggregation, pattern analysis, case management | Identity verification, risk profiling, ongoing monitoring |

| Regulatory Origin | Anti-fraud regulations | Anti-Money Laundering (AML) and KYC laws |

| Technology Used | Machine learning, AI, behavioral analytics | Document verification, database screening, biometric checks |

| Outcome | Reduced financial fraud losses, improved security | Compliance with law, reduced financial crime risk |

| Frequency | Real-time and continuous monitoring | At onboarding and periodic reviews |

Which is better?

Fraud orchestration integrates real-time data analysis and automated response systems to detect and prevent fraudulent activities across multiple channels, providing comprehensive protection for financial institutions. Customer due diligence (CDD) focuses on verifying customer identities and assessing risks to comply with regulatory frameworks such as AML (Anti-Money Laundering) and KYC (Know Your Customer). For effective banking security, combining fraud orchestration with robust customer due diligence ensures both proactive fraud prevention and regulatory compliance, reducing financial crime risks significantly.

Connection

Fraud orchestration integrates advanced analytics and real-time data monitoring to enhance customer due diligence processes, enabling banks to identify suspicious activities and verify identities more effectively. Streamlined collaboration between fraud orchestration systems and due diligence frameworks reduces false positives and accelerates compliance with regulatory standards such as AML and KYC. This connection strengthens overall risk management by providing a proactive approach to detecting and preventing financial crimes in banking institutions.

Key Terms

Customer due diligence:

Customer due diligence (CDD) involves verifying the identity and assessing the risk profile of clients to prevent financial crimes such as money laundering and terrorism financing. Effective CDD incorporates comprehensive data collection, risk assessment algorithms, and continuous monitoring to ensure compliance with regulatory standards like AML and KYC. Explore how advanced CDD solutions can enhance risk management and regulatory adherence.

Identity Verification

Customer due diligence employs identity verification to validate customer information and assess risk, ensuring compliance with KYC regulations. Fraud orchestration integrates identity verification into a broader framework that detects and prevents fraudulent activities in real time across multiple channels. Explore the differences in approach and technology to enhance your security strategy.

Risk Assessment

Customer due diligence (CDD) involves verifying client identities and assessing potential risks related to money laundering and terrorism financing, forming a critical part of compliance frameworks. Fraud orchestration integrates advanced analytics and real-time monitoring systems to detect, prevent, and respond to fraudulent activities dynamically across multiple channels. Explore how combining robust CDD processes with sophisticated fraud orchestration enhances comprehensive risk assessment strategies.

Source and External Links

Customer due diligence (CDD): An overview - Customer due diligence involves verifying customer identity, assessing risk through background checks and document verification, ongoing monitoring, and careful record keeping to comply with regulatory requirements in sectors like banking and finance.

What is Customer Due Diligence (CDD)? - CDD is the process used by financial institutions to collect and evaluate customer information, uncover risks related to doing business, and meet Know Your Customer (KYC) standards by analyzing data from multiple sources including sanctions lists and public records.

What is CDD (Customer Due Diligence)? - Customer due diligence helps detect financial crime and manage business risk by verifying identities and assessing risk levels, ranging from basic checks for low-risk clients to enhanced scrutiny for high-risk ones, typically embedded in KYC and anti-money laundering regulations.

dowidth.com

dowidth.com