Predictive analytics in banking leverages data mining, machine learning algorithms, and statistical models to forecast customer behaviors and financial trends, enhancing decision-making accuracy. Customer acquisition modeling focuses specifically on identifying and targeting potential clients by analyzing patterns such as demographic data, credit scores, and transaction history to maximize marketing ROI. Explore these advanced analytics strategies to transform banking customer engagement and growth.

Why it is important

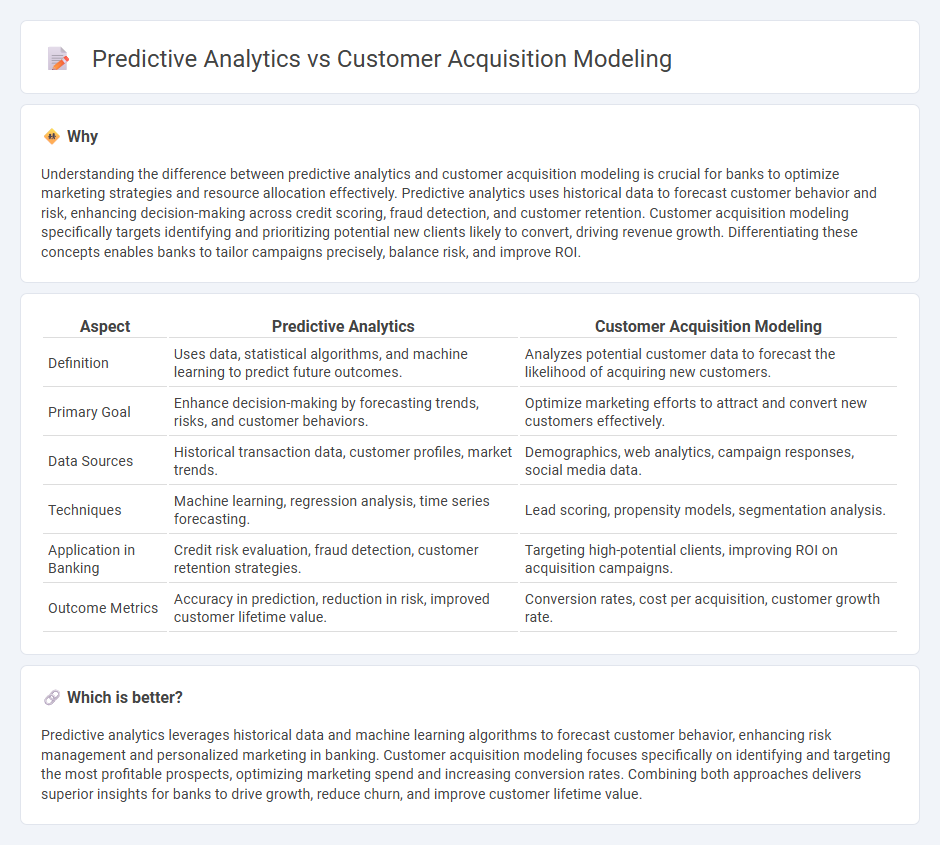

Understanding the difference between predictive analytics and customer acquisition modeling is crucial for banks to optimize marketing strategies and resource allocation effectively. Predictive analytics uses historical data to forecast customer behavior and risk, enhancing decision-making across credit scoring, fraud detection, and customer retention. Customer acquisition modeling specifically targets identifying and prioritizing potential new clients likely to convert, driving revenue growth. Differentiating these concepts enables banks to tailor campaigns precisely, balance risk, and improve ROI.

Comparison Table

| Aspect | Predictive Analytics | Customer Acquisition Modeling |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to predict future outcomes. | Analyzes potential customer data to forecast the likelihood of acquiring new customers. |

| Primary Goal | Enhance decision-making by forecasting trends, risks, and customer behaviors. | Optimize marketing efforts to attract and convert new customers effectively. |

| Data Sources | Historical transaction data, customer profiles, market trends. | Demographics, web analytics, campaign responses, social media data. |

| Techniques | Machine learning, regression analysis, time series forecasting. | Lead scoring, propensity models, segmentation analysis. |

| Application in Banking | Credit risk evaluation, fraud detection, customer retention strategies. | Targeting high-potential clients, improving ROI on acquisition campaigns. |

| Outcome Metrics | Accuracy in prediction, reduction in risk, improved customer lifetime value. | Conversion rates, cost per acquisition, customer growth rate. |

Which is better?

Predictive analytics leverages historical data and machine learning algorithms to forecast customer behavior, enhancing risk management and personalized marketing in banking. Customer acquisition modeling focuses specifically on identifying and targeting the most profitable prospects, optimizing marketing spend and increasing conversion rates. Combining both approaches delivers superior insights for banks to drive growth, reduce churn, and improve customer lifetime value.

Connection

Predictive analytics leverages historical banking data and machine learning algorithms to forecast customer behavior and identify high-value prospects. Customer acquisition modeling uses these insights to tailor marketing strategies, optimize targeting, and improve conversion rates in banking services. Integrating predictive analytics enhances the precision and efficiency of acquiring new banking customers, reducing costs and increasing lifetime value.

Key Terms

**Customer Acquisition Modeling:**

Customer acquisition modeling uses historical customer data and behavioral patterns to identify the most promising potential customers and optimize marketing strategies for higher conversion rates. It integrates demographic, psychographic, and transactional data to create targeted campaigns that efficiently allocate resources toward high-value prospects. Explore the methodologies and tools behind customer acquisition modeling to enhance your customer growth strategy.

Lead Scoring

Customer acquisition modeling utilizes historical data to identify patterns that predict potential customers most likely to convert, optimizing marketing spend and targeting efficiency. Predictive analytics in lead scoring leverages machine learning algorithms to assign scores based on attributes like demographic data, past interactions, and engagement levels, enhancing the precision of lead prioritization. Explore how integrating these approaches can revolutionize your lead management strategies and boost conversion rates.

Conversion Rate

Customer acquisition modeling leverages historical customer data to identify key factors driving conversions, optimizing marketing strategies to improve the conversion rate. Predictive analytics employs machine learning algorithms and statistical techniques to forecast future customer behaviors and conversion probabilities, enabling targeted campaign adjustments. Explore advanced methodologies to enhance your conversion rate through sophisticated data-driven insights.

Source and External Links

Customer Acquisition - This model maximizes the ability to identify customers with a high propensity to buy by using data to create buy propensity models and score customer data.

What is a Customer Acquisition Model? And Why You Need One - A customer acquisition model outlines the channels and journey a buyer takes from prospect to paying customer, focusing on building brand awareness and conversion.

User (and Customer) Acquisition Model - This model visualizes the customer journey through a funnel, from awareness to retention, to identify and bring in potential customers through various marketing stages.

dowidth.com

dowidth.com