Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behaviors, risks, and market trends, enhancing decision-making accuracy. Campaign response modeling focuses on identifying and targeting customers most likely to engage with specific marketing initiatives, optimizing campaign effectiveness and ROI. Explore how these advanced data-driven techniques transform banking strategies and customer engagement.

Why it is important

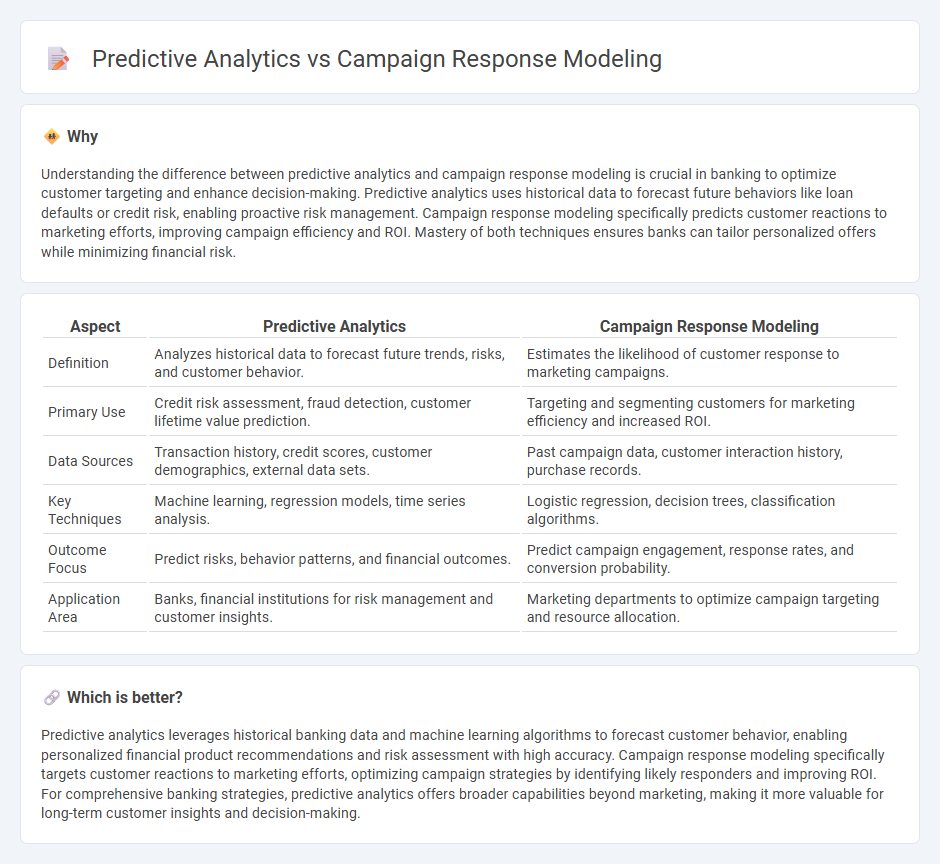

Understanding the difference between predictive analytics and campaign response modeling is crucial in banking to optimize customer targeting and enhance decision-making. Predictive analytics uses historical data to forecast future behaviors like loan defaults or credit risk, enabling proactive risk management. Campaign response modeling specifically predicts customer reactions to marketing efforts, improving campaign efficiency and ROI. Mastery of both techniques ensures banks can tailor personalized offers while minimizing financial risk.

Comparison Table

| Aspect | Predictive Analytics | Campaign Response Modeling |

|---|---|---|

| Definition | Analyzes historical data to forecast future trends, risks, and customer behavior. | Estimates the likelihood of customer response to marketing campaigns. |

| Primary Use | Credit risk assessment, fraud detection, customer lifetime value prediction. | Targeting and segmenting customers for marketing efficiency and increased ROI. |

| Data Sources | Transaction history, credit scores, customer demographics, external data sets. | Past campaign data, customer interaction history, purchase records. |

| Key Techniques | Machine learning, regression models, time series analysis. | Logistic regression, decision trees, classification algorithms. |

| Outcome Focus | Predict risks, behavior patterns, and financial outcomes. | Predict campaign engagement, response rates, and conversion probability. |

| Application Area | Banks, financial institutions for risk management and customer insights. | Marketing departments to optimize campaign targeting and resource allocation. |

Which is better?

Predictive analytics leverages historical banking data and machine learning algorithms to forecast customer behavior, enabling personalized financial product recommendations and risk assessment with high accuracy. Campaign response modeling specifically targets customer reactions to marketing efforts, optimizing campaign strategies by identifying likely responders and improving ROI. For comprehensive banking strategies, predictive analytics offers broader capabilities beyond marketing, making it more valuable for long-term customer insights and decision-making.

Connection

Predictive analytics leverages historical banking data and customer behaviors to forecast future actions, enhancing campaign response modeling accuracy. Campaign response modeling utilizes these forecasts to segment customers and tailor marketing efforts, increasing engagement and conversion rates. This connection enables banks to optimize resource allocation and drive personalized customer experiences.

Key Terms

**Campaign Response Modeling:**

Campaign response modeling uses historical customer data to predict the likelihood of individuals responding to specific marketing campaigns, enhancing targeting accuracy and ROI. It incorporates demographic, behavioral, and transactional data to segment audiences and optimize campaign strategies. Explore more to understand how campaign response modeling can transform your marketing efforts.

Propensity Score

Campaign response modeling leverages Propensity Score to estimate the likelihood of a customer's positive reaction to marketing efforts, improving targeting accuracy and resource allocation. Predictive analytics incorporates Propensity Score within broader data mining techniques to forecast customer behavior and optimize campaign outcomes based on historical and real-time data. Explore how Propensity Score enhances predictive precision in marketing strategies for deeper insights.

Uplift Modeling

Campaign response modeling predicts customer reactions to marketing efforts using historical data, focusing on identifying likely responders. Predictive analytics encompasses broader techniques, with uplift modeling specifically estimating the incremental impact of a campaign by comparing treated and untreated groups. Explore uplift modeling to optimize targeting strategies and maximize marketing ROI effectively.

Source and External Links

Multi Touch Attribution 2.0 - Campaign Response ... - Marketscience - Campaign Response Attribution (CRA) uses granular, real-time impression and sales data to build decision tree-based predictive response models, allowing marketers to assign accurate credit to each digital touchpoint in campaigns and optimize budget allocation across networks, publishers, and messages.

Unlocking Predictive Marketing with Response Modeling - Quantzig - Response modeling in marketing uses statistical and machine learning models, including linear and logistic response models, to predict customer likelihood to respond to campaigns, enabling data-driven targeting and resource optimization for better returns.

The most important output of your Marketing Mix Model: response curves - Response curves derived from Marketing Mix Modeling quantify the cause-and-effect relationship between marketing spend and business outcomes, helping forecast results and plan budget allocations by modeling how sales respond to different campaign investments.

dowidth.com

dowidth.com