Income streaming in banking refers to the continuous generation of revenue through multiple financial products such as loans, investments, and account fees, offering stability and long-term growth. Service charges, on the other hand, are specific fees levied for account maintenance, transactions, or additional banking services, providing immediate but variable income. Explore further to understand how banks balance these income sources to maximize profitability.

Why it is important

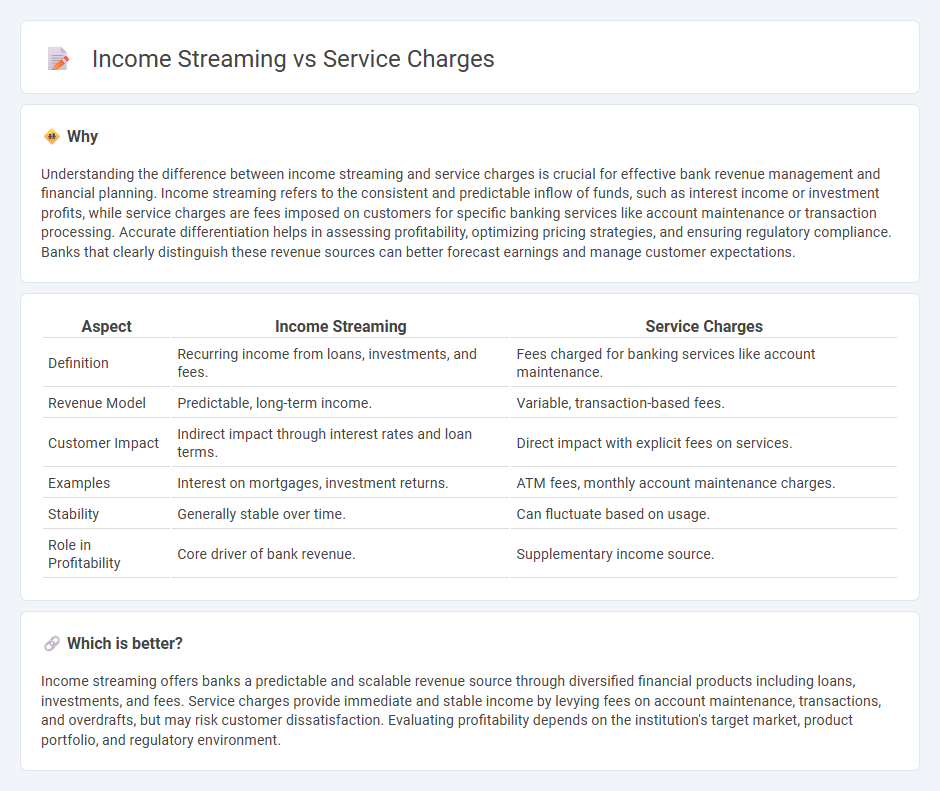

Understanding the difference between income streaming and service charges is crucial for effective bank revenue management and financial planning. Income streaming refers to the consistent and predictable inflow of funds, such as interest income or investment profits, while service charges are fees imposed on customers for specific banking services like account maintenance or transaction processing. Accurate differentiation helps in assessing profitability, optimizing pricing strategies, and ensuring regulatory compliance. Banks that clearly distinguish these revenue sources can better forecast earnings and manage customer expectations.

Comparison Table

| Aspect | Income Streaming | Service Charges |

|---|---|---|

| Definition | Recurring income from loans, investments, and fees. | Fees charged for banking services like account maintenance. |

| Revenue Model | Predictable, long-term income. | Variable, transaction-based fees. |

| Customer Impact | Indirect impact through interest rates and loan terms. | Direct impact with explicit fees on services. |

| Examples | Interest on mortgages, investment returns. | ATM fees, monthly account maintenance charges. |

| Stability | Generally stable over time. | Can fluctuate based on usage. |

| Role in Profitability | Core driver of bank revenue. | Supplementary income source. |

Which is better?

Income streaming offers banks a predictable and scalable revenue source through diversified financial products including loans, investments, and fees. Service charges provide immediate and stable income by levying fees on account maintenance, transactions, and overdrafts, but may risk customer dissatisfaction. Evaluating profitability depends on the institution's target market, product portfolio, and regulatory environment.

Connection

Income streaming in banking relies significantly on service charges as a steady revenue source generated from account maintenance fees, overdrafts, and transaction fees. Banks optimize service charge structures to enhance predictable income streams, balancing customer retention with profitability. Strategic management of these fees directly impacts the bank's financial stability and operational income diversification.

Key Terms

Fee Income

Fee income represents a critical component of a company's revenue, generated primarily through service charges levied on clients for specific offerings such as advisory, asset management, or transaction processing. Unlike income streaming, which involves recurring revenue from continuous services or products, fee income is often transaction-based and can vary significantly based on client activity and market conditions. Explore further insights on maximizing fee income and optimizing service charge strategies for sustainable financial growth.

Commission

Service charges often represent fixed fees paid for specific services, while income streaming through commissions relies on earning a percentage of sales or transactions, creating variable revenue fluctuations. Commission-based income encourages sales performance and aligns revenue directly with business growth, unlike static service charges. Explore how commission structures can maximize your revenue potential and drive sustainable business success.

Non-Interest Revenue

Service charges represent fees collected from customers for banking services like overdrafts or account maintenance, forming a significant portion of non-interest revenue. Income streaming from service charges provides banks with steady, predictable cash flow independent of interest rate fluctuations. Discover more about how diversifying non-interest revenue through strategic service charges enhances financial stability.

Source and External Links

Service Charge - Definition, Examples, Types - A service charge is a mandatory fee added to pay for services related to a product, such as utilities, Airbnb rentals, or dining, and is typically collected automatically by the provider.

What is Service Charge? Your Ultimate Guide - Eat App - Service charges are set fees applied to cover the cost of services provided--common in restaurants and hotels--to ensure staff are fairly compensated and are not refundable except in cases of error or significant dissatisfaction.

Service Charge vs. Tip: What Restaurants Need to Know - Toast POS - Unlike tips, service charges are mandatory, included in the total bill, and can appear in various industries such as banking, travel, and hospitality, allocated by the business, not directly by the customer.

dowidth.com

dowidth.com