Neo banking offers fully digital banking services through mobile apps without physical branches, emphasizing user-friendly interfaces and real-time account management. Online banking provides digital access to traditional banks' services, allowing customers to perform tasks like transfers and bill payments via web portals. Explore the distinctions between neo banking and online banking to find the best fit for your financial needs.

Why it is important

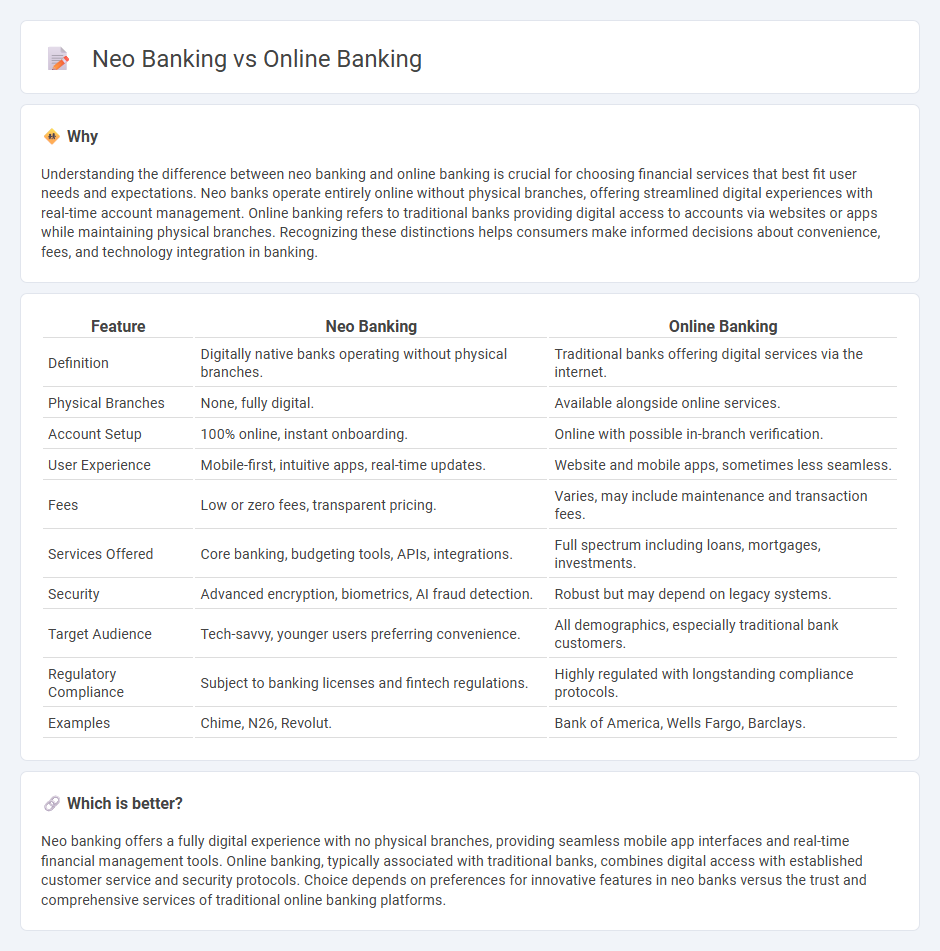

Understanding the difference between neo banking and online banking is crucial for choosing financial services that best fit user needs and expectations. Neo banks operate entirely online without physical branches, offering streamlined digital experiences with real-time account management. Online banking refers to traditional banks providing digital access to accounts via websites or apps while maintaining physical branches. Recognizing these distinctions helps consumers make informed decisions about convenience, fees, and technology integration in banking.

Comparison Table

| Feature | Neo Banking | Online Banking |

|---|---|---|

| Definition | Digitally native banks operating without physical branches. | Traditional banks offering digital services via the internet. |

| Physical Branches | None, fully digital. | Available alongside online services. |

| Account Setup | 100% online, instant onboarding. | Online with possible in-branch verification. |

| User Experience | Mobile-first, intuitive apps, real-time updates. | Website and mobile apps, sometimes less seamless. |

| Fees | Low or zero fees, transparent pricing. | Varies, may include maintenance and transaction fees. |

| Services Offered | Core banking, budgeting tools, APIs, integrations. | Full spectrum including loans, mortgages, investments. |

| Security | Advanced encryption, biometrics, AI fraud detection. | Robust but may depend on legacy systems. |

| Target Audience | Tech-savvy, younger users preferring convenience. | All demographics, especially traditional bank customers. |

| Regulatory Compliance | Subject to banking licenses and fintech regulations. | Highly regulated with longstanding compliance protocols. |

| Examples | Chime, N26, Revolut. | Bank of America, Wells Fargo, Barclays. |

Which is better?

Neo banking offers a fully digital experience with no physical branches, providing seamless mobile app interfaces and real-time financial management tools. Online banking, typically associated with traditional banks, combines digital access with established customer service and security protocols. Choice depends on preferences for innovative features in neo banks versus the trust and comprehensive services of traditional online banking platforms.

Connection

Neo banking and online banking are connected through their reliance on digital platforms to provide financial services without traditional brick-and-mortar branches. Both utilize internet technology to offer customers convenient account management, payments, and transfers, but neo banks operate entirely online with advanced app-based features and streamlined user experiences. The integration of APIs and real-time data analytics further bridges these two models, enhancing personalized banking solutions and faster transaction processing.

Key Terms

Digital Platforms

Online banking offers traditional financial institutions digital access to accounts through websites and apps, ensuring secure transactions and broad service availability. Neo banking operates entirely through mobile apps with streamlined interfaces, lower fees, and enhanced real-time features tailored for tech-savvy users. Explore the key differences and benefits of digital platforms in banking to find the best fit for your financial needs.

Regulatory Framework

Online banking operates under established banking regulations set by national financial authorities, ensuring comprehensive consumer protection and stringent compliance standards. Neo banking, often functioning as fintech entities without full banking licenses, navigates a complex regulatory landscape that varies significantly by jurisdiction, focusing on innovation within compliance limitations. Explore the evolving regulatory frameworks shaping both online and neo banking to understand their impact on financial services.

Customer Experience

Online banking delivers comprehensive financial services through established banks' digital platforms, ensuring robust security and a wide range of products. Neo banking offers a streamlined, app-driven experience with innovative features like real-time spending insights and personalized notifications, catering to tech-savvy users seeking convenience. Explore the distinct advantages of both banking models to find the best fit for your financial lifestyle.

Source and External Links

Online banking | Sign up and log in - U.S. Bank - Online banking allows you to securely manage money, deposit checks, pay bills, track spending, and set financial goals anytime from any device with industry-leading security features.

Online Banking - TD Bank - TD Bank's online banking and mobile app enable customers to deposit checks, pay bills, transfer and send money with Zelle, set alerts, and securely manage accounts 24/7 from anywhere.

Free Online Banking | Mobile Banking - OneUnited Bank - OneUnited Bank offers free online banking with AI-driven insights, easy money management, bill pay, and mobile banking designed for fast, simple, and secure financial wellness.

dowidth.com

dowidth.com